Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWhy is the Market Crashing? What to Expect?

As the market continues to experience periods of volatility, many investors are wondering: Is a market crash imminent? Why is the market crashing? With rising concerns about overvaluation, political risks, and sector-specific performance, it’s essential to understand what could drive the market toward a potential crash in 2026.

In this article, we’ll explore the key factors behind the recent market fluctuations, including the impact of AI, sector shifts, political uncertainty, and valuation concerns, to better understand why is the market crashing and what to expect in 2026.

AI as a Key Market Driver But at What Cost?

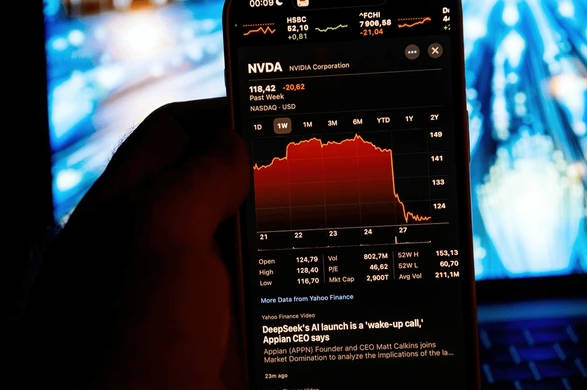

One of the dominant forces driving market growth in recent years is artificial intelligence (AI). Companies like Nvidia, Microsoft, and Google have invested billions into AI research and development, making it a central pillar of both technological innovation and market sentiment. AI has become more than just a tech buzzword. It is reshaping industries and driving the performance of key stocks.

However, this growth comes with a price. As AI becomes increasingly integral to the market, its impact is being reflected in stock prices, particularly in tech companies that rely on AI. Nvidia’s stock, for instance, has seen significant gains, but is it sustainable?

AI-related companies are now valued at levels that some investors argue are overinflated. As AI-driven stocks continue to surge, the risk of a correction looms large. If the market overestimates the long-term potential of AI or if these companies fail to meet overly optimistic expectations, we could see a sharp pullback.

The High Valuations Dilemma

Another critical issue for the market is its valuation. The S&P 500 currently trades at a 25x P/E ratio, well above its historical average of 15x. This indicates that stocks are priced much higher than their earnings would suggest. While high valuations are often justified during times of optimism and strong economic growth, they can also be a sign of an unsustainable market bubble. If investor sentiment shifts, or if economic conditions deteriorate, the market may be primed for a steep correction.

Despite these concerns, there are signs that the supply and demand for stocks remain strong. Investors are still pouring money into equities, corporate buybacks are continuing, and earnings expectations are rising. Some analysts, like those at Deutsche Bank, are optimistic that the market can continue to climb, citing AI investment as a driving force for further growth. However, this bullish outlook is tempered by the reality of high valuations, which makes the market susceptible to sudden shocks.

Sector Shifts and Market Fragility

One of the signs of potential market instability is the growing sector rotation. While tech stocks have been the leaders of the recent bull market, there is a noticeable shift toward sectors like consumer discretionary, healthcare, and financials. This shift in earnings expectations could suggest a changing market landscape. But if these new sectors fail to perform as expected, it could raise the question: why is the market crashing despite the optimism around diversification?

This rotation could be a sign that the economy is entering a new phase. However, it also highlights a growing fragility in the market. The market has been heavily reliant on AI and tech for growth, but as leadership in these sectors begins to wane, the broader market could lose momentum. If the new sectors fail to perform as expected, or if tech stocks experience a significant downturn, the market could face a steep and rapid decline.

Political Risks and Election Cycles

Political uncertainty is another factor that could contribute to a market downturn. With the 2026 U.S. midterm elections on the horizon, the market may face increased volatility. Historically, the second year of a U.S. presidential term, particularly during midterm election years, has been marked by political uncertainty and volatility in the markets.

President Trump’s second term, for example, saw a strong first half of the year followed by a collapse in the latter half, driven by trade tensions and policy changes. The trade war and rising geopolitical risks caused significant instability, and the market responded by dropping sharply.

As we approach the 2026 elections, similar risks loom. Tariffs, changing fiscal policies, and policy uncertainty could all trigger market instability. This uncertainty could be exacerbated if the government remains divided or if policy shifts in unpredictable directions. The potential for fiscal policy freezes and a lack of coordination between political parties could make the market more fragile, adding another layer of risk.

The Role of Rate Cuts and Economic Cycles

In addition to political risks, the Federal Reserve’s actions could play a significant role in shaping the market in 2026. Morgan Stanley predicts that the Fed might cut rates early if economic conditions weaken. The logic behind this is simple: if employment weakens and risk assets fall, the Fed will likely have to inject liquidity back into the market to stabilize it. While rate cuts could provide short-term relief and potentially push the market higher, they also raise concerns about asset bubbles.

Rate cuts could temporarily boost stock prices, but they also risk creating unsustainable market conditions. As interest rates are lowered to stimulate the economy, investors may flood into equities, driving up valuations even further. If economic growth doesn’t follow, the market could face a significant correction when investors realize that the growth was artificially supported by liquidity rather than fundamental earnings.

Is a Crash Looming in 2026?

While we are not yet in a market crash, the risks are clear. The combination of overvaluation, AI-driven stock performance, sector shifts, political uncertainty, and rate cuts all contribute to an environment where a crash could be on the horizon. Why is the market crashing in certain sectors? It’s because of the overreliance on tech stocks, high valuations, and shifting investor sentiment.

As we move into 2026, investors should be cautious. While the market may continue to perform well in the short term, these underlying risks could lead to a correction or even a crash if investor sentiment turns. A balanced, long-term investment strategy remains the best way to navigate these uncertain times.

By understanding why is the market crashing, investors can make informed decisions and prepare for whatever comes next.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.