Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteWhy Is Paypal Stock Down Today?

PayPal (NASDAQ: PYPL) stock is down today primarily due to renewed pressure in the fintech space. Recent reports confirm that JPMorgan Chase plans to begin charging fintech companies like PayPal for access to customer banking data. This move raises concerns about rising operational costs and data access limitations, both of which could directly impact PayPal’s core services. As a result, traders reacted sharply, causing the stock to fall approximately 5.7%, a drop that significantly underperformed the broader S&P 500 index, which declined by only 0.3% on the same day.

Additionally, trading volume surged to over 21.6 million shares, more than double its 65-day average of 9.3 million, reflecting heightened sell-side activity. At the same time, PayPal’s current valuation stands at a market cap of around $64.5 billion with a P/E ratio of 14.2 and earnings per share (EPS) of 4.45. The combination of negative fintech headlines, broader market weakness, and unusually high trading volume has driven the sharp move lower in PayPal stock today.

PayPal Stock Price Performance Overview

After peaking at $310.16 per share in July 2021, the PayPal stock price has seen a prolonged downtrend. As of mid-July 2025, it trades around $71, marking a steep decline of approximately 77% from its all-time high. This sustained drop has raised major concerns among traders regarding the company’s long-term growth potential and competitive position in the fintech space.

Why Did PayPal Stock Drop?

Weak Earnings and Revenue Growth

PayPal’s Q1 2025 results highlight ongoing revenue pressures. Revenue rose just 1% YoY to $7.79 billion, slightly missing analyst estimates of $7.85 billion. Total payment volume grew 3% YoY to $417 billion, reinforcing slow top-line momentum. Although GAAP net income surged 45% to $1.29 billion and non-GAAP EPS beat at $1.33 (+23% YoY) , management reiterated cautious full-year guidance. This conservative stance, driven by weak underlying growth despite margin gains, has weighed on trader sentiment.

Fierce Competition in Digital Payments

PayPal faces growing pressure as fintech rivals continue to advance. Branded checkout and Venmo volume rose only 6%, a modest gain that underwhelmed market watchers. Meanwhile, competitors like Apple Pay, Google Pay, and Block’s Cash App are expanding rapidly, grabbing share in both consumer and merchant payment channels . Slowing BNPL adoption and stagnant Venmo engagement further signal that PayPal must accelerate innovation or risk falling behind.

Strategic and Legal Headwinds

Strategic drift and legal risks are also impacting trader confidence. Earlier acquisitions like Honey (≈$4 billion) and Paidy (≈$2.7 billion) have underperformed, providing limited synergy with PayPal’s core business . Honey, in particular, has been embroiled in lawsuits alleging it hijacks affiliate commissions through last-click attribution, leading to class actions and a notable user decline of over 4 million Chrome users. Additionally, PayPal has seen executive turnover. CEO Schulman exited in 2023 and was replaced by Alex Chriss which, combined with weak M&A results, has raised doubts about the company’s long-term trajectory.

PayPal Stock Forecast: Can It Recover?

Despite PayPal’s recent struggles, analyst sentiment remains mixed, with some cautiously optimistic about long-term value while others remain skeptical in the near term.

Here’s a snapshot of current ratings and price targets:

| Analyst | Rating | Price Target |

| JPMorgan | Overweight | $77 |

| Goldman Sachs | Neutral | $74 |

| Morningstar | Fair Value | $94 |

- JPMorgan raised its target to $77, maintaining an overweight stance based on margin expansion and cost control, despite soft top-line growth.

- Goldman Sachs revised its price target to $74, citing a balanced risk-reward outlook with neutral revenue momentum.

- Morningstar sees PayPal as undervalued, estimating a fair value of $94, supported by strong free cash flow and brand strength in digital payments.

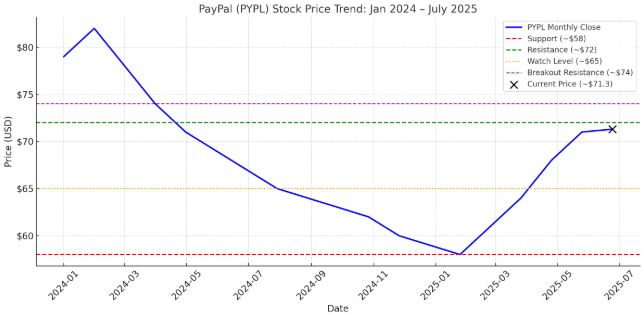

Paypal Stock Chart Analysis

The PayPal (PYPL) stock chart clearly illustrates a multi-month downtrend, marked by a series of lower highs and lower lows. After reaching a relative peak of around $79 in early 2024, the stock steadily declined, eventually hitting a key support level around $58 in March 2025.

Support Zone: ~$58

PayPal found a bottom around $58 in March 2025, a critical level that held after several attempts to break lower. This zone now serves as a major support level, and any breakdown below it would likely trigger further downside toward the low-$50s.

Resistance Level: ~$72

In April 2025, PayPal made a short-lived push to $72, but failed to break higher. This level has since acted as a firm resistance, with multiple rejections around this price in the months that followed. Bulls will need a decisive breakout above this level to signal any serious recovery momentum.

Breakout Watch: ~$74

Some traders are also watching the $74 level, which sits near the stock’s 200-day EMA. A strong breakout above both $72 and $74, with confirmation from rising volume, would be the first bullish signal in months. Without that, upward momentum remains highly limited.

Is Paypal Stock a Buy Now?

As of July 2025, PayPal (NASDAQ: PYPL) trades around $71.30, significantly below its July 2021 peak of $310.16. The company reported Q1 2025 revenue of $7.79 billion (+1% YoY) and net income of $1.29 billion (+45% YoY), with EPS of $1.33 and total payment volume of $417 billion (+3% YoY). It has a forward P/E ratio of 14.2 and a market cap of approximately $64.5 billion.

Analyst targets are mixed: JPMorgan rates the stock Overweight with a $77 target, Goldman Sachs maintains Neutral at $74, and Morningstar lists its fair value estimate at $94. Technically, the stock remains below its 200-day EMA (~$74) and is trading between support at $58 and resistance at $72. The answer to whether PayPal is a buy depends on individual risk tolerance, trading strategy, and interpretation of both fundamental and technical indicators.

Conclusion

PayPal stock remains in a prolonged downtrend, trading well below its all-time highs amid ongoing concerns about growth, competition, and strategic execution. While its recent earnings showed improved profitability, revenue growth and transaction volume continue to lag. Analyst price targets range from $74 to $94, reflecting a mixed outlook. Technically, the stock remains below its 200-day EMA, with key levels at $58 (support) and $72–$74 (resistance).

For traders monitoring opportunities in high-profile tech stocks like PayPal, having access to real-time data, advanced charting tools, and global market insights is essential. Ultima Markets provides a trading environment equipped with the tools and analytics needed to navigate volatile markets with confidence.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.