Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomBoxing Day Volatility: Bitcoin Flash Crash & Gold Rally Amid Thin Liquidity

Ultima Markets Daily Market Insights – December 26, 2025

With global financial markets in a “Boxing Day” lull, liquidity is extremely thin. While U.S. stock markets are open today, major hubs in Europe, the UK, Australia, and Hong Kong remain closed. This environment has shifted volatility into the cryptocurrency sector, highlighted by a dramatic (but localized) event involving the new USD1 stablecoin.

Crypto Focus: The “USD1” Stablecoin & Flash Crash

The primary story in the crypto market over the past 24 hours involves USD1, the stablecoin issued by Trump-linked World Liberty Financial (WLF).

The “Flash Crash” Event: On Christmas Day, Bitcoin briefly dropped to $24,000 on the BTC/USD1 trading pair on Binance before instantly rebounding to the market rate near $87,000.

This was a microstructure anomaly caused by extremely thin holiday liquidity on this pair, not a market-wide crash. It serves as a stark reminder for traders: low liquidity can trigger massive slippage, particularly in niche pairs.

Despite the glitch, USD1 is gaining traction. The stablecoin’s market cap jumped by $150 million this week after Binance launched a yield program offering up to 20% APR for holders. USD1 is now the 7th largest stablecoin, expanding aggressively via partnerships, including the recent integration with Velo’s PayFi ecosystem in Asia.

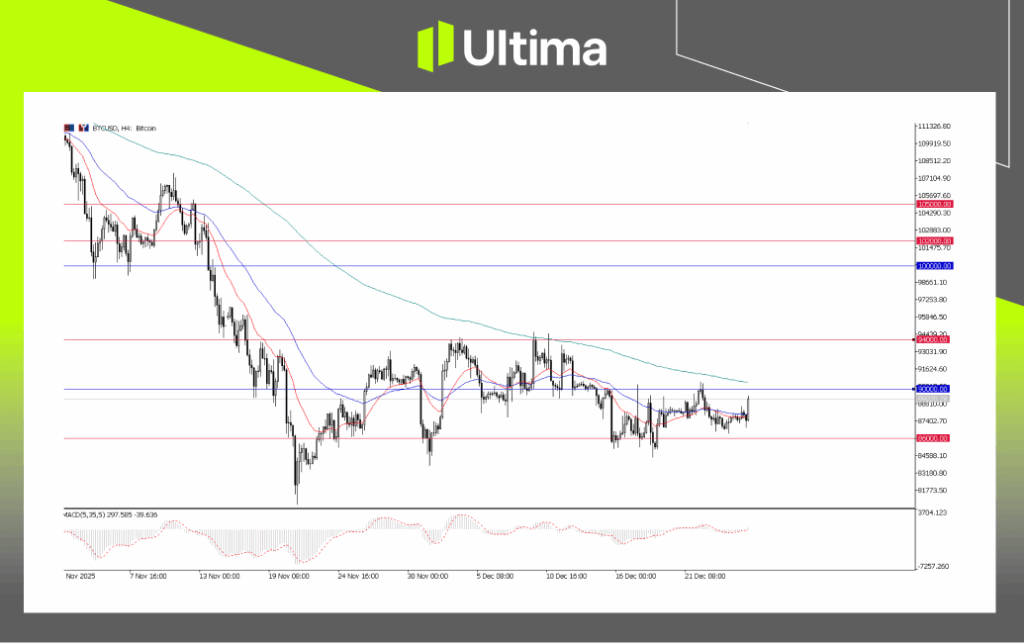

BTCUSD, H4 Chart | Ultima Markets MT5

Despite the BTC/USD1 flash crash, other BTC pairs were largely unaffected. BTC/USD continues to consolidate near the $90,000 mark. The $86,000–$94,000 range remains key, providing near-term trading opportunities within the range while waiting for a potential breakout.

Gold & Silver Hold the Highs

Precious metals remain firm post-Christmas, benefiting from the same thin liquidity conditions impacting crypto.

- Gold (XAU/USD): Gold is holding near record highs around $4,500/oz, following the brief record-breaking rally in the Asian session. The “buy-the-dip” mentality remains strong, supported by expectations of 2026 Fed rate cuts.

- Silver (XAG/USD): Silver continues to outperform, rallying toward $74.00/oz, supported by industrial demand (AI, solar) in addition to safe-haven flows. Dip-buying interest remains robust.

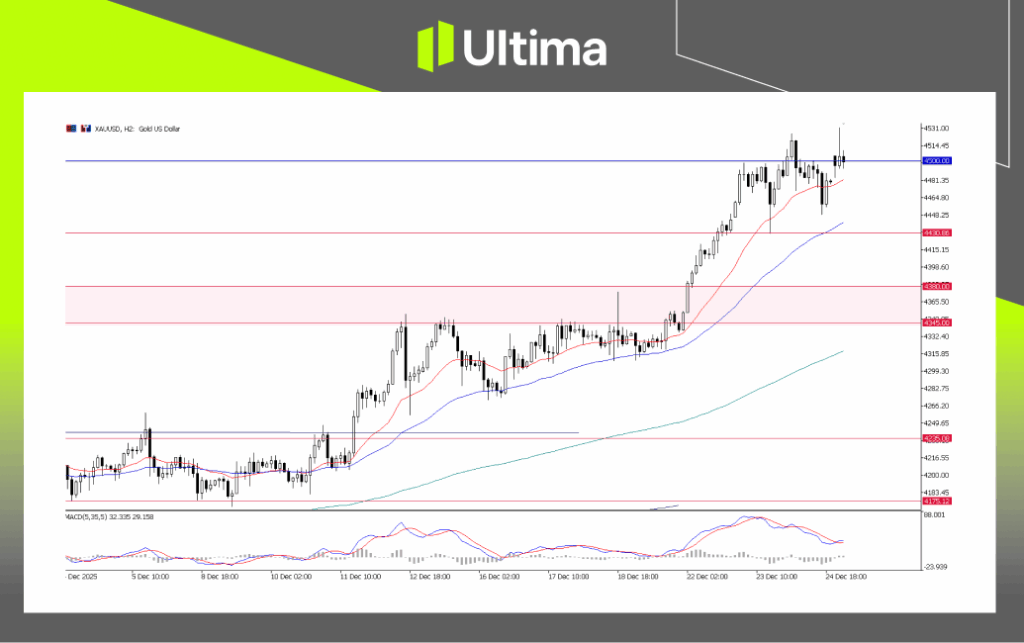

XAU/USD, H2 Chart | Ultima Markets MT5

Today’s record highs may be exaggerated due to thin liquidity. $4,500 remains a key level; failure to sustain above could result in a high-side consolidation within $4,500–$4,450/$4,430. The broader trend remains bullish as long as prices hold above $4,450.

Global Markets: Thin Liquidity & “Santa Rally” Drift

- US Markets Open: NYSE and Nasdaq are open for a full session today, but volume will be significantly lighter than usual.

- Europe/Asia Closed: Key markets in the UK, Germany, Australia, Hong Kong, and Canada remain closed for Boxing Day.

- Impact: Without European participation, expect choppy or sideways drift in U.S. price action. The “Santa Rally” bias remains, but breakouts may be unreliable.

- Crypto: Exercise caution with leverage; the USD1 flash crash illustrates that thin order books can be dangerous on holidays.

- Stocks: The U.S. market is open, but movements should be interpreted cautiously due to low volume.

Overall, Bitcoin and Gold remain key focus assets today. Technically, the outlook remains intact, but extreme thin liquidity could still create sudden “air pockets” in price.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server