Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteWill the Dollar Rate Increase Next Week?

Based on current market conditions, the U.S. dollar is expected to remain weak or decline next week. Analysts are predicting continued pressure on the dollar due to rate-cut expectations from the Federal Reserve and political uncertainties surrounding the Fed’s independence.

U.S. Dollar Index (DXY) Overview

The U.S. Dollar Index (DXY) has recently dipped to a one-month low of 97.8, down over 9% year-to-date. This decline is largely driven by expectations of a Federal Reserve rate cut, following dovish remarks from Chairman Powell. The market is now pricing in an 86% probability of a rate cut in September, which is contributing to the dollar’s softness.

Key Economic Drivers:

- Fed Rate Cut Expectations: Traders are anticipating that the Fed will cut rates to stimulate economic growth. This is putting downward pressure on the U.S. dollar, which typically strengthens when interest rates rise.

- Political and Fiscal Concerns: Growing concerns about U.S. fiscal policy, rising debt levels, and pressure on the Fed’s independence are also contributing to the dollar’s weakness. The current uncertainty surrounding these issues is keeping the dollar under pressure.

What Could Shift the Dollar Next Week?

Strong U.S. Economic Data

Surprising positive economic data, such as strong Non-Farm Payrolls (NFP) or higher-than-expected wages, could push the Fed to reconsider its rate-cut stance. This would lead to a possible rebound in the U.S. dollar, as higher wages and employment data suggest a stronger economy.

NFP Data: If job growth comes in significantly higher than expected, the dollar could gain as investors anticipate that the Fed will remain hawkish on rates.

Unexpected Hawkishness from the Fed

Any shift toward hawkishness from the Federal Reserve could boost the dollar. While the market expects a rate cut, if the Fed signals a pause or delay in the cuts, the dollar could recover, as the market reassesses its expectations for future policy.

Geopolitical Risk

While the dollar is currently under pressure, a geopolitical event or global risk-off sentiment could increase demand for the U.S. dollar as a safe-haven asset. However, the current political volatility may limit the dollar’s safe-haven appeal compared to other assets like gold, the Japanese yen (JPY), or the Swiss franc (CHF).

Regional Currencies Affected by Dollar Weakness

Euro (EUR)

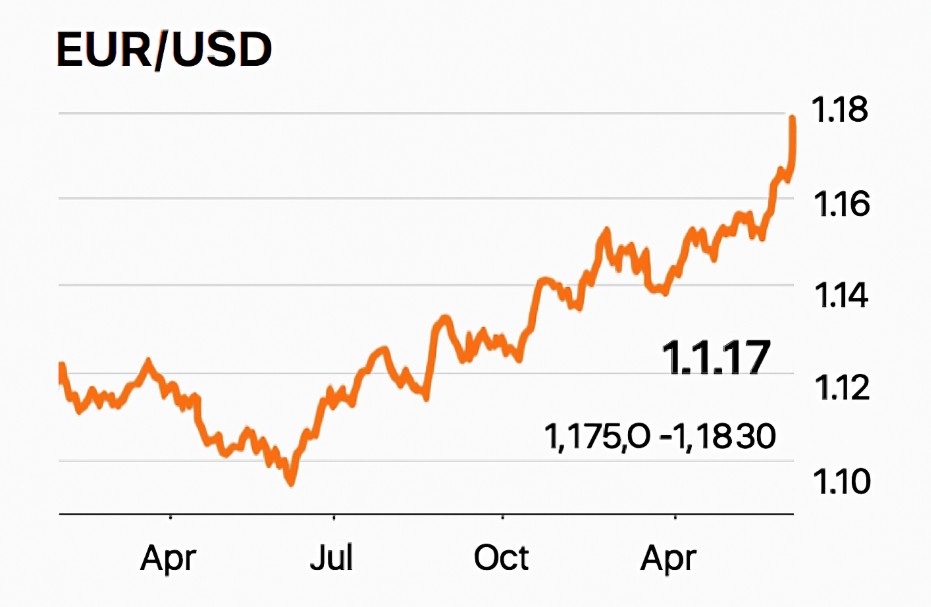

The EUR/USD pair has recently surged above 1.17, and experts are forecasting further upside, with potential moves toward 1.1750–1.1830 in the coming week. As the dollar weakens, the Euro benefits from relatively stable inflation and economic expectations in the Eurozone.

Chinese Yuan (CNY)

The Chinese Renminbi (CNY) has reached its strongest level against the U.S. dollar since November 2024, driven by a booming trade surplus and the Chinese government’s orderly currency policy. A strong CNY will likely continue to reflect the global weakness of the dollar.

Nigerian Naira (NGN)

The Nigerian Naira (NGN) has shown strength in the black market due to the faltering U.S. dollar. This is particularly notable in countries with currency control issues where the U.S. dollar’s global weakness is felt more acutely.

What the Charts Say: DXY and Key Levels to Watch

U.S. Dollar Index (DXY) Technical Support and Resistance

- Support Level: The DXY has strong support near the 96.6 level, which has historically acted as a floor for the dollar.

- Resistance Level: A break above 98 could suggest a potential reversal, but this would likely require a hawkish surprise from the Fed or strong economic data.

- Current Trend: The overall trend remains bearish for the dollar unless the Fed unexpectedly turns hawkish or if global events trigger a surge in dollar demand.

Expert Forecast: What to Watch Next Week

- U.S. Jobs Report (NFP): A strong NFP print could boost the dollar, but a weak report would likely reinforce expectations for a rate cut.

- Fed Chairman Powell’s Comments: Any changes in tone or guidance on the Fed’s policy stance could drive major fluctuations in the dollar.

- EUR/USD and DXY Levels: Watch for sustained closes above 1.1750 in the EUR/USD, which could indicate further weakness in the U.S. dollar.

Conclusion

In conclusion, the dollar’s performance next week will largely depend on economic data, Fed decisions, and geopolitical events. While rate-cut expectations are keeping the dollar under pressure, there is potential for a short-term reversal if the Fed signals a hawkish stance or if U.S. jobs data surprises to the upside.

Stay updated with the latest market news with Ultima Markets and expert insights, and monitor the key economic indicators closely to navigate potential moves in the U.S. dollar.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.