Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomThe world of trading has created some of the greatest fortunes ever made but only a few names stand above the rest. When people search for who is the richest trader in the world, three legendary figures dominate the conversation: George Soros, Jim Simons, and Paul Tudor Jones.

Who Is the Richest Trader in the World?

As of 2025, the richest trader in the world is Jim Simons, founder of Renaissance Technologies. His estimated net worth exceeds US$30 billion, built through algorithmic and quantitative trading. Known as “the Quant King,” Simons transformed mathematics into one of the most profitable trading systems ever created, inspiring legends like George Soros and Paul Tudor Jones.

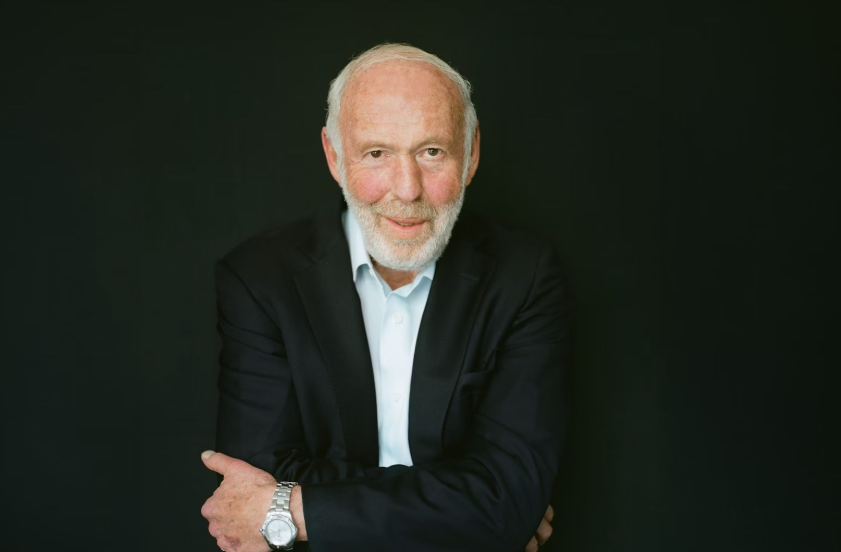

Jim Simons — The Quant King

- Estimated Net Worth (2025): US $31–32 billion

- Trading Style: Algorithmic & Quantitative Trading

Jim Simons, founder of Renaissance Technologies, is widely regarded as the richest trader in the world.

A former mathematician and codebreaker, Simons applied advanced algorithms and statistical models to detect market inefficiencies invisible to the human eye. His flagship fund, Medallion, reportedly generated annualized returns above 60% before fees for decades, a record unmatched in hedge-fund history.

Trading Pattern / Strategy:

- Uses quantitative models built by mathematicians, physicists, and data scientists.

- Trades thousands of instruments using high-frequency systems that hold positions for seconds to days.

- Relies entirely on data patterns, not intuition or emotion.

“Good traders are good scientists, they test ideas, measure results, and adjust fast.”

Simons’s disciplined, data-driven philosophy transformed Wall Street and proved that mathematics could outperform even the most instinctive traders.

George Soros — The Architect of the Billion-Dollar Bet

- Estimated Net Worth (2025): US $7–9 billion

- Trading Style: Global Macro & Currency Speculation

Known as “the man who broke the Bank of England,” George Soros earned over US $1 billion in a single day in 1992 by shorting the British pound. His Quantum Fund averaged more than 30% annual returns for decades and helped define the modern hedge-fund industry.

Trading Pattern / Strategy:

- Focuses on macroeconomic cycles, interest-rate trends, and policy shifts.

- Uses reflexivity theory, believing markets are shaped by perception as much as fundamentals.

- Acts decisively when conviction and data align.

“It’s not whether you’re right or wrong that matters, but how much money you make when you’re right and how much you lose when you’re wrong.”

Even in his 90s, Soros remains a global financial icon whose insights continue to influence macro funds and central-bank watchers worldwide.

Paul Tudor Jones — The Visionary of Market Discipline

- Estimated Net Worth (2025): US $8 billion

- Trading Style: Discretionary Macro & Technical Analysis

Paul Tudor Jones made his name by predicting the 1987 stock-market crash, achieving a 62% gain that year. He built Tudor Investment Corporation, managing billions through a mix of technical analysis and macroeconomic insight.

Trading Pattern / Strategy:

- Studies chart patterns and price momentum to spot reversals early.

- Emphasizes capital preservation and tight stop-loss control.

- Integrates investor psychology into every decision.

“Don’t focus on making money, focus on protecting what you have.”

Jones’s commitment to risk management and emotional balance makes him one of the most respected figures in discretionary trading.

The Foundations of Their Trading Style

Every great trader builds on a clear foundation, a guiding logic that defines how they view markets and make decisions.

- George Soros built his success on reflexivity, the belief that markets are driven not only by fundamentals but also by human behavior and perception. His trades often began with macro research but were confirmed by how investors reacted to policy or currency changes.

- Jim Simons removed emotion completely. His foundation lies in mathematics, coding, and data. Renaissance Technologies uses thousands of algorithms to identify patterns and inefficiencies that no human could detect.

- Paul Tudor Jones combines technical analysis and intuition. His foundation is visual — reading price charts, volume shifts, and investor psychology to find early signals of reversal or continuation.

Their differing foundations highlight one truth: there is no single formula for success. Whether through human insight, machine precision, or pattern intuition, the richest traders in the world rely on systems that match their strengths.

Risk Philosophy

Despite their different styles, Soros, Simons, and Jones share one principle — risk management comes before profit.

- Soros famously said that the secret to his success was “not my ability to predict but to react when I’m wrong.” He cut losing positions quickly and added aggressively to winners.

- Simons approached risk statistically. His systems diversify thousands of positions simultaneously, ensuring no single loss can damage overall returns. Every trade has a calculated probability and predefined exposure.

- Jones lives by the rule of capital preservation. He limits losses on every trade, often risking less than 1% of capital. His philosophy: protect the downside first, and the upside will take care of itself.

This disciplined attitude toward risk is what separates the richest traders in the world from the majority who chase short-term gains. For them, survival equals success.

What Retail Traders Can Learn From Them

While George Soros, Jim Simons, and Paul Tudor Jones trade at an elite level, their philosophies hold timeless lessons for retail traders. You don’t need billions in capital or supercomputers to apply their principles, you just need structure, discipline, and adaptability.

Think in Probabilities, Not Predictions

All three traders treat the market as a place of uncertainty, not certainty.

- Jim Simons never predicts, he lets data determine the odds.

- Soros often said, “I’m only rich because I admit my mistakes faster than others.”

- Jones constantly recalculates risk versus reward.

For retail traders, this means focusing less on being right and more on managing probabilities. Use stop-losses, track your win-loss ratio, and refine strategies through backtesting.

Build a System That Matches Your Strengths

The richest traders in the world don’t follow the same system, they follow one that fits their personality.

- If you’re analytical, follow Simons’s example: develop a data-driven plan using indicators or automated rules.

- If you’re intuitive, think like Soros: understand macro context and sentiment.

- If you prefer structure, emulate Jones: combine charts with risk management.

Success in trading comes from self-awareness, not imitation.

Manage Risk Like a Professional

Every legendary trader survives because they control losses before they control profits. Soros cuts losers instantly, Simons diversifies across thousands of micro-positions, and Jones limits every trade’s downside.

For retail traders, that means risking only a small percentage per trade, typically 1–2% of capital and respecting stop-loss levels even when emotions run high.

Stay Adaptable as Markets Change

Markets evolve and so do the best traders. Soros shifted from currencies to philanthropy, Simons automated everything, and Jones adapted technical setups to global macro shifts. Retail traders should stay flexible too, markets that worked in 2020 may behave differently in 2025. Keep learning, testing, and adjusting.

Focus on Longevity, Not Instant Wins

Every billionaire trader plays the long game. They don’t aim for one big trade, they aim for decades of compounding. Retail traders who treat trading as a business, not a gamble, will find consistency far more rewarding than adrenaline.

Conclusion

The stories of George Soros, Jim Simons, and Paul Tudor Jones go far beyond wealth, they define how the best traders think, act, and adapt. Each approached the markets differently: Soros mastered global macro speculation, Simons built algorithmic precision, and Jones perfected risk discipline. Yet, all three share one timeless rule, control risk first, and profits will follow.

Their influence continues to shape how professional and retail traders approach the forex market today.

Soros’s billion-dollar short on the British pound remains the ultimate case study in currency speculation.

Simons’s data-driven strategies mirror the logic behind modern AI-based forex algorithms, while Jones’s disciplined trading mirrors how top forex traders plan entries and exits with tight stop-losses and patience.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.