Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteWill iPhone 17 Release Boost Apple Stock?

The imminent iPhone 17 release is more than just a tech milestone — it’s a potential market mover. The Apple iPhone 17, expected to launch around September 9, 2025, could once again stir investor sentiment.

According to BofA Securities analyst Wamsi Mohan, Apple shares may see a short-term dip on unveil day — a classic “sell-the-news” reaction — before recovering within 30 to 60 days as preorder data and early analyst upgrades roll in.

Historical Patterns from Past iPhone Launches

Apple stock has a history of uneven reactions to new iPhone launches. The build-up often brings price gains, but launch day itself frequently produces flat or negative moves, reflecting the “buy the rumour, sell the news” effect.

- iPhone 12 (2020) — The first 5G iPhone sparked outsized demand, lifting Apple shares more than 60% in the months around launch.

- iPhone 14 (2022) — Shares climbed ahead of launch, only to slip shortly after as investors locked in profits.

- iPhone 15 (2023) — Global macro pressures muted stock performance, despite solid preorder strength.

- iPhone 16 (2024) — The most recent launch saw Apple stock dip less than 1% on announcement day, before ending September with a ~3% gain, defying weak seasonal trends.

Barron’s data shows that historically, Apple delivers an average 11% return within six months of iPhone launches.

AI at the Center of the iPhone 17 Release

After years of iPhone launches defined by design tweaks and camera upgrades, the iPhone 17 release is expected to mark Apple’s first truly AI-driven cycle. Apple has branded its new Apple Intelligence suite as the centerpiece of iOS 26, with intelligence woven across apps, services, and the broader ecosystem.

Key features include:

- Siri 2.0 — a major upgrade enabling voice-only control of third-party apps such as WhatsApp, YouTube, and Uber.

- System-wide AI tools — voicemail summaries, smarter writing assistants, and context-aware recommendations.

- Enhanced camera software — improved computational photography and video editing powered by machine learning.

For investors, the critical question is whether these AI features will drive an upgrade super-cycle similar to the 5G boost of the iPhone 12. If consumers view Apple Intelligence as indispensable, demand for the iPhone 17 could exceed expectations. If not, the cycle may resemble the iPhone 15 or 16, where launches had a limited effect on Apple’s share price.

What’s Changed in Apple’s Production

The iPhone 17 release arrives at a critical moment in Apple’s supply chain strategy. For the first time, all four iPhone 17 models, including Pro versions, will be assembled in India from day one. Apple is scaling production across five factories, a move that reflects years of preparation to reduce its reliance on China.

India’s Growing Role

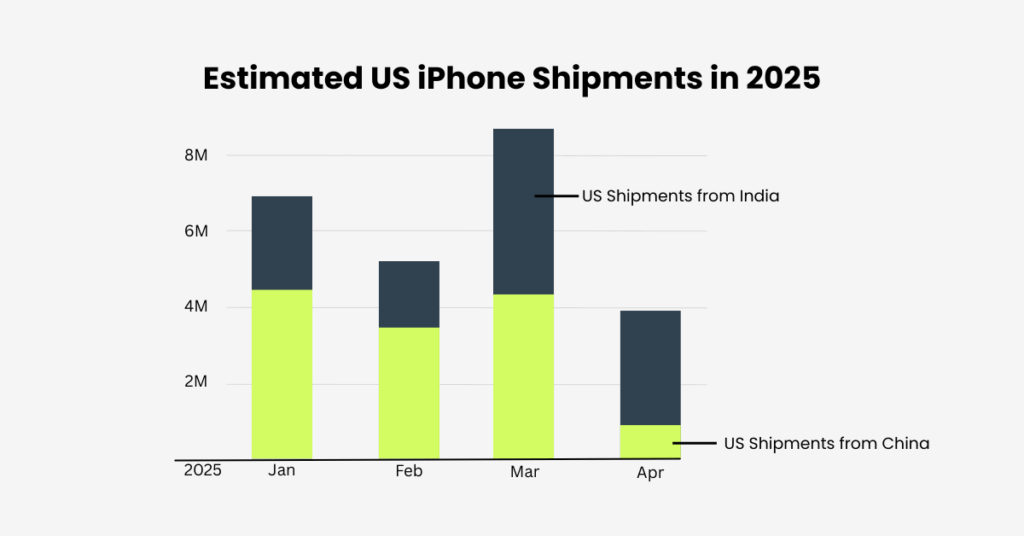

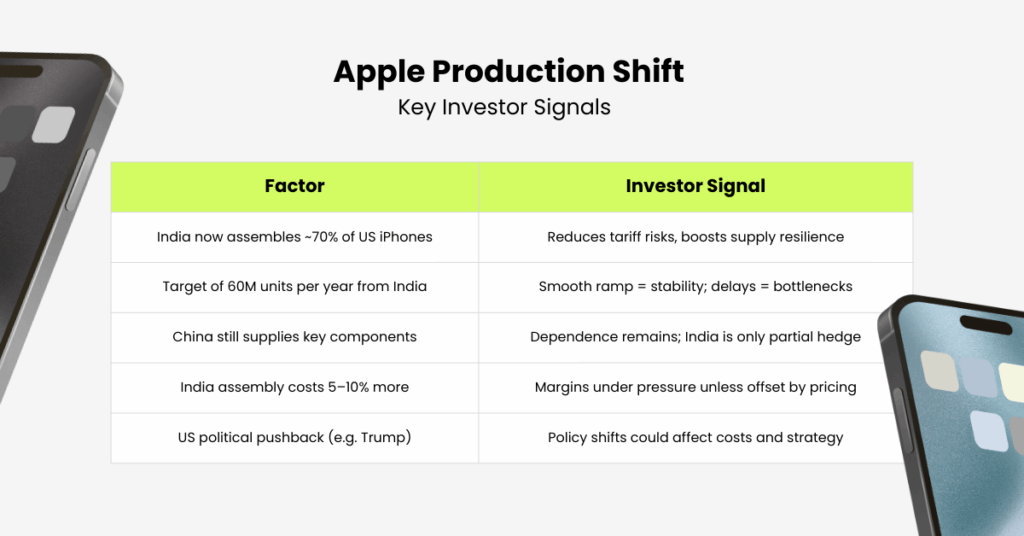

India’s role in Apple’s production footprint has expanded at record speed. In the second quarter of 2025, about 70% of iPhones sold in the US were supplied from India, up sharply from 31% a year earlier. In March alone, Apple shipped $2 billion worth of iPhones from India to the US, underscoring how quickly output has scaled. Analysts estimate Apple is targeting as many as 60 million iPhones annually from India, a substantial shift of volume away from China.

This expansion is driven by both political and practical factors. On the political side, Apple is hedging against US–China trade tensions and tariff risks. On the practical side, the company is reducing its dependence on a single geography — a necessity given potential risks ranging from geopolitical conflict to supply chain shocks.

India Is Not Replacing China

Despite headlines suggesting a relocation, analysts emphasise that India is supplementing, not replacing, China. Most of the critical components (chips, sensors, displays, and cameras) are still manufactured in China or by Chinese-owned suppliers. India’s contribution remains focused on final assembly, with infrastructure and supply networks still years behind China’s.

Apple’s presence in China is the result of two decades of co-creation. The so-called “Red Supply Chain”, a dense ecosystem of suppliers, engineers, and toolmakers, was built around Apple’s needs and remains unmatched anywhere else in the world. India, while growing quickly, is still building that ecosystem from scratch.

The US Factor

Apple’s move to India has also stirred political debate in the United States. Former President Trump criticised the company’s decision, arguing that moving from China to India does little for American workers. Some voices have even floated the idea of testing a small-scale “Made in America” iPhone line — possibly at higher prices — to gauge consumer appetite for supporting domestic manufacturing.

While such a move remains speculative, it highlights the political scrutiny Apple faces as it rebalances its supply chain. For investors, this means that Apple’s production story is as much about geopolitics as it is about efficiency.

Stock Outlook Into the iPhone 17 Release Cycle

Short term: Expect a dip on launch day if expectations are priced in, but supply chain headlines may help cushion downside.

0–3 months: Watch for preorder strength and India ramp updates. Stability in production could reduce tariff risks.

3–6 months: If India continues to expand its role without major supply bottlenecks, the historic six-month rebound pattern may repeat, supported by both iPhone sales and Apple’s growing services revenue.

Conclusion

The Apple iPhone 17 release date will again be one of the biggest market events of the year. Historically, Apple stock tends to rise before the launch, dip on the announcement, and recover over the following months.

What makes this cycle different is the production shift. Apple’s move to expand assembly in India reduces tariff exposure and provides geopolitical insurance. But the company remains deeply tied to China’s unmatched supply chain. For investors, the iPhone 17 is not only a product catalyst; it’s also a test of Apple’s ability to diversify production while protecting margins and delivering consistent supply.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.