Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

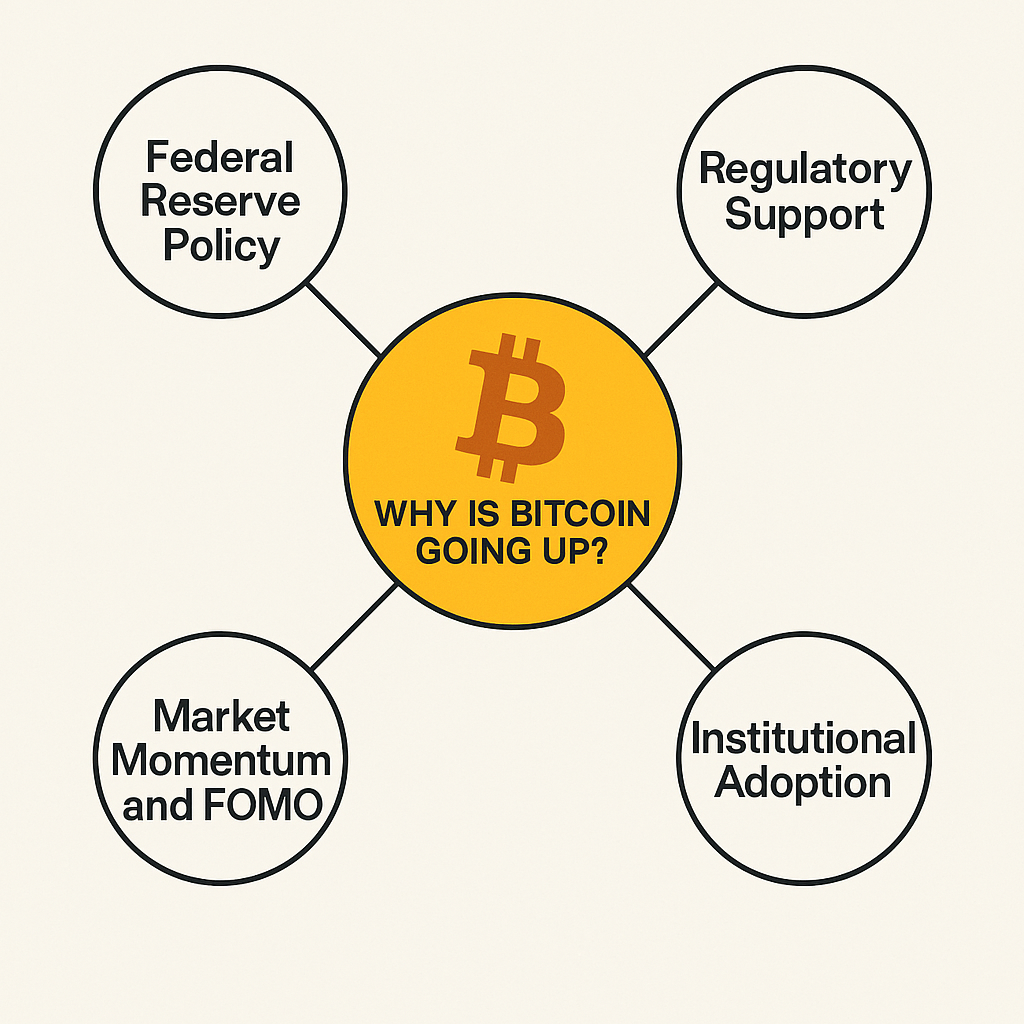

Why Is Bitcoin Going Up?

Bitcoin’s price surge is driven by several key factors. The expectation of U.S. Federal Reserve rate cuts has made risk assets like Bitcoin more attractive. Regulatory support is also boosting investor confidence, with Bitcoin now being included in 401(k) retirement plans, opening the market to more institutional investors. Additionally, institutional adoption continues to grow, as major companies and investment funds buy Bitcoin as a hedge against inflation and a store of value. Finally, market momentum and FOMO (Fear of Missing Out) from retail investors push the price higher as Bitcoin reaches new record highs.

Bitcoin’s price increase is largely driven by several key factors that reflect changes in economic conditions, institutional adoption, and investor sentiment.

Federal Reserve Policy

The U.S. Federal Reserve has signaled a shift toward rate cuts, which often leads to higher demand for risk assets like Bitcoin. Lower interest rates reduce the appeal of traditional investments, such as bonds or savings accounts, and make alternative assets like Bitcoin more attractive. Investors see Bitcoin as a potential hedge against inflation and a store of value, especially in times of monetary easing.

Regulatory Support

Recent regulatory changes have played a significant role. For example, the U.S. has allowed Bitcoin to be included in retirement accounts, such as 401(k)s, broadening its appeal among institutional investors and individual retirement savers. This regulatory clarity has reassured investors and opened the door for more traditional finance players to get involved in the Bitcoin market.

Institutional Adoption

Institutional investors are increasingly viewing Bitcoin as a long-term asset class. In 2025, more corporations and hedge funds are adding Bitcoin to their balance sheets, following the trend set by companies like Tesla and MicroStrategy. As more high-profile investors enter the space, Bitcoin’s legitimacy as a financial asset grows, contributing to the rising price.

Market Momentum and FOMO

As Bitcoin continues to rise, retail investors are jumping in, hoping to capitalize on the gains. This is often referred to as FOMO (Fear of Missing Out), which can drive prices even higher as more people buy in. Bitcoin’s recent price surge has sparked excitement across social media and financial news, further attracting new buyers and fueling the cycle.

In summary, Bitcoin’s price is going up due to a combination of macroeconomic factors, regulatory support, increased institutional involvement, and market sentiment. As these factors continue to evolve, Bitcoin’s value could see even more upward momentum in the near future.

Historical Context: Bitcoin’s Bull Runs and Patterns

Bitcoin’s price history shows that major rallies are rarely random. Key drivers in the past include:

- Halving events (e.g., 2012, 2016, 2020) slashed supply and triggered huge demand spikes.

- The 2017 bull run took BTC from under $1,000 to nearly $20,000, largely retail-driven.

- In 2020–2021, institutional adoption pushed Bitcoin close to $70,000 amid pandemic stimulus.

- In 2024, ETF approvals and policy shifts drove BTC past $100K.

Takeaway: Today’s rally fits Bitcoin’s historical pattern, big catalysts, limited supply, and surging demand.

Comparison to Other Assets: Bitcoin vs. Stocks, Gold, and Beyond

Bitcoin is becoming an increasingly viable alternative to traditional assets like stocks, gold, and real estate. It combines the characteristics of a store of value, inflation hedge, and digital asset with high growth potential. As institutional interest grows and regulatory clarity improves, Bitcoin’s role in diversified portfolios will likely expand, making it a compelling option for risk‑tolerant investors.

Bitcoin vs. Stocks:

- Volatility: Bitcoin is much more volatile than stocks, with prices subject to rapid fluctuations. Stocks tend to be less volatile, especially for established companies.

- Risk and Return: Bitcoin offers high-risk, high-reward potential, while stocks are generally more stable but offer slower, more consistent growth.

- Market Hours: Bitcoin trades 24/7, while stocks operate on fixed trading hours, making Bitcoin more accessible for global trading.

Bitcoin vs. Gold:

- Store of Value: Bitcoin is often compared to gold as a store of value, especially in times of inflation. Unlike gold, Bitcoin offers higher growth potential but comes with greater risk.

- Inflation Hedge: Both Bitcoin and gold are seen as hedges against inflation, but Bitcoin’s digital nature and limited supply make it increasingly appealing.

- Liquidity: Bitcoin is more liquid than gold, as it can be traded instantly across borders without the need for physical storage.

Bitcoin vs. Other Assets (Real Estate, Commodities):

- Real Estate: Bitcoin is more liquid and accessible compared to real estate, which requires significant capital and long-term commitment.

- Commodities: Unlike traditional commodities, Bitcoin is digital, with no physical constraints, but it shares volatility with oil and other hard assets.

Implications

The 2025 Bitcoin rally has significant implications for both investors and traders. Here’s how it could impact you:

For Traders:

- Increased Volatility: Bitcoin’s price surges are typically followed by periods of high volatility. While this opens up opportunities for short-term profits, it also comes with greater risk. Traders need to stay vigilant, use tools like stop-losses, and be prepared to manage sudden price swings.

- New Market Dynamics: As institutional investment increases, Bitcoin’s price movements may start to be influenced by macro events (like Fed policy changes or geopolitical shifts) more than ever before. Technical analysis may still work, but understanding macro trends will become increasingly important.

For Investors:

- Long-Term Store of Value: Bitcoin’s growth potential and role as a digital hedge against inflation make it an attractive option for long-term investors looking to diversify their portfolios. Institutional interest and regulatory clarity add credibility to Bitcoin as an asset class.

- Portfolio Diversification: For those already holding traditional assets like stocks or gold, Bitcoin offers diversification. It can act as a risk asset in portfolios, especially if inflation fears or market instability rise.

- Risk-Reward Balance: Despite its potential, Bitcoin remains highly speculative. Investors should balance their risk exposure, especially considering its historical volatility and regulatory uncertainties.

For the Market:

- Mainstream Acceptance: As Bitcoin’s price increases, more institutions and businesses are likely to treat it as a mainstream financial asset, leading to further regulatory developments and integration with traditional markets.

- Potential for Global Impact: Bitcoin’s rise signals the growing importance of digital assets in global financial markets, reshaping how assets are traded and stored, with broader economic implications.

For the Broader Economy:

- Potential Disruption: Bitcoin could disrupt traditional banking systems by offering an alternative to fiat currencies, particularly in regions with unstable currencies or economies. As more businesses adopt Bitcoin, it could reshape global payment systems and reduce reliance on traditional financial intermediaries.

In summary, the Bitcoin rally presents both exciting opportunities and considerable risks. Whether you’re a trader, long-term investor, or simply someone looking to understand the economic implications, staying informed and carefully managing your exposure will be crucial in navigating Bitcoin’s evolving role in the market.

Conclusion

The 2025 Bitcoin rally is a defining moment for both the crypto market and traditional financial systems. With growing institutional interest, regulatory clarity, and the broader economic trends favoring digital assets, Bitcoin is proving to be not just a speculative asset but a mainstream investment. However, as with any high-growth asset, volatility remains a key risk, and understanding these dynamics is crucial for making informed trading decisions.

At Ultima Markets, we believe in empowering traders with cutting-edge tools and insights to navigate volatile markets like Bitcoin. Whether you’re looking to capitalize on Bitcoin’s short-term price movements or integrating it into a broader diversified portfolio, Ultima Markets’ platform provides the resources and market access you need to stay ahead of the curve.

As Bitcoin continues to rise, Ultima Markets remains committed to supporting smart, informed trading backed by reliable market analysis and global financial expertise. Trade with purpose, stay up to date on the latest market trends, and leverage Ultima Markets’ unique offerings to unlock new opportunities in the world of digital assets.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.