Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomADP “Relief” Stabilizes Dollar; Gold & Silver Retreat on Profit-Taking

Ultima Markets Daily Market Insights – January 8, 2026

The “Recession Panic” that plagued the Greenback earlier this week was firmly dialed back yesterday. A double-dose of economic data—the ADP Employment Report and a robust ISM Services PMI—provided a much-needed sigh of relief for the US economy and the Dollar. By confirming that the US economy is not collapsing, the data triggered a squeeze on short-USD positions and prompted sharp profit-taking in the overextended precious metals market.

ADP Employment & PMI: The “Not Worse” Relief

The US Dollar found fresh buyers yesterday not because the jobs data was explosive, but because it wasn’t a disaster.

After a shocking contraction in November (revised to -29,000), December private payrolls rebounded to +41,000. While the number slightly missed the consensus (47k), the return to positive territory “eased market concerns” that the labor market was in freefall.

This stability forced traders to unwind aggressive “recession bets,” putting a floor under the Dollar ahead of Friday’s NFP.

If ADP provided relief, the ISM Services PMI provided the muscle with a surprise beat.

- The Data: The US Services sector (the biggest part of the economy) surged to 54.4 in December, smashing the forecast of 52.6.

- The Signal: New Orders and Employment components both expanded. This directly contradicts the “hard landing” narrative. A resilient economy means the Fed is less likely to panic-cut rates in early 2026.

This was the catalyst that pushed Treasury Yields higher, helping the US Dollar Index (DXY) reclaim the 98.00 handle and press toward 98.50.

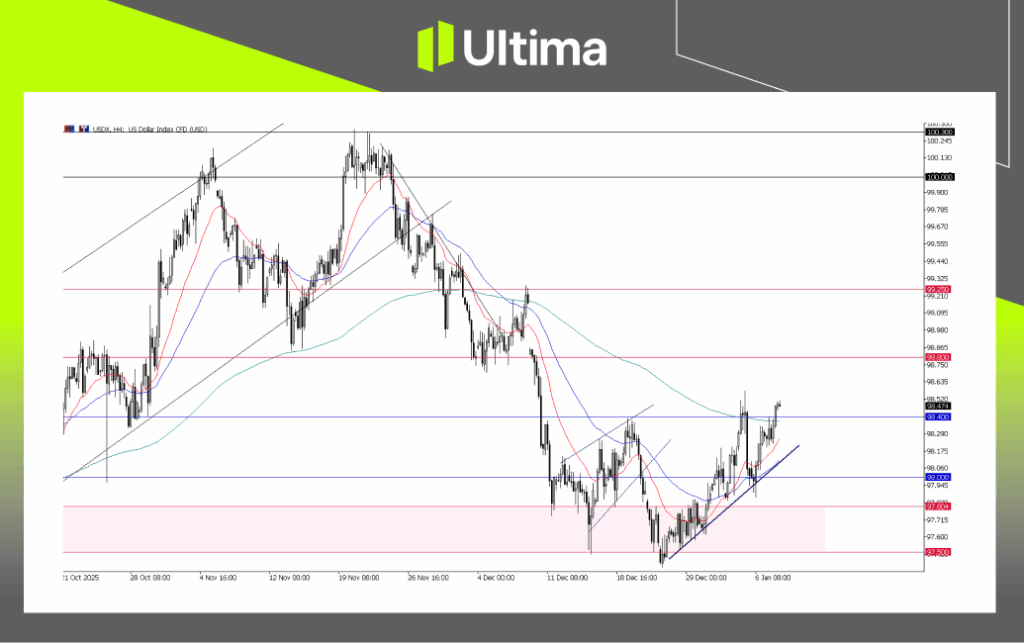

USDX, H4 Chart | Ultima Markets MT5

The US Dollar Index extended its rebound yesterday after finding a floor at the 98.00 support. With the potential break of 98.40, this could stage a bullish reversal for the Dollar in the near term.

Outlook: The Dollar is likely to extend its bullish reversal in the near term, unless the Non-Farm Payrolls (NFP) data delivers a surprise downside shock.

Gold & Silver: The “Sell the Fact” Pullback

As the Dollar stabilized on better data, the “Safety Bid” evaporated, leading to sharp profit-taking in precious metals, especially in Silver, which had recently extended into overbought territory.

Gold (XAU/USD) plunged over 1%, dropping from $4,500 to test the $4,445 zone. Silver (XAG/USD) was hit harder, tumbling ~4% to trade below $78.00. This potentially reflects traders who bought the rumor of a “Jobs Collapse” selling the fact when the data showed stability.

Silver Technical Outlook

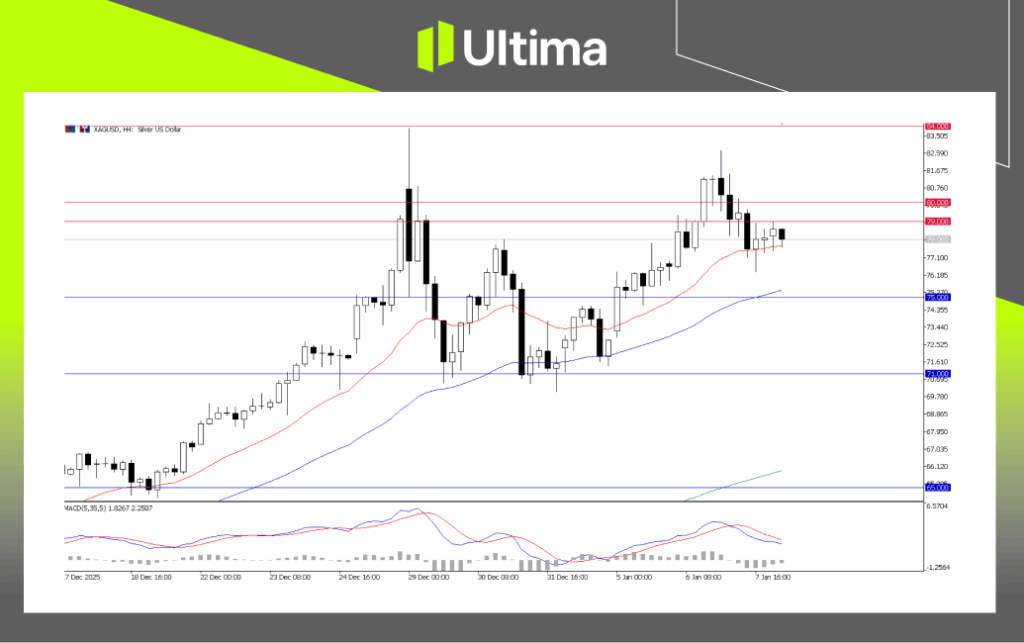

XAGUSD, H4 Chart | Ultima Markets MT5

Technically, Silver’s brief breakout above 80.00 failed to extend further, suggesting a false breakout that could potentially lead to a reversal.

Outlook: If buyers fail to regain the 80.00 level in the near term, Silver is likely to extend its downside move, seeing consolidation within the broader trend. Next levels to watch are 75.00 and 71.00.

Gold Technical Outlook

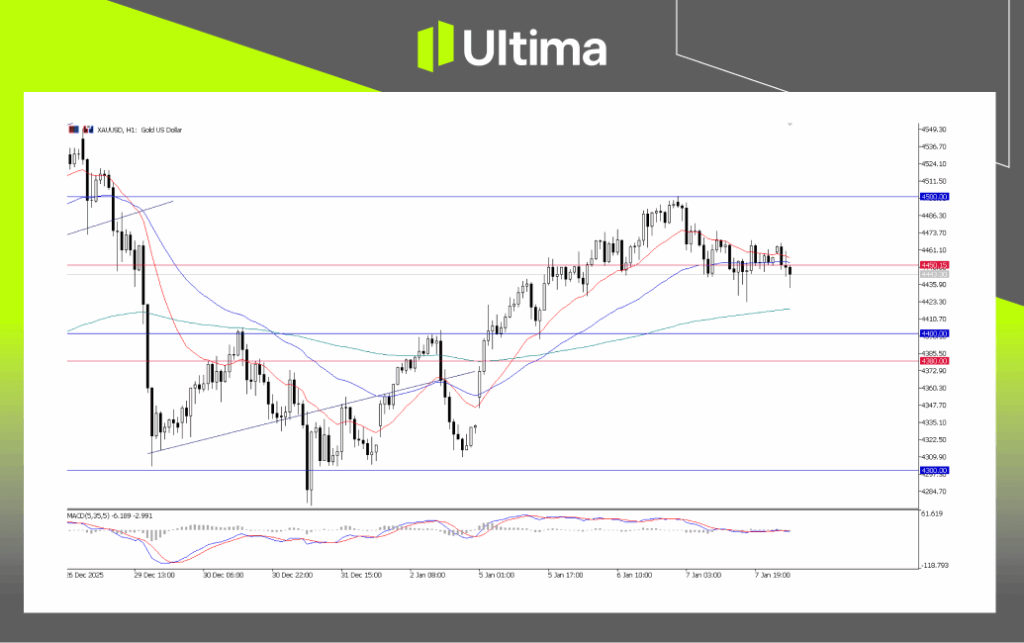

XAUUSD, H1 Chart | Ultima Markets MT5

Meanwhile, Gold, after facing resistance at 4,500, is now testing the 4,450 support. Continuing pressure could see another leg down toward the 4,400 support.

Outlook: The intraday outlook remains under pressure if Gold fails to regain 4,450, potentially dipping to 4,400 again. However, the 4,400 level would likely provide a “buy the dip” opportunity if this major psychological level holds.

What to Watch Today?

With the “ADP Employment & PMI Relief” in play, the market focus today shifts to verifying this stability. The key focus is on the US Initial Jobless Claims.

- Forecast:~220k.

- Impact: If Claims remain low (stable), it reinforces yesterday’s “Resilient Economy” narrative, pushing the Dollar higher and keeping Gold under pressure. A spike above 230k would undo the Dollar’s recovery.

Bottom Line: The market has shifted from panic to verification mode. Today’s data will determine whether yesterday’s Dollar rebound evolves into a sustained trend—or proves to be another short-covering bounce.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server