Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

If you’ve been watching the crypto markets lately, you’ve probably noticed the sharp and sudden drop in prices. Bitcoin, Ethereum, and altcoins have all taken a hit, leaving traders scrambling for answers. But why is crypto dropping now?

How Much Has Crypto Dropped?

Before diving into the causes, it’s essential to understand the scale of the current drop. Over the past few weeks, cryptocurrency prices have fallen sharply, with Bitcoin (BTC) losing nearly 10% of its value, Ethereum (ETH) seeing a significant downturn, and altcoins following the trend.

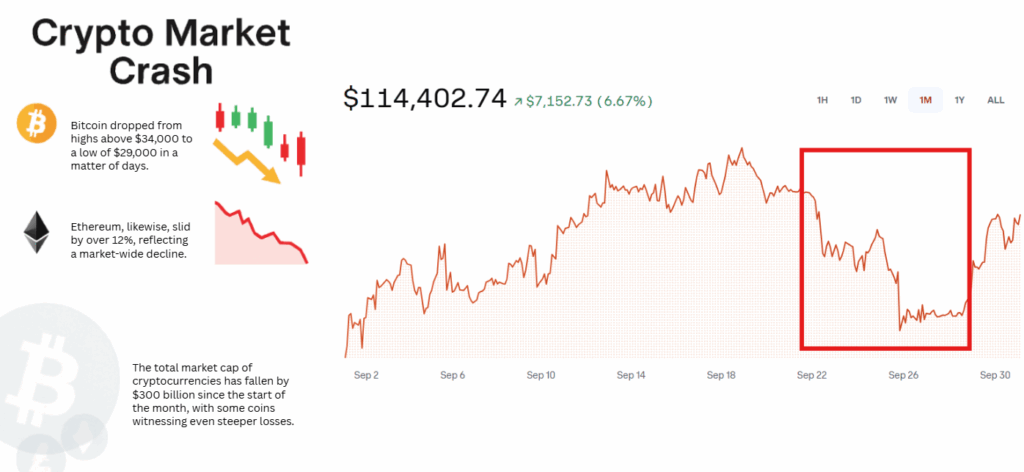

- Bitcoin dropped from highs above $34,000 to a low of $29,000 in a matter of days.

- Ethereum, likewise, slid by over 12%, reflecting a market-wide decline.

The total market cap of cryptocurrencies has fallen by $300 billion since the start of the month, with some coins witnessing even steeper losses. This kind of drop triggers a natural question: what is driving these movements?

Why Is Crypto Dropping

Several intertwined factors explain why crypto prices are falling. Let’s break them down:

Leverage and Forced Liquidations

One of the most significant contributors to the recent crypto drop is the effect of leveraged positions. Crypto traders often use leverage to amplify their gains, borrowing funds to increase the size of their trades. However, when prices move against these leveraged positions, it triggers a wave of forced liquidations, where positions are automatically sold to cover losses.

- $1.5 billion worth of leveraged positions were liquidated in a single day in the recent crash, affecting over 400,000 traders.

- These forced sell-offs lead to even greater downward pressure on prices, causing a cascade effect, as we saw during the recent downturn.

When market liquidity is thin, as is often the case in crypto markets, these liquidations can have a massive impact, leading to extreme volatility.

Global Macro & Interest Rate Pressures

The global macroeconomic environment plays a huge role in cryptocurrency prices. In 2025, cryptocurrencies have become increasingly correlated with traditional financial markets, particularly U.S. monetary policy.

- Rising real yields and a stronger U.S. dollar have increased the cost of risk assets.

- The Federal Reserve’s interest rate hikes aimed at controlling inflation have made assets like crypto less attractive, as the opportunity cost of holding non-yielding assets (like Bitcoin) increases.

When central banks around the world take a hawkish stance on monetary policy, risk-on assets like crypto often take the brunt of the sell-off.

Weakening Institutional and ETF Flows

For the past few years, institutional investors have increasingly driven demand for Bitcoin and other cryptocurrencies, mainly through Bitcoin ETFs and other crypto investment vehicles. However, there are signs that institutional demand has cooled:

- Recent data indicates that institutional inflows into crypto ETFs have slowed, reflecting waning confidence in the market.

- Several prominent hedge funds and asset managers have reduced their crypto holdings in anticipation of ongoing macroeconomic uncertainties.

This cooling of institutional demand, particularly in the face of strong U.S. dollar performance and high interest rates, has created a supply-demand imbalance, further weighing down prices.

Market Sentiment & Technical Breakdown

Sentiment in the cryptocurrency market is volatile, and this drop is no exception. The Fear and Greed index, a popular measure of market sentiment, recently shifted from Greed to Fear, signaling a bearish outlook among traders.

- Key support levels for Bitcoin and Ethereum were breached, sparking further panic selling.

- Technical analysts point to a break below the $30,000 support level for Bitcoin as a signal of more downside potential.

When sentiment shifts from greed to fear, it creates a domino effect, as more traders are forced to sell their holdings to limit further losses.

Liquidity & Exchange Risk

Liquidity, or the ease with which assets can be bought or sold without moving the price significantly, is often a problem in the cryptocurrency market. When the liquidity is shallow, even small movements can lead to drastic price changes.

- During times of heightened market stress, exchanges may experience system outages or delays, further exacerbating volatility.

- The Bybit exchange hack in 2025, where $1.5 billion worth of Ethereum was stolen, added additional fear and uncertainty among traders, contributing to the sell-off.

Crypto exchanges’ operational risks, combined with the inherent liquidity problems, have made crypto markets more vulnerable to sharp corrections.

What to Watch Next

So, what should investors keep an eye on moving forward? Here are the key indicators to monitor:

Macro Data (CPI, PCE, Fed Decisions)

U.S. inflation data, including CPI and PCE index, will provide clues on whether the Fed will maintain its hawkish stance.

The next Fed meeting and their decision on interest rates will be critical in shaping crypto market expectations.

On-chain Signals (Whale Wallets, Funding Rates)

Whale wallets that control significant amounts of Bitcoin and Ethereum often act as market movers. Tracking their behavior can give clues on future price action.

Watch for negative funding rates, which can signal that traders are overly bearish, often leading to a short squeeze.

ETF Flows and Institutional Sentiment

Monitor institutional inflows into crypto investment products, as this will be a strong indicator of whether the market is finding support from large investors.

Technical Support Levels for BTC and ETH

Keep an eye on critical support levels for Bitcoin and Ethereum. A break of these levels could signal more downside.

Regulatory and Event Risk

Any announcements of regulatory crackdowns, or large-scale exchange hacks, could cause further sell-offs.

Is This a Healthy Correction or Bear Market Signal?

From a technical and macro standpoint, the current drop could be seen as a healthy correction in an overbought market. Leveraged positions being flushed out and technical support zones being tested are typical during bull market pullbacks.

However, the risk remains high:

- If macro conditions worsen, the downturn could extend into a prolonged bear market.

- On the other hand, if institutional interest picks up or macro conditions stabilize, a recovery could be in store.

Conclusion

The recent downturn in the cryptocurrency market has been significant, but it’s important to remember that such fluctuations are part of the natural market cycle. While factors like leverage liquidations, macroeconomic pressures, and institutional demand have all contributed to the drop, there are still opportunities to navigate this volatile market strategically.

At Ultima Markets, we encourage traders to stay informed and be mindful of the risks and rewards. Whether you’re an experienced trader or just starting, our platform offers tools and educational resources to help you adapt to changing market conditions. By leveraging technical analysis, understanding market sentiment, and keeping an eye on macroeconomic indicators, you can position yourself to capitalize on potential rebounds when the market stabilizes.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.