Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

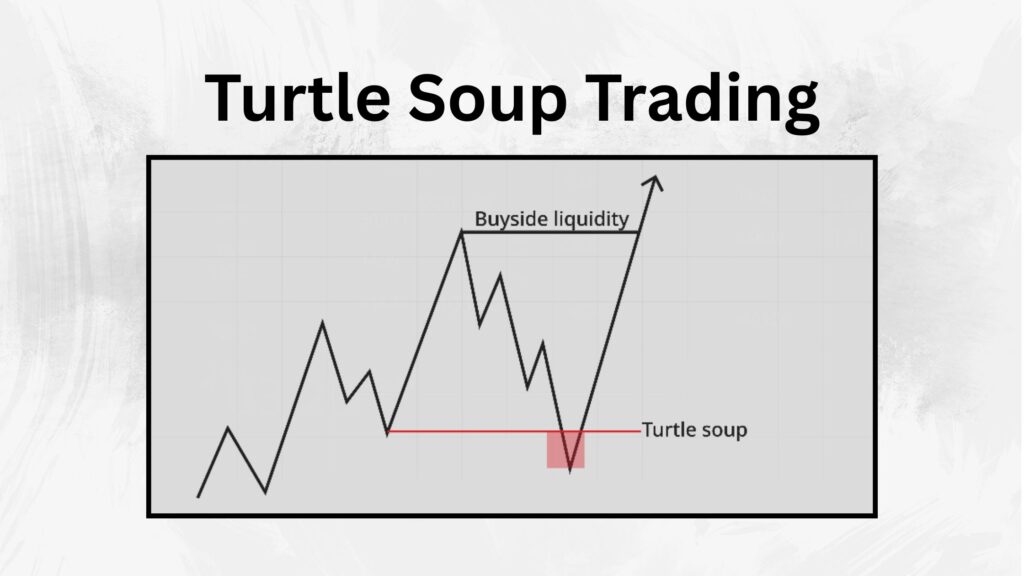

What Is Turtle Soup Trading?

Turtle Soup Trading is a countertrend trading strategy that capitalizes on false breakouts in the market. Unlike the original Turtle Trading System, which is trend-following, Turtle Soup seeks to identify short-term reversals following a brief price breakout. This strategy is popular across various asset classes, including forex, indices, commodities, and cryptocurrencies, due to its ability to profit from market mispricing during volatile conditions.

Understanding the Turtle Soup Trading Strategy

Turtle Soup is designed to take advantage of false breakouts, situations where the price briefly moves beyond key support or resistance levels and then reverses. Traders can enter a position in the opposite direction of the breakout, anticipating that the price will revert to the mean.

Key Elements of the Turtle Soup Strategy:

- Entry Signal: A breakout beyond a key support or resistance level, followed by a quick reversal.

- Stop Loss: Set just beyond the breakout level to limit risk in case the trend continues in the breakout’s direction.

- Profit Target: Typically based on a risk-to-reward ratio, often 1:2, or set at significant market levels such as previous support/resistance.

- Timeframe: Primarily used for short-term trading, often with 30-minute or hourly charts.

Turtle Soup Trading Example

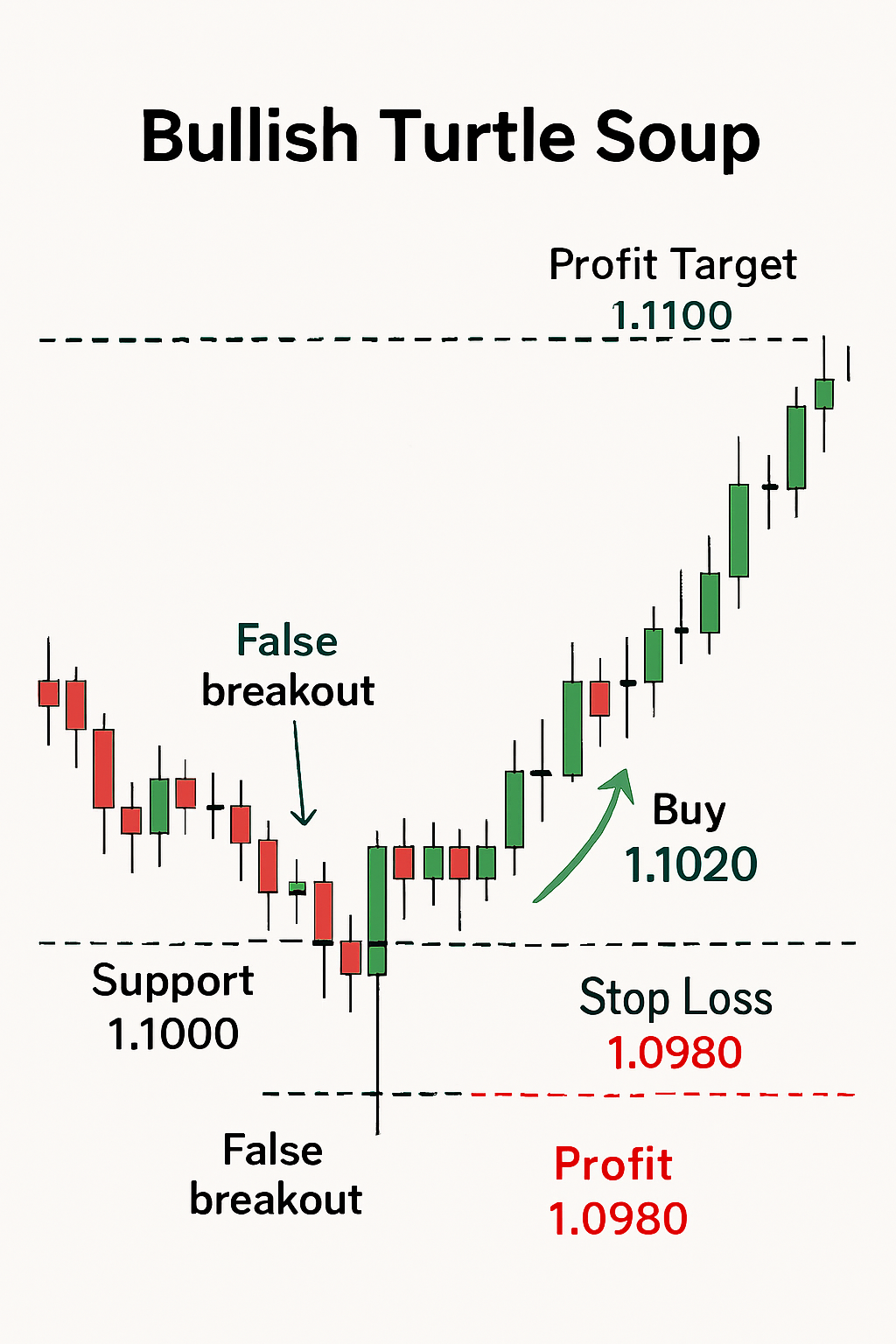

Bullish Turtle Soup Example

Let’s say EUR/USD breaks below a key support level at 1.1000, which leads to a short-sell position. However, the price quickly rises back above 1.1000. This is a false breakout, and traders could enter a buy position at 1.1020, placing a stop loss below the recent low at 1.0980. The profit target might be set at 1.1100, which is the previous resistance level.

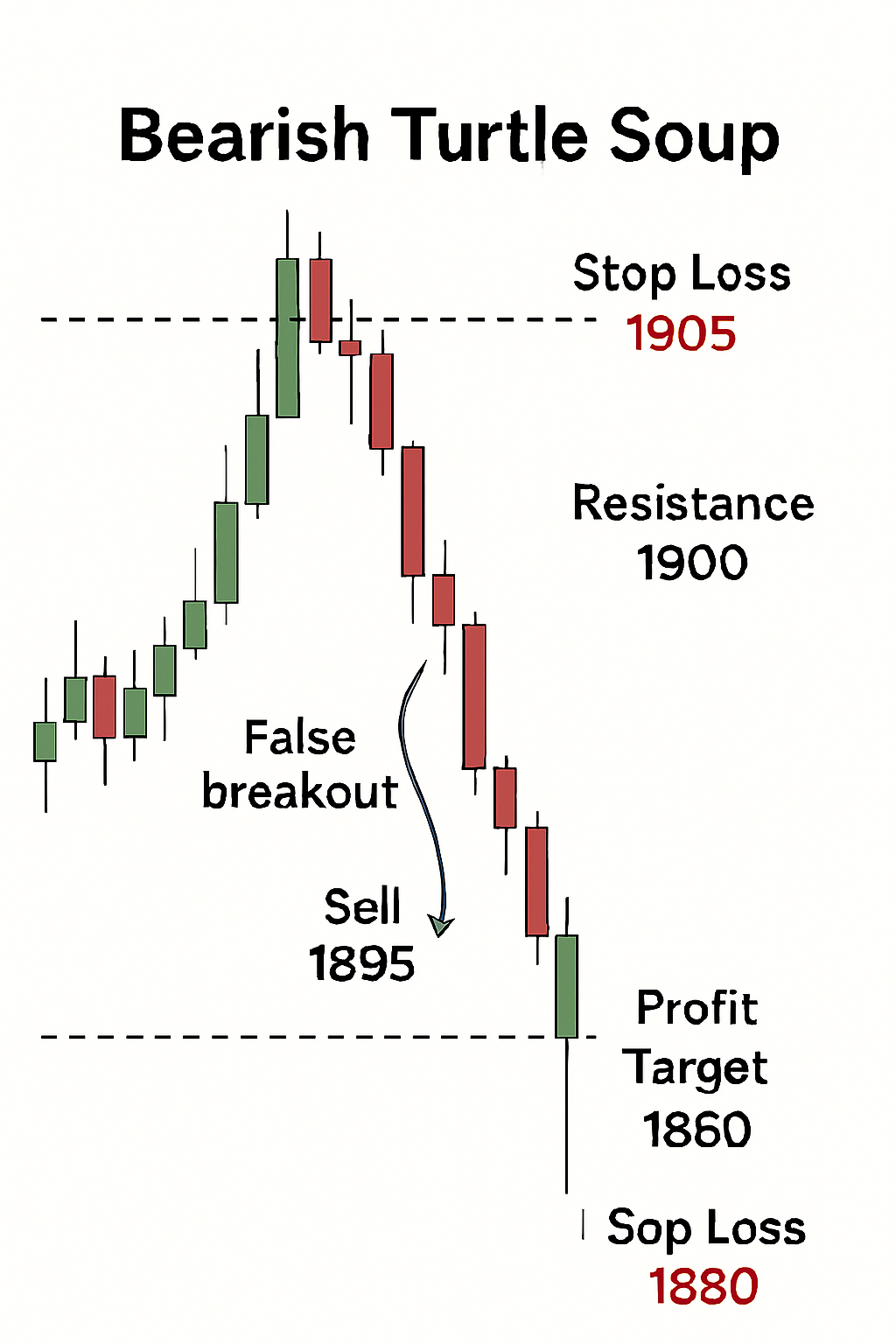

Bearish Turtle Soup Example

For a bearish example, consider Gold (XAU/USD). Gold breaks above $1,900 but then quickly falls below this level. A sell order is placed at $1,895, with a stop loss just above the breakout point at $1,905. The profit target would be set at $1,880, near the next support level.

Turtle Soup Trading Strategy Rules

Bullish Rules

- Identify a False Breakout: Look for a price breach below a key support level.

- Confirm the Reversal: Ensure the price moves back above the support level to confirm the reversal.

- Enter Buy Position: Once the reversal is confirmed, enter a long position.

- Set Stop Loss: Place the stop loss just below the breakout level.

- Profit Target: Set your target based on a 1:2 risk-to-reward ratio or at significant resistance levels.

Bearish Rules

- Identify a False Breakout: Look for a price breach above a key resistance level.

- Confirm the Reversal: Ensure the price moves back below the resistance level to confirm the reversal.

- Enter Sell Position: Enter a short position when the price confirms the reversal.

- Set Stop Loss: Place the stop loss just above the breakout level.

- Profit Target: Set your profit target based on a 1:2 risk-to-reward ratio or at key support levels.

How ICT Refines the Turtle Soup Strategy

ICT (Inner Circle Trader) has refined the Turtle Soup strategy by incorporating market structure analysis and institutional order flow. ICT traders focus on liquidity pools, where stop orders accumulate, and use this information to time entries with high probability.

They also apply advanced tools like Fair Value Gaps (FVG) and Breaker Blocks to ensure a more accurate entry, aligning with market moves driven by large institutions.

Turtle Soup Trading in Forex, Indices, Commodities, and Crypto

Turtle Soup Trading is adaptable across various financial markets. Let’s explore its application in key markets:

Turtle Soup in Forex

In the forex market, major currency pairs like EUR/USD, GBP/USD, and USD/JPY often experience false breakouts. These markets are particularly well-suited for Turtle Soup, especially during high-impact news events or economic reports.

Turtle Soup in Indices

Indices like the S&P 500 and NASDAQ also experience false breakouts due to shifts in market sentiment. The Turtle Soup strategy can help traders catch reversals during periods of volatility.

Turtle Soup in Commodities

Commodities such as gold, oil, and natural gas frequently break above or below key support and resistance levels. The Turtle Soup strategy can profit from these price swings when the breakout quickly reverses.

Turtle Soup in Crypto

Cryptocurrencies are notorious for their high volatility, making them ideal for the Turtle Soup strategy. Popular assets like Bitcoin (BTC) and Ethereum (ETH) regularly experience false breakouts, providing traders with reversal opportunities.

Turtle Trading vs. Turtle Soup Trading: Key Differences

While both strategies involve breakouts, their objectives differ significantly.

Key Differences:

- Trend-following vs. Countertrend: Turtle Trading follows the trend, while Turtle Soup seeks to capitalize on countertrend movements.

- Risk Management: Turtle Trading generally uses wider stop losses due to longer-term trends, whereas Turtle Soup uses tight stop losses just beyond the breakout level.

- Profit Targets: Turtle Soup tends to target quick reversals, while Turtle Trading aims for larger trends over time.

Conclusion

Turtle Soup Trading offers a unique opportunity to profit from market reversals and false breakouts. With Ultima Markets, traders have access to powerful tools and resources, enabling them to apply this strategy across forex, indices, commodities, and crypto. Whether you’re a beginner or experienced trader, Ultima Markets provides the platform and support you need to succeed with the Turtle Soup Trading strategy. Start trading today and unlock your potential with Ultima Markets.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.