Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

Why Is Gold So Valuable

Gold is so valuable because it is rare, durable, and trusted as a universal store of value. Unlike other metals, gold doesn’t corrode or tarnish, making it ideal for preserving wealth over time. Its scarcity, historical role in global currencies, and use by central banks further enhance its worth. Traders and investors value gold for its ability to hedge against inflation, economic uncertainty, and currency risk.

From ancient empires to modern financial systems, gold has consistently held its place as one of the most important and valuable assets in the world.

The Historical Role of Gold in the Economy

Gold’s value traces back over 5,000 years, used first for ornamental purposes and later as a medium of exchange. Ancient civilizations such as the Egyptians, Greeks, and Romans used gold for trade, currency, and storing wealth.

Its unique properties, non-corrosive, rare, and easily divisible, made it ideal for minting coins. Even today, many central banks hold gold reserves, underlining its ongoing importance to the financial system.

Why Is Gold Valuable Compared to Silver or Copper?

While silver and copper are also precious metals, gold surpasses them in several key areas:

| Metal | Industrial Use | Rarity | Price Volatility | Store of Value |

| Gold | Low | Very Rare | Low | Excellent |

| Silver | High | Less Rare | High | Moderate |

| Copper | Very High | Common | High | Poor |

- Rarity: Gold is much rarer than copper and significantly more difficult to extract.

- Non-reactivity: Unlike silver and copper, gold doesn’t tarnish or oxidize, making it ideal for long-term storage.

- Demand consistency: Gold demand remains strong even during downturns, unlike silver and copper which are tied to industrial cycles.

In short, gold’s scarcity, durability, and role as a hedge make it more valuable.

Why Is Gold So Important to the Economy?

Gold plays a stabilizing role in the global economy. Here’s why:

- Monetary Reserves: According to the World Gold Council, central banks collectively hold over 35,000 tonnes of gold as part of their foreign reserves. Gold helps countries hedge against currency depreciation and financial instability.

- Inflation Hedge: In periods of high inflation, investors often trade gold as a hedge, preserving purchasing power.

- Crisis Asset: During geopolitical conflicts or economic downturns, gold prices typically rise due to increased demand for safe-haven assets.

In short, gold acts as an anchor during volatile times, attracting investors, traders, and governments alike.

What Affects Gold Prices?

Gold prices are influenced by a range of macroeconomic factors that impact global markets. Understanding these drivers is essential for anyone looking to trade gold or invest long-term.

Interest Rates

When interest rates are low, traditional income-generating assets like bonds offer lower returns. This makes non-yielding assets like gold more attractive to investors seeking stability. Conversely, when interest rates rise, gold may lose appeal as investors shift to assets with higher yields.

US Dollar Strength

Gold is priced in US dollars. When the dollar weakens, gold becomes cheaper for international buyers, increasing demand and pushing prices up. On the other hand, a strong dollar can suppress gold prices by making it more expensive globally.

Inflation Expectations

Rising inflation erodes the purchasing power of paper currencies. During such periods, gold is often seen as a hedge against inflation, as its value tends to hold steady or rise when fiat currencies lose value.

Geopolitical and Economic Uncertainty

During times of crisis such as wars, financial crashes, or global pandemics. Investors typically flock to safe-haven assets like gold. This increased demand drives up prices as traders seek protection from volatility in stocks, bonds, or currencies.

Central Bank and ETF Demand

Central banks play a major role in gold markets. When they increase gold reserves, it signals confidence in gold’s long-term value, boosting investor sentiment. Similarly, inflows into gold-backed ETFs (exchange-traded funds) also support price increases through increased physical gold demand.

For traders, these indicators provide important clues for anticipating gold price movements. By monitoring changes in interest rates, dollar strength, inflation data, and geopolitical risks, you can make more informed decisions when entering or exiting gold trades.

How Much Gold Is There in the World?

As of 2025, an estimated 208,000 metric tonnes of gold have been mined globally, based on World Gold Council data. Here’s how it’s distributed:

- Jewelry: ~92,000 tonnes (44%)

- Investment (bars, coins, ETFs): ~48,000 tonnes (23%)

- Official Reserves (central banks): ~36,000 tonnes (17%)

- Technology and Industry: ~30,000 tonnes (14%)

The amount of gold yet to be mined is limited, reinforcing the scarcity factor in its value.

Which Country Has the Most Gold?

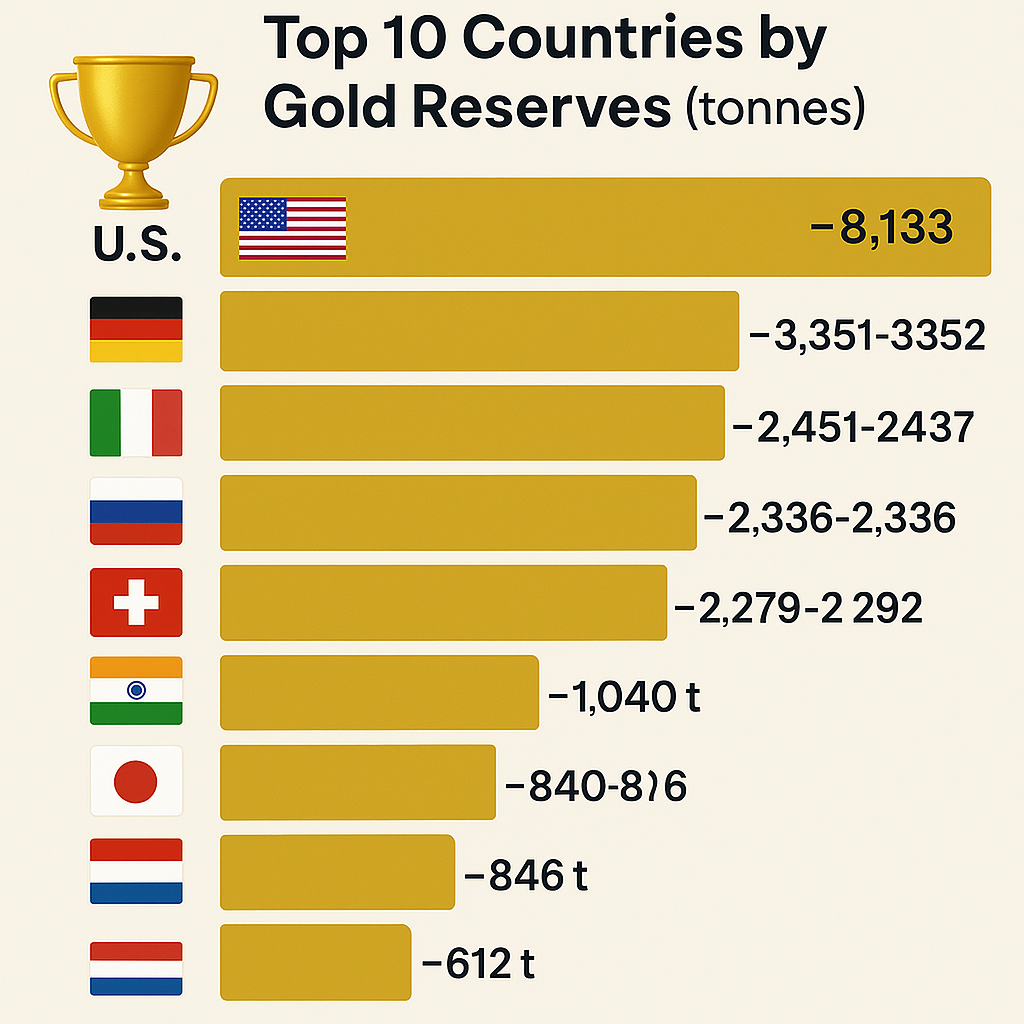

According to the International Monetary Fund (IMF), the countries with the largest official gold reserves are:

- United States – 8,133 tonnes

- Germany – 3,352 tonnes

- Italy – 2,452 tonnes

- France – 2,437 tonnes

- Russia – 2,300+ tonnes

- China – 2,262 tonnes (and growing)

The United States leads by a wide margin with over 8,133 tonnes, nearly surpassing the combined holdings of Germany, Italy, and France. Germany, Italy, and France follow, each holding between 2,400 and 3,350 tonnes.

Russia and China round out the top five, with China’s reported reserves increasing quietly to around 2,280 tonnes while some analysts suggest actual holdings may be higher. Switzerland, India, Japan, and Netherlands complete the top ten with holdings from around 600 to 1,040 tonnes.

Why Do Traders Buy Gold?

For traders, gold provides:

- Liquidity: The gold market is one of the most liquid globally, making it suitable for short-term trades.

- Safe-haven behavior: Traders turn to gold in volatile markets, particularly when equities or bonds underperform.

- Leverage opportunities: Gold is widely available via futures, CFDs, and ETFs, allowing leveraged positions.

- Technical predictability: Gold exhibits strong chart patterns and reacts reliably to macro indicators.

Traders often trade gold during major economic announcements, inflation data releases, and central bank meetings due to its high responsiveness.

Conclusion

So, why is gold so valuable? Its value is derived not just from tradition or shine, but from its scarcity, stability, and universal acceptance. Compared to other metals, gold stands out as a global standard for wealth, risk management, and portfolio insurance.

Whether you’re a central bank, institutional investor, or retail trader, gold remains a crucial asset in navigating uncertain markets. With limited supply and growing demand, gold’s value is likely to remain high for the foreseeable future.

Ready to access the gold market? Partner with Ultima Markets, a trust trading platform offering real-time spreads, low-cost gold CFD trading, and secure account management.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.