Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWhat Is The Currency of Thailand

Thailand’s official currency is the Thai Baht (THB), issued by the Bank of Thailand. It plays a significant role in both regional trade and the forex market, particularly among emerging Asian currencies. For traders, understanding the dynamics of the currency of Thailand is essential for making informed financial decisions.

The Thai currency is called the Thai Baht, abbreviated as THB. Its symbol is ฿, and the currency code is THB, used in global financial markets and currency exchanges. The Baht is further divided into 100 satang, although satang is rarely used in daily transactions.

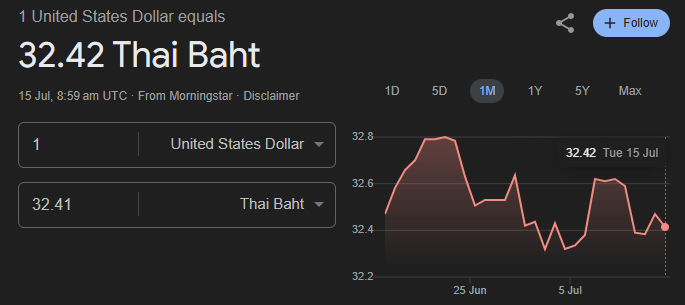

As of July 2025, the exchange rate of Thailand currency to US dollar is approximately 1 USD = 32.42 THB, but rates fluctuate based on monetary policy, trade flows, and global sentiment.

Thai Currency Historical Performance

The Thai Baht has a long monetary history, transitioning from a silver-based system in the 19th century to a floating exchange rate regime in 1997, following the Asian Financial Crisis. Since then, THB has remained relatively stable, outperforming several emerging market currencies in the region.

Key historical milestones:

- 1997: Baht was floated; dropped from 25 to nearly 50 per USD.

- 2008–2020: Baht showed strength due to current account surpluses.

- 2020–2022: COVID-19 impacted tourism revenues, weakening the Baht.

- 2023–2025: Stabilized as tourism and exports rebounded.

Why Is the Thai Baht So Strong?

The strength of the Thai Baht is influenced by several macroeconomic factors:

- Trade Surplus: Thailand often runs a positive current account, mainly from agricultural exports and tourism revenue.

- Foreign Reserves: The Bank of Thailand holds high levels of foreign exchange reserves, boosting investor confidence.

- Low External Debt: Compared to other emerging economies, Thailand has lower foreign-denominated debt, which supports currency stability.

In recent years, Thai vs other Asian currencies like MYR (Malaysian Ringgit) or IDR (Indonesian Rupiah) shows Baht’s relative strength due to consistent capital inflows and monetary discipline.

Thai Currency in the Forex Market

In the forex market, the Thai Baht is categorized as an emerging market currency. While not as liquid as major pairs like EUR/USD, it is frequently traded in regional pairings.

Popular Thai Currency Forex Pairs:

- USD/THB – Most liquid and widely traded pair

- EUR/THB – Common for European-Asian trade

- JPY/THB – Important due to Japan–Thailand investment ties

- THB/SGD – Regional trade influence

Forex traders monitor THB due to its sensitivity to tourism trends, regional risk sentiment, and commodity price fluctuations (like rice, rubber, and crude oil).

Thai vs Other Asian Currencies

The Thai Baht (THB) stands out among emerging Asian currencies due to its relative strength, macroeconomic stability, and consistent demand in both trade and tourism. Here’s how it compares against major Asian peers:

Stronger Than: IDR, VND, PHP

Indonesian Rupiah (IDR):

IDR is a highly inflationary currency and more prone to capital flight. Its lower interest rates, wider current account deficits, and political instability make it weaker and more volatile than THB. For example, USD/IDR trades around 16,000+, while USD/THB is around 35.5.

Vietnamese Dong (VND):

The VND is a non-convertible currency tightly controlled by the State Bank of Vietnam. It’s not freely traded on global forex markets and experiences frequent mini-devaluations to support export competitiveness. In contrast, THB is fully convertible and more market-driven.

Philippine Peso (PHP):

The PHP is often undermined by trade deficits, high import dependency, and external debt. Its performance is also tied closely to overseas remittances. THB, by comparison, benefits from stronger export earnings and tourism flows, making it more resilient.

More Stable Than: KRW, MYR

South Korean Won (KRW):

While KRW is liquid and widely traded, it’s highly sensitive to geopolitical risks (e.g., North Korea) and external shocks due to Korea’s export-heavy economy. The Won often shows sharp volatility during risk-off periods, whereas THB remains more range-bound.

Malaysian Ringgit (MYR):

The MYR is partially managed and susceptible to swings in commodity prices, especially crude oil and palm oil. MYR is also affected by capital controls and foreign investor sentiment. The Thai Baht, with its broader economic base and fewer restrictions, tends to hold value more consistently.

Less Liquid Than: JPY, CNY

Japanese Yen (JPY):

JPY is a major reserve currency and considered a safe-haven asset during global crises. It is one of the most traded currencies worldwide (part of the top three with USD and EUR), offering deep liquidity and tight spreads.

Chinese Yuan (CNY):

Despite capital controls, the offshore Yuan (CNH) is increasingly liquid due to China’s global trade dominance and inclusion in IMF’s SDR basket. CNY is used in large volumes in Asia-Pacific trade settlements, giving it broader utility than THB.

Is the Thai Baht a Good Trading Currency?

Yes, the Thai Baht (THB) is a viable trading currency in the forex market, particularly through the USD/THB pair. It is commonly traded by regional investors and institutional traders due to its:

- Consistent technical range behavior, especially in USD/THB

- Influence from seasonal tourism flows

- Impact from regional capital inflows and outflows

However, traders should be aware of the risks:

- Lower liquidity compared to major pairs like EUR/USD or USD/JPY

- Wider spreads and slippage during periods of high volatility

- Possible intervention by the Bank of Thailand, which actively manages excessive currency fluctuations

Effective trading of the Thai Baht requires both fundamental analysis (such as economic indicators, tourism data, and central bank policy) and technical strategies (using tools like support/resistance levels, moving averages, and momentum indicators).

Conclusion

The Thai Baht (THB) plays a significant role in the Asian forex landscape, supported by Thailand’s solid economic fundamentals, trade surplus, and regional influence. While it presents opportunities through pairs like USD/THB, traders must stay aware of factors such as central bank actions, liquidity levels, and market volatility.

To navigate these dynamics effectively, partner with Ultima Markets, a trust forex broker offering real-time spreads, technical tools, and market insights tailored for trading emerging currencies like the Thai Baht. Whether you’re monitoring seasonal flows or executing macro-driven strategies, Ultima Markets equips you with the resources to trade with confidence and precision.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.