Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

Malaysian Ringgit (MYR) has been making notable strides, appreciating steadily against the US Dollar (USD). This shift in the MYR’s performance has garnered attention in the financial markets, as traders and investors look to capitalize on the currency’s momentum.

Why Malaysia Ringgit Strengthen? 4 Key Reasons

The Malaysian Ringgit (MYR) is strengthening due to several key factors:

1) Softer US Dollar and Narrowing Interest Rate Differentials

A significant factor contributing to the strengthening of the Ringgit is the weaker US Dollar. With the US Federal Reserve’s interest rate hikes slowing, the dollar has lost some of its earlier momentum. Meanwhile, Malaysia’s stable policy stance, supported by Bank Negara Malaysia’s (BNM) monetary policies, has narrowed the interest rate gap between Malaysia and the US, providing a supportive backdrop for the MYR.

2) Stronger Economic Fundamentals in Malaysia

Malaysia’s economy has shown resilience, with a 5.2% GDP growth in the third quarter of 2025. This growth, driven by domestic consumption, exports, and key sectors like mining and construction, has fostered positive sentiment towards the Malaysian economy. The fiscal deficit reduction efforts by the Malaysian government also reflect the country’s commitment to improving its financial standing, which in turn strengthens confidence in the MYR.

3) Malaysia’s Fiscal Consolidation and Strong Reserves

Another reason behind the MYR’s improvement is the Malaysia government’s fiscal consolidation efforts. The country’s fiscal deficit is projected to fall to 3.5% of GDP by 2026, down from 3.8% in 2025. Furthermore, Malaysia’s international reserves, currently at USD 123.4 billion, offer substantial support to the currency, ensuring stability and reducing the risk of sharp declines.

4) Positive Trade Balance and FDI Inflows

Malaysia has a strong export sector, especially in electronics, semiconductors, and clean energy, which generates foreign exchange inflows. Additionally, Malaysia continues to attract foreign direct investment (FDI), which further supports the Ringgit. This steady flow of investment capital has been a key factor in maintaining MYR’s strength.

When Was the MYR the Strongest?

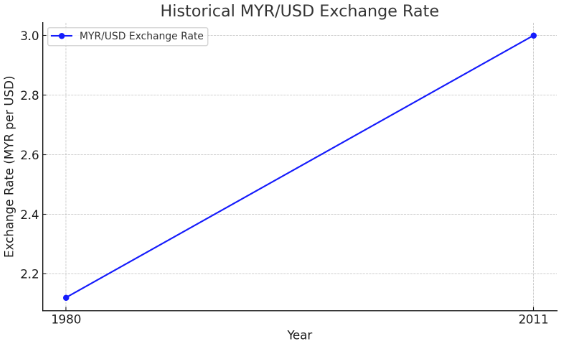

Historically, the Malaysian Ringgit has performed best when the country’s economic fundamentals were strongest, particularly during the early 1980s. The MYR/USD exchange rate hit its lowest value of 2.12 in September 1980. More recently, MYR touched 3.0 against the US dollar around 2011, after Malaysia moved away from its currency peg. These periods marked the strongest moments in MYR history.

What Does a Stronger Ringgit Mean for USD/MYR Pairs?

A stronger Ringgit (MYR) against the US Dollar (USD) directly affects the USD/MYR currency pair, a popular trading instrument in the forex market. As the MYR appreciates, the exchange rate for USD/MYR declines, meaning one US Dollar is worth fewer Malaysian Ringgit. For traders, this trend offers multiple opportunities:

- Potential for Short Positions in USD/MYR: As the Ringgit strengthens, traders may look to open short positions on the USD/MYR pair, betting on the Ringgit’s continued appreciation.

- Risk Management: A strengthening Ringgit could introduce volatility, especially in reaction to global economic news. Traders should adjust their stop-loss and take-profit levels accordingly to protect against sudden reversals.

- Interest Rate Differentials: If Malaysia’s interest rates remain attractive relative to the US, the Ringgit’s strength may persist, providing trading opportunities in favor of the MYR. Monitoring Bank Negara Malaysia’s (BNM) policies will be essential for gauging future MYR strength.

For traders, understanding the reasons behind Ringgit strength, such as economic growth or softer US dollar sentiment, will help in anticipating the USD/MYR movement and adapting strategies for short-term and long-term trades.

Key Technical Indicators to Watch

As the MYR strengthens against the USD, several technical indicators can help traders assess potential price movements in the USD/MYR pair:

- Moving Averages: Watch the 50-day and 200-day simple moving averages (SMA). A bullish crossover (50-day SMA crossing above the 200-day SMA) could indicate sustained strength in the Ringgit, suggesting further downward movement in the USD/MYR pair.

- Relative Strength Index (RSI): The RSI helps traders determine whether the USD/MYR pair is overbought or oversold. If the RSI is above 70, it could signal an overbought condition for USD/MYR, potentially indicating a reversal in USD strength. A value below 30 may suggest that the Ringgit is nearing an overbought condition.

- MACD (Moving Average Convergence Divergence): The MACD can highlight potential momentum shifts. A bullish crossover in the MACD (the MACD line crossing above the signal line) often indicates increased buying pressure for the MYR.

- Support and Resistance Levels: Key support levels for the USD/MYR pair (such as around RM 4.22 or RM 4.10) and resistance levels (like RM 4.30) can act as crucial points for traders to set their entry and exit points.

By focusing on these technical indicators, traders can gain valuable insights into potential price movements and refine their trading strategies as the Ringgit strengthens.

Should Traders Adjust Their Forex Strategy as MYR Gains Strength?

Yes, traders should definitely adjust their forex strategy as the Malaysian Ringgit gains strength. A strengthening Ringgit presents both risks and opportunities, so it’s essential to adapt trading approaches based on the market conditions:

- Shift Focus to Long MYR Positions: Traders who anticipate further MYR strength may consider long positions in MYR or short positions in USD. This shift would involve taking advantage of the USD/MYR decline and capitalizing on the Ringgit’s appreciation.

- Reevaluate Risk Management: With increased volatility in the USD/MYR pair, traders should be mindful of risk management. This may include adjusting stop-loss levels to ensure protection against sudden market reversals or geopolitical events that could impact the MYR.

- Monitor Economic Indicators: A rising MYR often reflects Malaysia’s strong economic fundamentals, such as solid GDP growth, fiscal discipline, and external trade surpluses. Traders should closely track data such as GDP reports, inflation data, and interest rate announcements from Bank Negara Malaysia.

- Diversify Trading Pairs: If the Ringgit strengthens significantly, traders may consider diversifying their portfolios by trading other emerging market currencies or cross-currency pairs, such as MYR/SGD, which might also be affected by MYR strength.

Traders should stay agile, constantly monitor key indicators, and adjust their strategies to match the evolving market conditions in order to capitalize on the Ringgit’s upward movement.

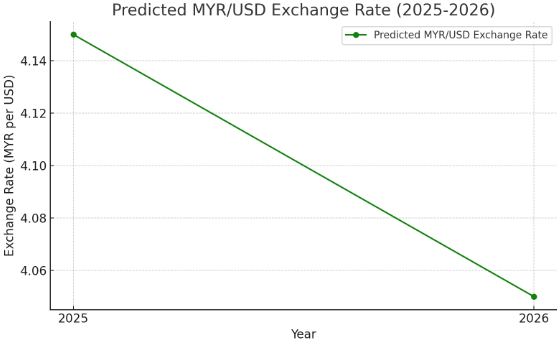

Malaysia Ringgit to USD: Forecast for 2025 and Beyond

Analysts suggest that the USD/MYR exchange rate will likely see a moderate decline in the coming years. Specifically, the MYR could appreciate towards RM 4.15 by the end of 2025 and potentially RM 4.05 by the end of 2026, assuming stable global growth and continued positive economic performance in Malaysia.

However, this appreciation will likely be gradual and contingent on various factors, including the global economic environment, commodity prices, and foreign investment flows.

Risks to the Forecast

While the outlook is positive, several risks could impact the MYR’s trajectory:

- Stronger-than-expected US economic performance could push the USD higher, slowing the Ringgit’s appreciation.

- Declining global commodity prices (such as oil) could reduce Malaysia’s trade surplus, affecting the flow of foreign currency and dampening MYR strength.

- Geopolitical instability or global market uncertainty could result in a flight to safety, with investors turning to the US Dollar, potentially weakening the MYR.

In conclusion, while the MYR is expected to appreciate gradually against the USD in 2025 and 2026, its path will depend on a mix of domestic economic factors, US economic developments, and global market conditions.

Conclusion

As the Malaysian Ringgit strengthens against the US Dollar, forex traders have an excellent opportunity to capitalize on the USD/MYR currency pair. By leveraging technical analysis, economic data, and central bank policies, traders can identify potential entry and exit points, while adjusting their strategies to the evolving market conditions.

For those new to forex or looking to refine their strategies, demo trading accounts offer a valuable platform to practice without financial risk. A demo account enables traders to test strategies for trading the strengthening Ringgit in real market conditions, using virtual currency to understand the mechanics of trading, manage risk, and assess their approach before transitioning to live trading.

Whether you’re an experienced trader or a newcomer, demo accounts are an essential tool for gaining confidence and enhancing trading skills in a dynamic forex environment. By understanding the factors driving the MYR’s strength and practicing on a demo account, traders can position themselves to make informed, strategic decisions in the evolving USD/MYR market.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.