Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

Will Gold Rate Decrease In Coming Days 2026?

Gold prices are unlikely to decrease significantly in the coming days of 2026. Gold remains supported by strong central bank demand, geopolitical uncertainty, and expectations of stable or easing interest rates. Unless there is a sudden shift in monetary policy or a strong rebound in the US dollar, any near-term dips are likely to be limited rather than the start of a sustained fall.

Recent Gold Price Trends

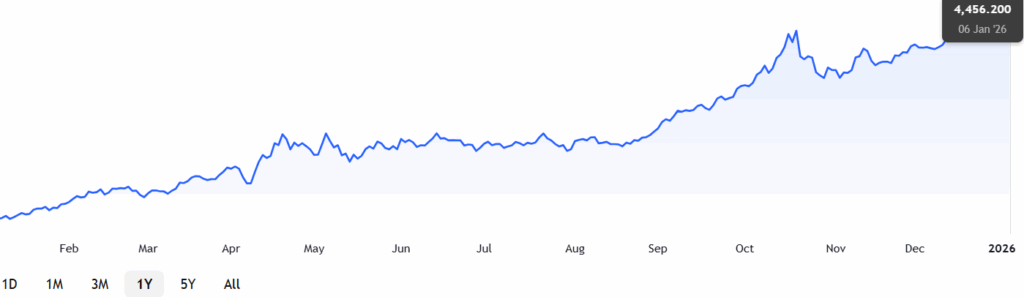

Recent gold price data shows a clear and sustained upward trend, with XAU/USD climbing steadily throughout the year and accelerating sharply in the second half. After a period of consolidation between mid-year months, prices broke higher from September onward, signaling strong buying momentum. Gold reached a new high of 4,456.20 on 6 January 2026, and despite brief pullbacks in late Q4, the overall structure remains bullish. The ability of prices to hold near highs into early 2026 suggests continued demand and a strong underlying trend rather than a short-term speculative spike.

Factors Influencing Gold Prices in 2026

Understanding whether gold rates will decrease requires looking at the key drivers impacting the precious metal:

Gold prices in 2026 are shaped by a combination of macroeconomic forces, structural demand, and market sentiment rather than short-term speculation.

Central Bank Demand

Central banks remain one of the strongest pillars of gold demand in 2026. Ongoing reserve diversification and a desire to reduce reliance on the US dollar continue to support gold purchases, keeping prices elevated.

Interest Rates and Monetary Policy

Expectations of stable or gradually easing global interest rates reduce the opportunity cost of holding non-yielding assets like gold. Any shift toward looser monetary policy tends to strengthen gold prices.

US Dollar Strength

Gold typically moves inversely to the US dollar. Periods of dollar softness in 2026, driven by fiscal deficits or policy uncertainty, increase gold’s appeal as an alternative store of value.

Inflation and Purchasing Power

While inflation has moderated from peak levels, persistent cost pressures keep gold attractive as an inflation hedge, especially during periods of renewed price volatility.

Geopolitical and Economic Uncertainty

Ongoing geopolitical tensions, trade fragmentation, and political uncertainty continue to fuel safe-haven demand, supporting gold prices during market stress.

Investor and ETF Flows

Renewed inflows into gold-backed ETFs and institutional portfolios signal long-term confidence in gold as a strategic asset rather than a short-term trade.

Will Gold Rate Decrease in Coming Days?

Short-term pullbacks in gold prices remain possible in 2026, particularly if economic data surprises to the upside or risk sentiment improves. However, a sharp decline appears unlikely in the near term.

Most analysts expect gold to remain well supported above the USD 2,700–2,900 per ounce range in 2026, underpinned by central bank demand, geopolitical uncertainty, and expectations of easier monetary policy. Technical indicators point to strong buying interest near key support zones, suggesting any dips are likely to be corrective rather than the start of a sustained downturn unless macro conditions shift materially.

Will Gold Rate Go Down or Up Tomorrow?

Many traders search for daily gold price movements, but it’s important to understand that daily price action is driven by:

- Market sentiment

- Fed comments or economic data releases

- Currency volatility

For short-term traders, keeping an eye on US non-farm payrolls, CPI data, and Fed speeches can give clues about the next direction.

Benefit of Investing in Gold

Despite short-term price movements, gold remains a strategic investment in 2026 due to its long-standing role as a store of value. Here’s why investors continue to favor gold:

- Inflation Hedge: Gold preserves purchasing power during inflationary periods. As real interest rates remain low, gold helps investors maintain the value of their assets.

- Portfolio Diversification: Gold has low or negative correlation with equities and fixed income assets. Adding gold can reduce overall portfolio volatility, especially in times of economic stress.

- Safe-Haven Asset: During geopolitical turmoil or financial market instability, gold consistently attracts demand as a reliable store of wealth.

- High Liquidity: Gold is one of the most liquid assets globally. It can be quickly bought or sold in major markets at transparent prices.

- Currency Protection: Gold provides a hedge against currency depreciation. In 2025, with the U.S. dollar facing downward pressure, gold offers protection for those holding weaker currencies.

- Growing Institutional Demand: Central banks and sovereign wealth funds have significantly increased their gold reserves, reinforcing its credibility and perceived safety.

- No Counterparty Risk: Physical gold does not depend on a third party to fulfill a contract, unlike most financial instruments.

These benefits collectively position gold as a defensive and strategic asset in an unpredictable 2025 economic landscape.

Expert Outlook: What Analysts Are Saying About Gold

Major financial institutions expect gold prices to remain elevated into 2026, supported by structural demand and macro uncertainty.

- Goldman Sachs projects gold to trade in the USD 2,800–3,200 range in 2026, citing sustained central-bank buying, geopolitical risk, and long-term hedging demand.

- JPMorgan analysts expect gold to stay firm above USD 2,700, supported by anticipated global rate cuts, fiscal deficits, and diversification away from the US dollar.

Overall, analysts view gold as a strategic store of value in 2026, rather than a short-term speculative asset, with prices likely to stay historically high even during periods of volatility.

Conclusion

Whether you’re a short-term trader or a long-term investor, staying informed is key. Monitor global trends, economic releases, and central bank policies. As of now, there is no strong indication that gold will sharply decrease in price in the coming days.

Stay ahead in your gold trading journey with accurate insights and smart strategies, brought to you by Ultima Markets.

FAQs

Gold prices may see short-term pullbacks, but a significant drop is unlikely in 2026 due to strong central bank demand, geopolitical risks, and supportive monetary conditions.

The cheapest time to buy gold is usually during market pullbacks, periods of strong US dollar strength, or when interest rate expectations rise, which often pressure gold prices temporarily.

Gold can be a good buy in 2026 for long-term diversification and risk hedging, especially if purchased during price dips rather than after sharp rallies.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.