Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteWill the Anduril IPO Be Coming Soon?

In the dynamic world of defense technology, Anduril Industries has emerged as a game-changer, leveraging cutting-edge AI-powered surveillance systems, autonomous drones, and advanced military technologies. With its innovative approach to national security, Anduril is steadily positioning itself at the forefront of the defense tech sector. Now, many investors are asking: Will Anduril IPO soon?

Anduril’s Rise and Achievements Ahead of Its IPO

Founded in 2017 by Palmer Luckey, the former Oculus VR inventor, Anduril Industries has grown from a small startup to one of the most highly valued private defense tech companies.

Known for autonomous drones, AI surveillance systems, and advanced border security solutions, the company has secured major contracts and raised substantial funding, further cementing its place as a leader in defense technology.

Anduril has recently achieved a $30.5 billion valuation, after raising $2.5 billion in a funding round. The company’s recognition as No.1 on CNBC’s Disruptor 50 list for 2025 highlights its influence and innovative edge in the industry.

Additionally, Anduril’s $22 billion contract with the U.S. Army to take over Microsoft’s augmented reality headset program strengthens its position in the defense sector.

The Path Towards Anduril IPO

Anduril’s impressive growth trajectory has led to increasing speculation about its potential IPO. CEO Palmer Luckey confirmed that the company will “definitely” go public, emphasising that Anduril is designed to become a publicly traded company. He noted that securing large defense contracts, such as the $1 trillion F-35 Joint Strike Fighter deal, would be much harder for a private company.

Though no specific IPO timeline was given, Chairman Trey Stephens stated that Anduril is in the process of preparing for a public offering. This suggests that, while the IPO may not happen immediately, the company is actively laying the groundwork for future listing.

Expanding Capabilities and Key Partnerships

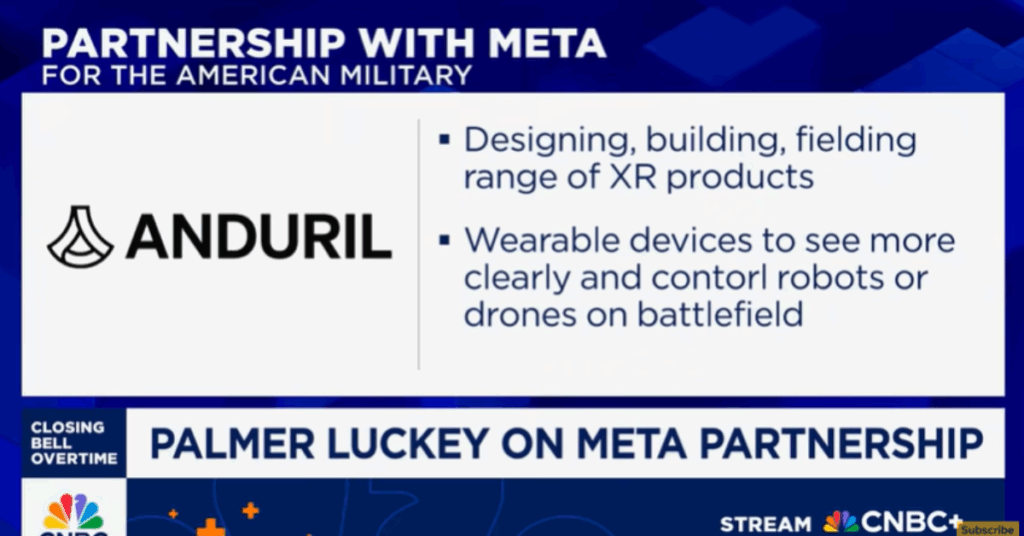

Anduril Industries has been expanding both its technological capabilities and its global reach. The company is collaborating with Meta and OpenAI, reinforcing its role in integrating AI with defense solutions. Additionally, Anduril is working with international partners, including Japan and Germany, as these countries significantly increase their defense budgets.

Anduril’s acquisition of Area-I, a company specialising in autonomous aircraft, further strengthens its position in the unmanned aerial systems (UAS) market. This strategic acquisition, combined with $1 billion in investments for a manufacturing facility in Ohio, underscores Anduril’s commitment to innovation and expansion in autonomous technologies.

Financial Position and Valuation Insights

Anduril’s recent Series G funding round, which raised $2.5 billion, boosted its valuation to $30.5 billion. This rapid growth, however, does come with a high price-to-sales ratio of 30.5, positioning Anduril at a premium compared to competitors like AeroVironment. Despite not being profitable yet, Anduril’s strong growth trajectory, doubling revenue in 2024, suggests significant market potential.

The company has expanded into new markets, including solid rocket motor (SRM) manufacturing, with plans to produce 6,000 tactical rocket motors per year by 2026 at its Mississippi facility. These moves highlight Anduril’s expanding influence across multiple domains within the defense industry.

Innovation and Technology at Anduril

At the core of Anduril’s strategy is innovation. The company’s autonomous systems and AI-driven solutions redefine modern military technology. From the development of Ghost Drones to its Lattice command-and-control platform, Anduril is pushing the boundaries of what is possible in national security and military defense.

Unlike traditional defense contractors like Lockheed Martin and Northrop Grumman, Anduril operates with a software-first approach. This agility allows the company to quickly develop scalable, IP-rich platforms, which have become a significant factor in its market appeal.

Navigating Regulatory Challenges

Operating as a private company in the defense sector means Anduril Industries faces complex regulatory requirements. The company is subject to stringent oversight, particularly in relation to the development and deployment of AI-powered military solutions.

However, Anduril has developed a reputation for navigating this regulatory landscape successfully, positioning itself as a trusted partner to the U.S. Department of Defense and allied nations.

As Anduril expands globally, the company continues to ensure that its products meet regulatory standards, giving it a competitive edge in the defense tech market.

What’s Next: Anduril IPO on the Horizon?

Although Anduril Industries has not officially confirmed a specific IPO date, the signs point to a public offering in the near future. The company’s $30.5 billion valuation, rapidly growing product line, and the strong demand for AI-driven defense technologies make it a likely candidate for a highly anticipated IPO in the defense tech space.

Conclusion

Anduril Industries has already established itself as a leader in defense technology, and its global expansion, technological innovation, and strong financial position suggest a bright future ahead.

While its IPO timeline remains uncertain, Anduril is positioning itself for success as it scales its operations. When the company eventually goes public, it is likely to become one of the most sought-after IPOs in the defense tech sector.

Key Takeaways:

- Anduril Industries IPO is confirmed by CEO Palmer Luckey, but no official timeline has been provided.

- The company’s $30.5 billion valuation following a $2.5 billion funding round shows strong market confidence.

- Anduril’s technological innovations, including AI-powered systems and autonomous drones, make it a leading player in the defense tech industry.

- Anduril continues to expand, with key defense contracts and partnerships with Meta and OpenAI, positioning it for further growth.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.