Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWhat Is the U.S. Dollar Index (USDX)?

The USDX also shown as DXY measures the U.S. dollar against a fixed basket of six major currencies. The index is published by Intercontinental Exchange and is widely used by forex traders to gauge broad USD strength or weakness at a glance. The basket includes EUR, JPY, GBP, CAD, SEK, CHF. When USDX rises, it signals the dollar is gaining against the basket on average; when it falls, the dollar is weakening

History of the USDX

USDX launched in 1973 as currencies began floating after the end of Bretton Woods. The base value was set to 100.00. The composition has changed once in 1999, the euro replaced several legacy European currencies. Since then, the six-currency basket and its weights have remained the same.

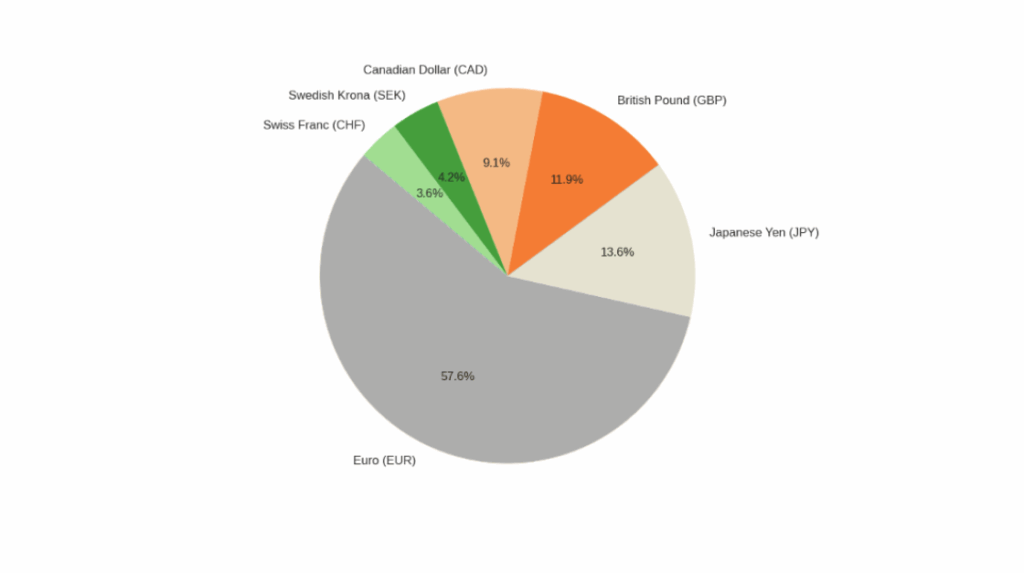

Basket Composition and Official Weights

The U.S. Dollar Index (USDX) represents the average value of the U.S. dollar against a basket of six major world currencies. Each component has a specific weighting that reflects the importance of the U.S. trade relationship with the countries behind those currencies at the time of the index’s creation in 1973.

The weights have remained unchanged since 1999, when the euro replaced several European currencies (including the German mark, French franc, Italian lira, Dutch guilder, and Belgian franc). This stability means the USDX remains consistent over time, although it also means the index doesn’t fully reflect today’s global trade patterns, an important consideration for analysts.

The index is geometrically weighted with these official shares of influence:

- Euro EUR 57.6%

- Japanese Yen JPY 13.6%

- British Pound GBP 11.9%

- Canadian Dollar CAD 9.1%

- Swedish Krona SEK 4.2%

- Swiss Franc CHF 3.6%

These weights are set by ICE and have remained unchanged since the euro’s introduction. The heavy EUR share means USDX is particularly sensitive to moves in EURUSD.

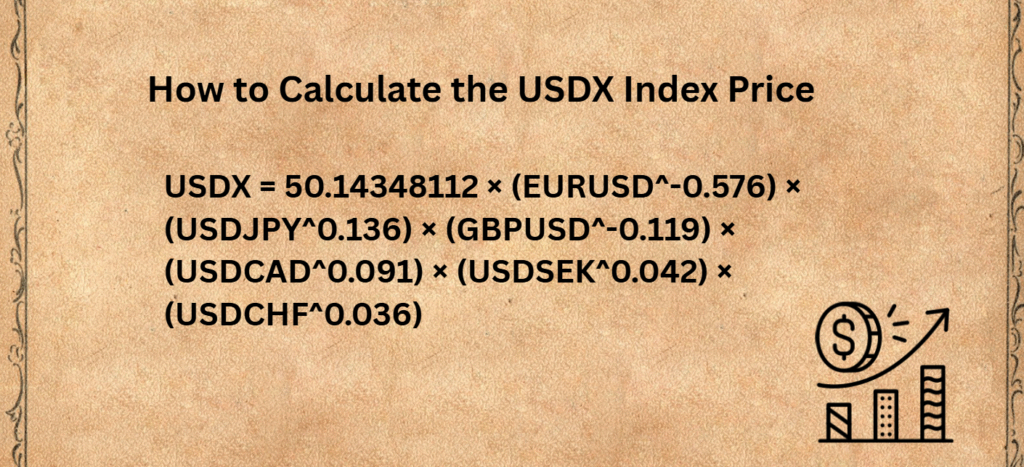

How to Calculate the USDX Index Price

USDX uses a geometric mean so percentage moves in each currency pair combine proportionally. The formula is:

USDX = 50.14348112 × (EURUSD^-0.576) × (USDJPY^0.136) × (GBPUSD^-0.119) × (USDCAD^0.091) × (USDSEK^0.042) × (USDCHF^0.036)

Pairs where USD is the quote currency enter with negative exponents because dollar strength pushes those pairs down. Pairs where USD is the base get positive exponents because dollar strength pushes them up. The constant 50.14348112 normalises the base period to 100.

Understanding the calculation of USDX is important because the index is geometric rather than arithmetic, pricing nuances filter through to futures and ETPs that track the index. Understanding this helps explain small tracking differences versus the “spot” index you see on charting platforms.

How to Trade the USDX

Trading the U.S. Dollar Index (USDX) allows you to take a position on the overall strength or weakness of the U.S. dollar instead of trading individual currency pairs. Whether you are a retail forex trader or an institutional participant, there are several ways to trade or gain exposure to the index from futures and ETFs to CFDs and synthetic baskets.

USDX Futures and Options on ICE

The most direct way to trade the USDX is through futures and options contracts listed on the Intercontinental Exchange (ICE Futures U.S.), under the symbol DX.

Key features of DX futures:

- Contract size: USD 1,000 × index value

- Tick size: 0.005 = USD 5

- Minimum fluctuation: 0.005 points

- Trading hours: Almost 21 hours a day (Sunday evening to Friday afternoon, U.S. ET)

- Settlement: Physical delivery of the six currencies, though most traders offset positions before expiry

- Contract months: March, June, September, and December

Why trade DX futures?

- High liquidity and transparency

- Tight spreads and institutional-grade pricing

- Clear exposure to broad USD movement

- Tradable on margin through regulated exchanges

Options on DX futures allow traders to express directional or volatility-based views. For instance, you could buy a call option to benefit from USD strength or sell a put option if expecting dollar stability.

USDX ETFs and ETPs (For Investors)

If you prefer to trade through stock exchanges rather than futures, you can use exchange-traded funds (ETFs) or exchange-traded products (ETPs) that replicate the U.S. Dollar Index.

The most popular example is:

Invesco DB U.S. Dollar Index Bullish Fund (Ticker: UUP)

- Tracks long exposure to the USDX via ICE futures

- Suitable for investors who want to bet on a stronger dollar without entering the futures market

- Available on major exchanges like NYSE Arca

For those who expect the dollar to weaken, there’s also:

- Invesco DB U.S. Dollar Index Bearish Fund (Ticker: UDN), which seeks to deliver inverse performance of USDX futures.

These instruments are ideal for portfolio hedging and longer-term positioning, though they can diverge slightly from spot USDX due to futures roll costs and fund management fees.

USDX CFDs (For Retail Forex Traders)

Most online forex brokers offer CFDs (Contracts for Difference) that track the USDX spot price.

This allows retail traders to go long or short the U.S. dollar index without trading individual pairs.

Advantages of trading USDX CFDs:

- Easy access via MT4, MT5, or proprietary platforms

- Tradeable in small contract sizes (micro or mini lots)

- Ability to use leverage

- No need for exchange membership

If you believe the U.S. dollar will strengthen due to upcoming Fed rate hikes, you could open a long position on the USDX CFD. If you expect the dollar to weaken after soft inflation data, you could open a short position. Always monitor related events such as the CPI, NFP, and FOMC announcements for volatility triggers.

Synthetic USDX Baskets

Some advanced forex traders create a synthetic USDX position using the same six currency pairs and weightings that make up the index:

- EUR/USD (57.6%)

- USD/JPY (13.6%)

- GBP/USD (11.9%)

- USD/CAD (9.1%)

- USD/SEK (4.2%)

- USD/CHF (3.6%)

By going long or short these pairs in the correct proportions, you can replicate the USDX exposure even if your broker doesn’t list it as a standalone symbol. However, this requires more capital, precise lot sizing, and strong correlation management.

Managing Risk When Trading the USDX

Because USDX reflects broad market sentiment, volatility can spike around news events.

Risk management is critical:

- Use stop-loss orders to limit downside.

- Avoid over-leverage; USDX can swing 50–100 points quickly.

- Correlate your USDX exposure with open USD pairs to prevent double risk.

- Monitor economic calendars for data releases that can drive USD volatility.

Why the U.S. Dollar Index Matters in Forex

The USDX (U.S. Dollar Index) matters because it’s the fastest way to gauge the dollar’s overall strength across major currencies, helping traders set bias for pairs like EUR/USD and USD/JPY. It reacts to Fed policy and risk sentiment, aids hedging, and improves timing around events (CPI, NFP, FOMC) by confirming trend and momentum.

USDX Versus the Fed Trade Weighted Dollar Index

USDX is a tradable six-currency gauge with static weights. The Federal Reserve Broad Dollar Index and its related series cover a wider set of U.S. trading partners and reweight annually based on trade, offering a more representative macro view but no direct tradable contract. For trading liquidity, use USDX. For economic representativeness, cross-check with the Fed indexes.

Practical Trading Framework Using USDX

Top Down Bias

Start each session by marking whether USDX is trending above or below your medium-term moving average. That sets your USD bias across pairs.

Event Confluence

Align USDX inflection zones with upcoming macro catalysts. A break above a recent USDX swing high ahead of CPI can validate USD-long setups.

Pair Selection

Express the view where the cross-currents agree. If USDX is breaking higher and EUR data are soft, EURUSD typically offers the cleanest vehicle due to the EUR weight.

Risk and Overlap

Avoid stacking multiple USD trades that all depend on the same USDX move. Size positions using volatility metrics and set invalidation levels in advance.

Conclusion

The U.S. Dollar Index (USDX) remains one of the most powerful tools in forex trading. It helps traders quickly understand whether the dollar is broadly strengthening or weakening and provides valuable context for trading major pairs like EUR/USD, GBP/USD, and USD/JPY.

By combining USDX analysis with economic data, technical levels, and event timing, traders can make smarter, more informed decisions. Whether used for trend confirmation, risk management, or hedging, the USDX offers a clear snapshot of the market’s overall sentiment toward the U.S. dollar making it an essential reference for anyone serious about forex trading.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.