Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomA crypto bull run is a sustained, broad-based rally led by Bitcoin making new highs, rising total market cap, improving liquidity, and strong participation from ETFs and institutions. In October 2025, Bitcoin sits just off fresh records around $125k and ETFs show heavy net inflows hallmarks of a continuing bull phase.

Key Takeaways

- Market status (Oct 2025): Bitcoin printed new all-time highs near $125–126k this week and remains elevated.

- Liquidity pulse: U.S. spot Bitcoin ETFs logged about $3.2B in weekly net inflows at the start of October; BlackRock’s IBIT discloses ~$98B AUM on its fund page.

- Market breadth: Total crypto market cap hovers ~$4.3T; breadth and depth vary day-to-day but remain consistent with a bull regime.

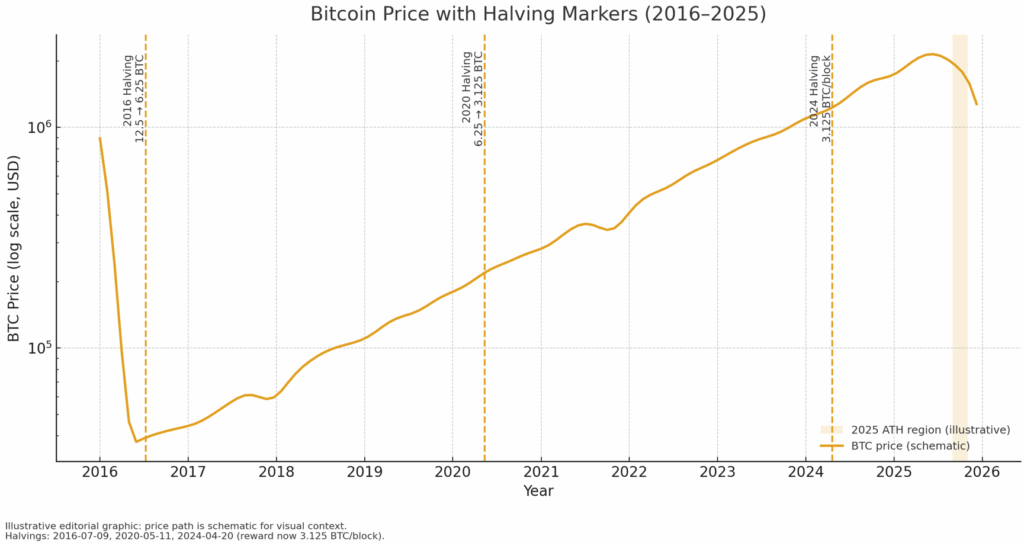

- Structural driver: The 2024 Bitcoin halving cut issuance to 3.125 BTC per block, tightening new supply into rising demand.

- Watchlist: ETF flow trends, stablecoin market cap (now >$300B), and policy headlines are the next catalysts/risks.

When is the Next Crypto Bull Run?

The next crypto bull run is already underway. Bitcoin hit new highs above $125k, the market’s value is roughly $4.3T, stablecoin supply passed $300B, and spot BTC ETFs logged about $3.2B in weekly net inflows, typical post-halving dynamics after issuance fell to 3.125 BTC per block.

What Is a Crypto Bull Run?

A crypto bull run is a multi-month period where most large-cap coins trend higher, led by Bitcoin breaking and holding above prior ATHs, rising total market cap, and expanding liquidity (spot volumes, stablecoins, ETF creations). Confirmation usually requires breadth, a majority of top assets outperforming for weeks, not days.

Today’s context: BTC set new records around $125–126k this week; risk appetite is strong and ETF demand is robust, typical of a bull backdrop.

Are We in a Bull Run Right Now?

Yes. As of October 2025, Bitcoin hit fresh all-time highs above $125k, the total crypto market cap sits around $4.3T, and stablecoin supply just topped $300B, three objective signs of a crypto bull run driven by post-halving supply cuts and strong ETF/institutional inflows.

What’s happening recently

- Price leadership: Bitcoin just set a new all-time high above $125k and is still trading near records, classic bull-market behavior.

- Scale & breadth: The total crypto market cap ~$4.3–4.4T confirms a broad move, not a single-coin spike.

- Liquidity rising: Stablecoin supply > $300B, a fresh high, signals more deployable capital on-chain.

Why we’re in a bull run

- Post-halving supply shock: The April 2024 halving cut Bitcoin issuance to 3.125 BTC per block, tightening new supply for 12–18 months, historically a tailwind when demand is firm.

- Institutional access & demand: Mainstream coverage points to strong institutional participation and supportive policy headlines, lowering frictions for capital to enter.

- Macro backdrop: A softer dollar and policy uncertainty (e.g., U.S. shutdown risk) have pushed some investors toward non-sovereign assets like Bitcoin, reinforcing momentum.

- Liquidity flywheel: Growing stablecoin float (now $300B+) and higher spot activity support rotations from BTC into majors/alts as the cycle matures.

Simple Checklist

- BTC holds above prior ATHs for weeks, not hours.

- Global crypto market cap trends up with higher highs/higher lows.

- Stablecoin market cap expands (fresh highs vs. flat/shrinking in bears).

What’s Driving the Crypto Bull Run?

Issuance Shock Post-Halving

Bitcoin’s April 2024 halving reduced the block reward to 3.125 BTC, curbing new supply. While not a guarantee of gains, prior cycles often saw strength in the 12–18 months following halvings as demand met reduced issuance.

ETF Flywheel and Institutional Access

Spot Bitcoin ETFs reduce access frictions for RIAs and institutions. Fund disclosures show IBIT near $100B AUM, and industry trackers cite $3.2B weekly net inflows at the start of “Uptober.” Sustained creations support price, depth, and volatility absorption.

Liquidity & Confidence Signals

A rising stablecoin market cap (now >$300B) often coincides with fresh capital entering the system, supporting broader rallies and smoother rotations into altcoins later in the cycle.

2025 Outlook: Risks to Watch

The crypto bull run is being powered by post-halving supply dynamics, persistent ETF inflows, and expanding stablecoin liquidity, but it’s still highly sensitive to policy headlines and market microstructure.

Catalysts

- ETF flows: Continued net creations in BTC spot ETFs, monitoring daily/weekly creations vs. redemptions helps gauge demand sturdiness.

- Potential product expansion: Analysts and industry media cover a pipeline of non-BTC ETF filings; timelines and outcomes remain uncertain and price-sensitive.

- Macro: A softer dollar/real yields can buoy risk assets, including crypto; watch cross-asset reactions around policy headlines and shutdowns.

Risks

- Regulatory delays/surprises: Slower ETF approvals or adverse guidance can dent sentiment.

- Flow reversals: A string of ETF outflow days can flip the tone quickly, especially near highs.

- Leverage & liquidity pockets: When altcoin rotations begin, shallow books can amplify drawdowns.

Checklist to Confirm a Bull Phase

This checklist turns the “bull run” question into data you can track weekly, price leadership, ETF flow persistence, liquidity expansion, market breadth, and the character of pullbacks so you confirm trend strength with evidence, not hype.

- New highs + hold: BTC breaks ATH and holds for multiple weeks.

- ETF creations: Net positive creations over multi-week windows.

- Liquidity trend: Stablecoin market cap and spot/derivatives volumes grind higher month-over-month.

- Breadth: 60–70% of top-50 alts outperform BTC across 60–90 days as rotations mature.

- Drawdown character: Pullbacks are shallower/shorter than in bear regimes (higher lows, faster recoveries).

Real Examples

Each example includes a clear date and metric across price, ETF flows, liquidity, breadth, and equity spillovers, so readers and editors can fact check quickly and see why conditions align with a sustained uptrend.

- BTC sets new ATHs: Reports across mainstream finance media confirm fresh records around $125–126k this week.

- ETF heat: $3.2B net inflows in a single week second-best since launch underscore persistent demand.

- Scale of adoption: IBIT discloses ~$98B AUM (issuer site), evidencing rapid institutional uptake.

Conclusion

The evidence points to a live bull phase, but durable success still comes from discipline, tracking objective signals, sizing positions conservatively, and preparing for volatility around policy and ETF headlines.

If you want structured, research-driven learning and tools to navigate this cycle, explore Ultima Markets Academy for step-by-step guides, checklists, and weekly market briefs. You can practice with a risk-free demo, review our platform risk controls such as Negative Balance Protection, and follow our education series on market breadth, ETF flows, and liquidity tracking to make more informed decisions.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.