Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

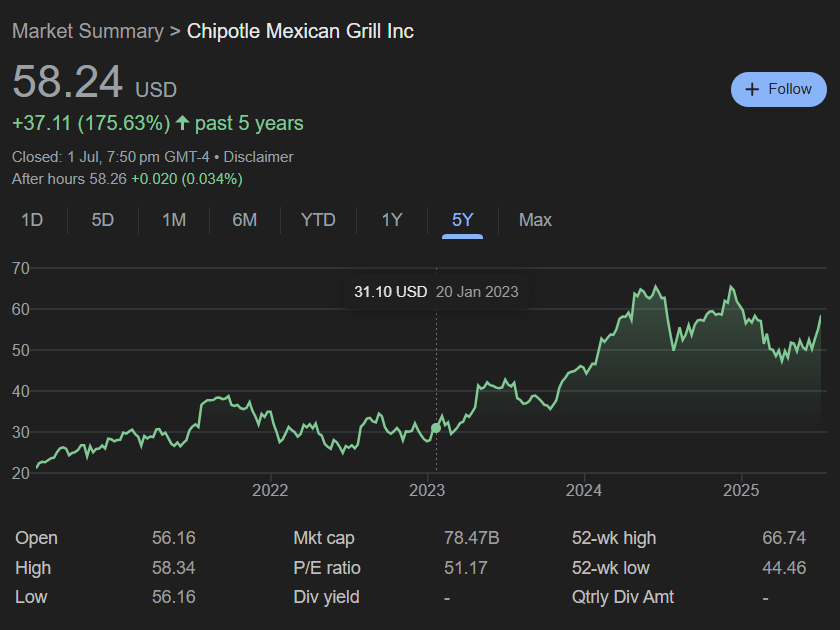

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomChipotle Mexican Grill’s stock has reached record-breaking levels, leaving many investors and curious traders asking “why is Chipotle stock so high?”. This article explores the key factors driving Chipotle’s stock price growth, its performance over time, and what it means for investors.

Chipotle Stock Price: An Overview

As of mid-2025, Chipotle stock (NYSE: CMG) trades around $60–$70 per share following its 50-for-1 stock split in June 2024, which made the stock more accessible to retail investors. Prior to the split, the stock was trading above $3,000, reflecting years of strong growth, investor confidence, and strategic expansion.

Chipotle Stock Price Before Split

Before the split, Chipotle’s stock price climbed steadily, reaching over $3,200 per share in mid-2024. This made it one of the most expensive restaurant stocks in the U.S. market, rivaling big tech names in value per share. The high share price was a result of long-term investor optimism and strong financial performance.

Why Is Chipotle Stock So High?

Several key factors drive Chipotle’s high valuation:

Strong Revenue Growth

Chipotle has consistently posted strong quarterly earnings, driven by increasing same-store sales and higher average order values. Consumers continue to value its fast-casual, health-conscious menu options.

Digital Expansion and Loyalty Program

Its mobile ordering and loyalty program have fueled repeat business. Digital orders now account for more than 35% of its total revenue.

Limited Competition in Premium Fast-Casual

Few brands compete directly in the premium Mexican fast-casual niche, giving Chipotle pricing power and customer loyalty.

Operational Efficiency

Chipotle maintains high margins by owning its stores instead of franchising, streamlining operations and quality control.

Stock Split Accessibility

The 50-for-1 stock split lowered the per-share price from over $3,000 to under $70, opening the door for more retail investors and increasing market liquidity.

Chipotle Mexican Grill Stock Price: Then and Now

| Time Period | Price Range (Pre-Split) | Price Post-Split (Adjusted) |

| IPO (2006) | ~$22 | ~$0.44 |

| 2020 | ~$1,200 | ~$24 |

| Mid-2024 | ~$3,200 | ~$64 |

Note: Prices adjusted for 50:1 split

Why Is Chipotle Stock Price So High?

The price reflects strong fundamentals, scalability, and market leadership. Analysts remain optimistic about Chipotle’s ability to grow internationally and expand menu innovation while keeping high customer retention.

Why Is Chipotle Stock So Expensive?

Chipotle’s high valuation is justified by its financial metrics:

- Consistent double-digit revenue growth

- Expanding profit margins

- Minimal debt and strong cash flow

This positions Chipotle as a premium investment in the restaurant industry.

How Many Chipotle Stocks Are There?

After the 50-for-1 stock split, the number of outstanding shares increased significantly. For example, if there were originally 30 million shares, the split would have resulted in 1.5 billion shares.

How Much Was Chipotle Stock When It Went Public?

Chipotle’s IPO occurred in January 2006 at $22 per share. The stock soared over 100% on its first day of trading.

Final Thoughts on Chipotle’s Stock

Chipotle’s stock remains a favorite for long-term investors due to its blend of innovation, profitability, and brand strength. While the share price may seem high in historical context, it aligns with the company’s performance and market confidence.

Ready to explore trading opportunities like Chipotle? Ultima Markets offers a wide range of trading instruments, educational resources, and powerful platforms to help you trade smarter.

From U.S. stocks to global indices, Ultima Markets gives you access to the tools and insights you need, whether you’re a beginner or a seasoned trader.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.