Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

When Will Databricks IPO?

Databricks has not announced an IPO date as of September 2025. The company raised a $100 billion Series K round in August 2025, giving it financial flexibility and reducing any immediate need to list publicly. Analysts suggest a potential IPO could happen in late 2025 or 2026, but no filing with the SEC has been made, meaning the timeline remains unconfirmed.

What is Databricks?

Databricks was founded in 2013 by the team behind Apache Spark, one of the most influential open-source frameworks for data processing. Its mission has been clear from the start: to simplify data and AI for enterprises.

At its core, Databricks offers a Lakehouse platform, a hybrid approach that combines the scalability of data lakes with the structure of data warehouses. This unified system allows companies to store, process, and analyze massive datasets efficiently while also enabling machine learning and AI workloads.

New Developments in 2025

Databricks has expanded its platform aggressively:

- Agent Bricks: A toolkit to help enterprises build, deploy, and manage AI agents tailored to business operations.

- Lakebase: A next-generation operational database optimized for AI-first workloads, bridging the gap between transactional and analytical data.

These moves signal Databricks’ ambition not only to compete in the data space but to become a cornerstone of enterprise AI.

How Does Databricks Make Money?

Understanding how Databricks makes money is crucial for analyzing its long-term value. Unlike traditional software providers that rely on license fees, Databricks uses a consumption-based model.

Customers are billed using Databricks Units (DBUs), a per-second measure of computational resources consumed. This allows companies to scale costs directly with usage:

- A business processing large-scale data pipelines pays more.

- A company running occasional analytics workloads pays less.

Pricing also varies across cloud providers (AWS, Azure, Google Cloud) and workload types (SQL, ML, model serving). For large enterprises, Databricks offers commitment contracts with discounts in exchange for guaranteed spend.

This model creates predictable growth. As more organizations adopt AI and expand workloads, their Databricks usage and thus spending tends to rise steadily.

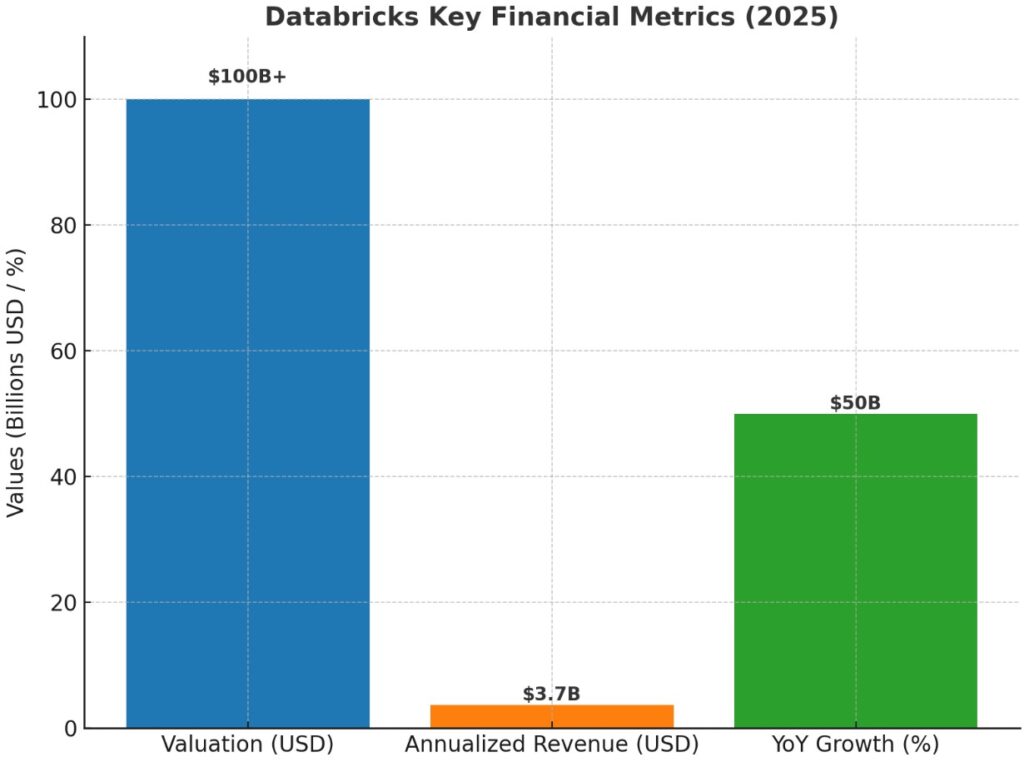

Databricks by the Numbers

- Valuation: Over $100 billion (Series K, August 2025).

- Annualized revenue run-rate: About $3.7 billion by July 2025.

- Growth rate: ~50% year-over-year.

- Customers: Thousands globally, including Fortune 500 enterprises across finance, healthcare, retail, and technology.

Databricks’ valuation puts it in rare company. Few startups like Stripe, OpenAI, SpaceX share this level of private-market prestige. For investors, this scale signals that when Databricks eventually lists, it could be one of the largest IPOs in tech history.

Can You Buy Databricks Pre-IPO?

Retail investors cannot buy Databricks directly before the IPO. However, accredited investors may sometimes access pre-IPO shares through secondary marketplaces. These platforms allow employees or early investors to sell their shares, subject to company approval.

Note:

- Pre-IPO investments are illiquid and pricing is volatile.

- Minimum investment requirements apply.

- Access is not guaranteed.

For most investors, waiting for the official IPO remains the most practical option.

What Might Drive Databricks Stock Price After IPO?

If Databricks lists, investors will evaluate several key drivers:

- Adoption of AI Products: The success of Agent Bricks and Lakebase could boost long-term revenue.

- Consumption Growth: Expanding customer usage will directly fuel top-line performance.

- Competition: Databricks faces rivals like Snowflake, Palantir, and cloud hyperscalers. Competitive wins will matter.

- Profitability Path: Investors will watch margins and whether Databricks can transition from hyper-growth to efficient scale.

- Market Sentiment: The broader IPO environment, tech valuations, and interest rate trends will affect demand for the stock.

Databricks IPO Stock Price and Price Prediction

Because Databricks has not filed for IPO, there is no official stock price or ticker yet.

Any Databricks IPO stock price prediction is speculative. Analysts typically value IPO candidates using EV/Revenue multiples. Snowflake, for example, listed in 2020 at ~40x forward revenue. If Databricks trades at similar levels, its valuation could justify a significant IPO raise.

However, without an S-1 filing, investors should treat all numeric predictions as hypothetical.

Comparisons: Databricks vs Other Tech IPOs

To understand what Databricks might look like as a public company, it’s useful to compare it to recent tech listings:

- Snowflake (2020 IPO): Valued at $70B at listing, shares soared as demand for data platforms spiked.

- Palantir (2020 Direct Listing): Entered with strong government contracts but has faced volatility.

- Nutanix & MongoDB: Examples of infrastructure software IPOs that found steady growth post-listing.

Compared to these, Databricks combines data infrastructure with AI leadership, potentially giving it broader investor appeal.

Conclusion

The Databricks IPO remains one of the most closely watched events in global markets. With revenues nearing $4 billion and a valuation above $100 billion, Databricks is positioned to become a landmark listing once it files. While the exact timing is still unconfirmed, the company’s growth in AI and data infrastructure ensures it will be a major focus for investors when it finally enters public markets.

At Ultima Markets, we believe knowledge and preparation are the keys to trading success. That’s why our platform provides traders with the latest insights, market analysis, and educational resources to help navigate opportunities like the Databricks IPO. Whether you are monitoring tech IPOs, trading forex, or exploring equities, Ultima Markets is here to support you with a secure, regulated environment and the tools you need to trade with confidence.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.