Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWhat is BlackRock (BLK)?

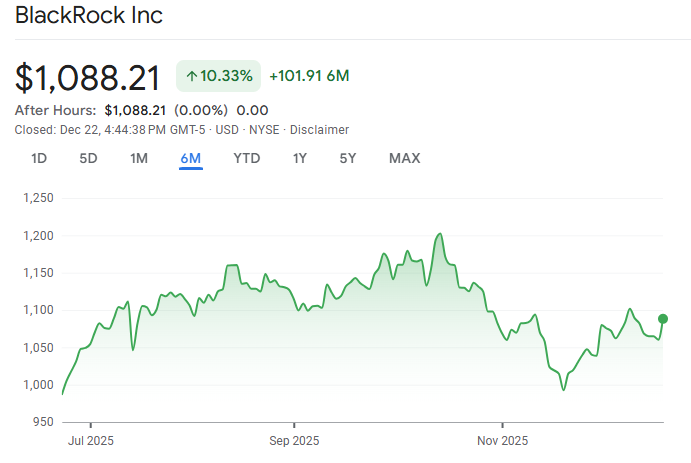

BlackRock is a global investment management corporation founded in 1988 and headquartered in New York City. The company is known for its extensive range of investment products, including mutual funds, ETFs, and institutional investment strategies. BlackRock’s clients range from individual investors to large institutions, including governments, foundations, and pension funds.

Key Facts About BlackRock:

- Founded: 1988

- Headquarters: New York City, USA

- Total AUM (Assets Under Management): Over $9 trillion (as of 2025)

- Market Cap: $120 billion (as of 2025)

- Public Stock: Yes, BlackRock is publicly traded on the NYSE under the ticker symbol BLK.

Who Owns BlackRock (BLK) Stock?

BlackRock (BLK) stock is primarily owned by institutional investors, BlackRock insiders, and retail investors. The largest institutional shareholders include Vanguard Group, State Street Global Advisors, and BlackRock itself. Larry Fink, BlackRock’s CEO, is the largest insider shareholder, holding a small percentage of the company’s total shares.

Key Points:

- Vanguard Group: Around 8-9% of BlackRock shares.

- BlackRock: Owns approximately 3-4% of its own stock.

- State Street Global Advisors: Owns 5-6% of shares.

- Larry Fink: Holds around 0.1-0.2% of shares.

Major Shareholders of BlackRock (BLK)

Institutional Investors

Institutional investors, including mutual funds, pension funds, and hedge funds, hold a significant portion of BlackRock’s shares. These investors are often long-term shareholders with a vested interest in BlackRock’s financial success.

- Vanguard Group: As of 2025, Vanguard is the largest institutional shareholder of BlackRock, holding approximately 8-9% of the outstanding shares.

- BlackRock itself: Interestingly, BlackRock holds a portion of its own stock as part of its investment strategies, constituting another 3-4%.

- State Street Global Advisors: Another major institutional investor, holding around 5-6% of the stock.

BlackRock Insiders

Insider ownership refers to the shares held by executives, directors, and employees of BlackRock. While the proportion of shares held by insiders is relatively smaller, it is still significant in terms of corporate governance.

- Larry Fink: The CEO of BlackRock, Larry Fink, is the largest individual insider shareholder. As of 2025, Fink owns approximately 0.1-0.2% of the company’s shares.

- Other executives: Other key executives, such as the Chief Investment Officer and Chief Financial Officer, also own a small percentage of shares.

Retail Investors

Retail investors, or individual shareholders, make up a portion of BlackRock’s ownership. These are typically individuals who buy shares on the open market through brokerage accounts. BlackRock’s stock is widely held by investors who see value in its stable dividend payouts and long-term growth potential.

Who Are the Major Shareholders Among BlackRock Insiders?

Insider ownership can offer valuable insights into the confidence that company executives have in the future performance of the company. As of 2025, the major insiders who own BlackRock stock include the company’s CEO, Larry Fink, as well as other executives and board members. Insider ownership can often indicate alignment between the company’s management and its shareholders.

Larry Fink’s Role in BlackRock’s Ownership

As the CEO and co-founder of BlackRock, Larry Fink plays a key role in the ownership structure. Fink is deeply involved in both the day-to-day operations and long-term strategic decisions that drive the company’s growth. His substantial ownership in the company signals his confidence in BlackRock’s future prospects.

Is BlackRock a Public Stock?

Yes, BlackRock is a public company listed on the New York Stock Exchange (NYSE) under the ticker symbol BLK. It became a publicly traded company in 1999 when it completed its initial public offering (IPO). Since then, BlackRock has grown into one of the largest asset management firms in the world, with shares available for purchase by individual and institutional investors alike.

Should I Buy BlackRock Stock?

BlackRock’s stock has consistently been a strong performer, thanks to the company’s expansive global footprint and diverse range of investment products. But should you buy BlackRock stock? Here are a few factors to consider:

Pros of Buying BlackRock Stock:

- Strong Financial Performance: BlackRock has demonstrated consistent growth in both revenue and assets under management (AUM).

- Global Reach: With a presence in over 100 countries, BlackRock benefits from a diverse range of investment opportunities across multiple regions.

- Sustainability Focus: The company’s growing emphasis on sustainable investing and environmental, social, and governance (ESG) criteria positions it as a leader in the evolving investment landscape.

Cons of Buying BlackRock Stock:

- Valuation: Some analysts believe that BlackRock’s stock may be overvalued, especially given its current market capitalization and the competitive nature of the asset management industry.

- Regulatory Risks: As a major financial institution, BlackRock faces regulatory scrutiny, which could impact its operations and profitability in certain markets.

If you’re looking for a stable, long-term investment in the asset management sector, BlackRock could be an attractive option. However, like all investments, it’s important to do your own research and consult with a financial advisor before making any decisions.

Conclusion

In conclusion, understanding who owns BlackRock (BLK) stock provides valuable insights into the company’s governance and stability, which can be helpful for investors looking to make informed decisions. Similarly, when engaging in share trading with Ultima Markets, it is crucial to focus on market transparency, regulatory compliance, and staying informed about major market players like BlackRock.

Ultima Markets offers a reliable platform for traders interested in a wide range of shares, including top companies like BlackRock, ensuring you have the tools, insights, and support to make smart trading decisions. Whether you’re new to share trading or an experienced investor, Ultima Markets provides access to a user-friendly trading environment, advanced market tools, and educational resources to help you succeed.

By staying informed about shareholder structures, stock performance, and broader market trends, you can navigate the complexities of the stock market with confidence. Ultima Markets is here to guide you every step of the way as you explore the exciting world of share trading.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.