Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWhat Is the ORB Strategy in Trading?

Day trading is a fast-paced, high-stakes game, where every decision can make or break your profits. To navigate this whirlwind, traders need strategies that are not only reliable but also easy to execute. One such strategy that has gained significant popularity is the Opening Range Breakout (ORB) Strategy. By focusing on the price action in the first few minutes or hours of the trading session, the ORB strategy allows traders to capture early momentum and profit from the market’s initial moves.

While many swear by this strategy, the truth is, it’s not as simple as it seems. So, why do so many traders lose money with it? And more importantly, how can you use the ORB strategy to your advantage and avoid the common pitfalls? In this guide, we’ll break down the ORB strategy, explain why it works, and give you the tools you need to make it a profitable part of your trading arsenal.

What Is the Opening Range Breakout (ORB) Strategy?

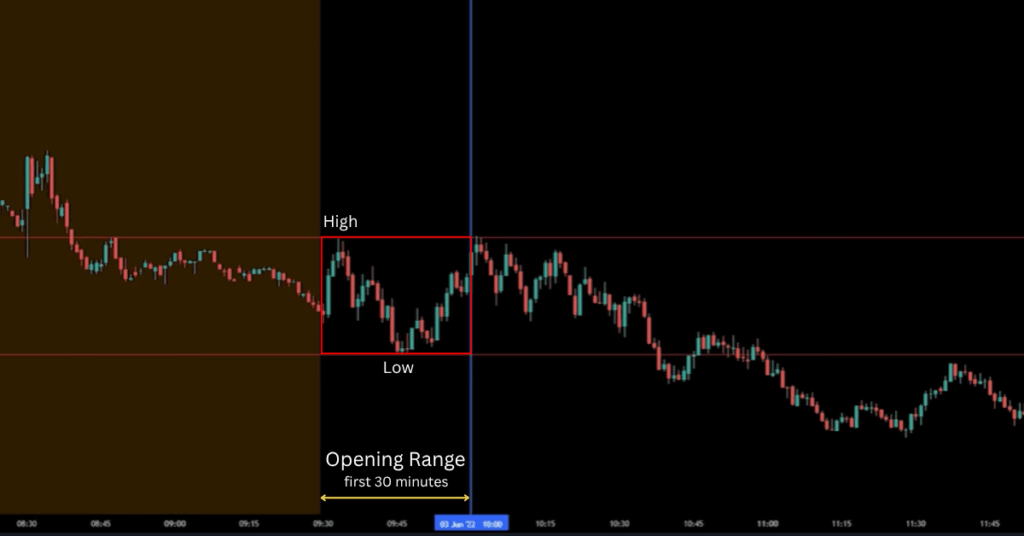

The Opening Range Breakout (ORB) strategy revolves around the price action within the first few minutes or hours after the market opens. Traders define the opening range by marking the highest and lowest prices of the initial period, typically the first 15, 30, or 60 minutes after the market opens. The strategy then focuses on taking a position when the price breaks above or below this range, signaling the potential for continued movement in that direction.

The reason this strategy is popular is due to its simplicity: traders look for a clean breakout in either direction. However, as some in the trading community highlight, this strategy when used in isolation can be ineffective and even risky due to its predictable nature. Institutional traders are aware of the popularity of ORB, which is why they may use it to trap retail traders into false breakouts and reverse the price action quickly, resulting in stop-loss hits.

How Does the ORB Strategy Work?

Executing the ORB strategy involves a few steps that traders can follow for consistency:

1. Define the Opening Range

The first step is to choose a time frame for your opening range. Most traders use the first 15 or 30 minutes after the market opens, but this can vary based on the asset or trading style. Once the time frame is chosen, mark the highest and lowest points within that range. This is your opening range.

2. Wait for the Breakout

Once the range is established, traders wait for the price to break above or below this range. If the price rises above the high, it signals a potential long position (buy). If the price drops below the low, it signals a potential short position (sell). The breakout should be clear and accompanied by sufficient volume to confirm the move.

3. Confirm with Volume

A strong breakout should be confirmed by an increase in volume, which suggests that the move is supported by significant market interest. If volume is low, the breakout may be a false signal, and traders should exercise caution before entering the trade.

4. Set Stop-Loss and Profit Targets

Risk management is crucial in trading. Set your stop-loss order just outside the opening range to protect against false breakouts. The stop-loss should be placed outside the high or low of the range, depending on whether you are going long or short. Profit targets can be set based on previous support or resistance levels, or traders can use a fixed risk-to-reward ratio to determine where to exit the trade.

Why Is the ORB Strategy Effective?

The ORB strategy is effective because it offers clear entry and exit points, and it capitalizes on the market’s initial momentum, but its success hinges on key factors:

1. No Context, No Trend

The biggest flaw with relying solely on the ORB strategy is that it doesn’t consider market context. The breakout from the opening range can happen in a trending market or a choppy one. Without understanding the broader trend, traders can easily be caught in false breakouts.

2. Liquidity Pools and Fakeouts

Liquidity plays a major role in breakouts. Often, price will move quickly to trigger stop-losses placed around the range, only to reverse immediately. Understanding liquidity pools and fakeouts is essential to avoid entering trades that are set up to fail.

How to Use the ORB Strategy Effectively

While the ORB strategy can be highly profitable, it needs more context to be truly effective. Here’s how to improve your use of the strategy:

1. Trade with the Trend

To enhance the success of the ORB strategy, it’s crucial to trade in the direction of the higher time frame trend. Whether you’re looking at the 15-minute, 1-hour, or daily chart, ensure that the breakout aligns with the overall market trend. This additional filter will increase the probability that the breakout will sustain.

2. Watch for Fakeouts

Fakeouts, where the price briefly breaks out only to reverse, are common in volatile markets. One way to confirm the breakout is to wait for a retest, where the price moves back to the breakout level before continuing in the direction of the trend.

3. Use Additional Confirmation Tools

While the ORB strategy can be effective on its own, combining it with other technical indicators, such as moving averages, RSI, or Fibonacci retracements, can provide additional confirmation and reduce the risk of false breakouts.

4. Be Aware of Liquidity

Understanding where liquidity lies can help you avoid fake breakouts. If the price breaks through the opening range and immediately reverses, it might be due to a liquidity trap, where institutional traders are triggering stop-losses. Always be cautious in such scenarios and ensure that the breakout is supported by volume and momentum.

Potential Risks of the ORB Strategy

The ORB strategy, while powerful, is not without its risks. False breakouts are common, and institutional players are often aware of retail trading patterns. Here are some ways to mitigate these risks:

- Use Stop-Loss Orders: Always use a stop-loss order just outside the opening range to protect your capital in case of a false breakout.

- Confirm with Volume: A strong breakout should be accompanied by an increase in volume. Low volume can often lead to a false breakout, so confirm the breakout before entering a trade.

- Don’t Trade in Choppy Markets: The ORB strategy works best in trending markets. Avoid using it during sideways or low-volatility periods where breakouts are more likely to fail.

Final Thoughts

The Opening Range Breakout (ORB) strategy is a simple but effective tool for day traders, especially when combined with market context and confirmation tools. While the strategy can yield strong results, it’s important to be aware of its limitations and potential pitfalls, such as false breakouts and liquidity traps.

By incorporating additional filters like trading with the higher time frame trend and using tools like Fibonacci and trend lines, traders can significantly improve the effectiveness of the ORB strategy. With discipline, risk management, and practice, the ORB strategy can be a valuable addition to your trading toolkit.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.