Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

Which Countries Uses Euro?

20 European Union countries use the euro as their official currency: Austria, Belgium, Croatia, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Portugal, Slovakia, Slovenia, and Spain. From 1 January 2026, Bulgaria will join as the 21st eurozone member.

These nations meet the EU’s Maastricht convergence criteria and share a single monetary policy under the European Central Bank (ECB).

Non-EU Countries That Use The Euro

Non-EU countries that use the euro include Andorra, Monaco, San Marino, and Vatican City through formal agreements with the EU, as well as Kosovo and Montenegro, which adopted it unilaterally.

This makes 26 jurisdictions worldwide that officially or de facto use the euro.

But why do some non-EU countries use the euro without joining the EU?

Non-EU countries like Andorra, Monaco, San Marino, and Vatican City use the euro through formal agreements with the EU because of close economic and geographic ties, but they are too small, have unique political arrangements, or choose to remain outside the EU. Kosovo and Montenegro adopted the euro unilaterally to stabilize their economies and simplify trade, but have not joined the EU due to political, economic, or membership criteria.

Why Some European Countries Don’t Use Euro

Some European countries don’t use the euro because they either have legal opt-outs, have not yet met the EU’s convergence criteria, or choose to retain monetary independence.

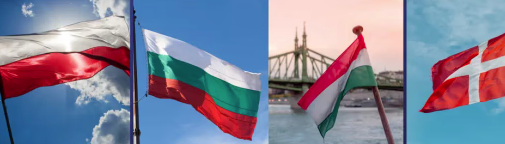

- Opt-out agreement – Denmark negotiated a permanent exemption and keeps the Danish krone.

- Not yet meeting adoption criteria – Countries like Czechia, Hungary, Poland, Romania, and Sweden remain outside the eurozone until they satisfy the Maastricht rules on inflation, debt, interest rates, and currency stability.

- Political and economic choice – Some governments prefer controlling their own monetary policy to respond quickly to local economic conditions.

From a trading perspective, these differences create currency volatility opportunities. For example, the Swedish krona or Polish zloty may move independently from the euro, allowing traders to exploit divergences in central bank policies and economic data.

How Many Countries Use the Euro?

The euro is used by 20 European Union member states and 6 non-EU countries, making a total of 26 jurisdictions. Bulgaria will become the 21st EU member to adopt the euro on 1 January 2026.

- EU members: 20 (21 from 2026)

- Non-EU users: 6 (4 microstates + 2 unilateral adopters)

- Total jurisdictions: 26

Which EU Country Has the Largest Economy?

Germany holds the title of the EU’s largest economy, contributing around 21% of EU GDP. Its economic performance strongly influences euro exchange rates and ECB policy decisions, making it a focal point for currency traders.

Pro and Cons of Using The Euro

Pros

- Simplified Trade and Travel – Businesses and individuals can trade, invest, and travel across eurozone countries without currency conversion costs, making transactions faster and cheaper.

- Price Transparency – The same currency makes it easy to compare prices across borders, encouraging competition and benefiting consumers.

- Lower Exchange Rate Risk – Eliminating currency fluctuations between member countries reduces uncertainty for exporters, importers, and investors.

- Economic Stability for Smaller Economies – Tying to the euro can bring stability and lower inflation for smaller or historically unstable economies.

Cons

- Loss of Independent Monetary Policy – Countries cannot set their own interest rates or adjust their currency value to respond to local economic conditions.

- One-Size-Fits-All Policy – ECB decisions are designed for the whole eurozone, which may benefit larger economies (e.g., Germany) while not fitting smaller or struggling ones.

- Transition Costs – Adopting the euro requires meeting strict economic criteria and can involve significant administrative, legal, and financial adjustments.

- Potential for Regional Imbalances – Economic shocks in one country can ripple through the entire eurozone due to shared currency dependence.

From a forex perspective, the euro’s shared policy framework means macro events in one major economy (like Germany or France) can significantly move the EUR/USD, EUR/GBP, or EUR/JPY. However, the lack of independent currency tools for smaller members can also lead to prolonged recessions, creating both long-term positioning opportunities and short-term volatility spikes.

Conclusion

Understanding Which Country Uses Euro As Their Currency along with the economic reasons behind adoption or rejection is essential for both investors and forex traders. The euro’s reach across 26 jurisdictions makes it one of the most traded currencies in the world, and developments such as Bulgaria’s upcoming 2026 entry can create notable market movements.

At Ultima Markets, we provide traders with up-to-date market analysis, economic insights, and real-time trading tools to help you capitalize on opportunities in EUR pairs and other global markets. Whether you’re tracking ECB policy shifts or monitoring non-euro EU members for divergence plays, our platform equips you with the knowledge and resources to trade with confidence.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.