Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWhat Is the Currency of Saudi Arabia?

The official currency of Saudi Arabia is the Saudi Riyal (SAR). It’s subdivided into 100 halalas (هللة) and issued by the Saudi Central Bank (SAMA, formerly SAMA).

- Currency name: Saudi Riyal (SAR)

- ISO code: SAR

- Symbol: ر.س (Arabic) or “SAR” in international markets

- Subunit: 1 SAR = 100 halalas

- Coins: 1, 5, 10, 25, 50 halalas, and 1 or 2 riyal

- Banknotes: Frequently used – 5, 10, 50, 100, 500 SAR; rarely used – 1, 20, 200 SAR

How Does Saudi Arabia Money Look Like?

The modern sixth issue of Saudi Riyal notes, launched in 2016, reflects Saudi Arabia’s culture and leadership:

- King Salman appears on the 5, 10, 50, and 100 SAR notes

- King Abdulaziz is featured on the 500 SAR

- National landmarks like the Kaaba, Prophet’s Mosque, and Shaybah oil field are prominent

- Polymer 5 SAR note released in 2020

- 200 SAR note commemorated Vision 2030 in 2021

Security features include tactile markings, metallic threads, and color-shifting ink designed to prevent counterfeiting and support visually impaired users.

SAR vs USD Forex Market Analysis

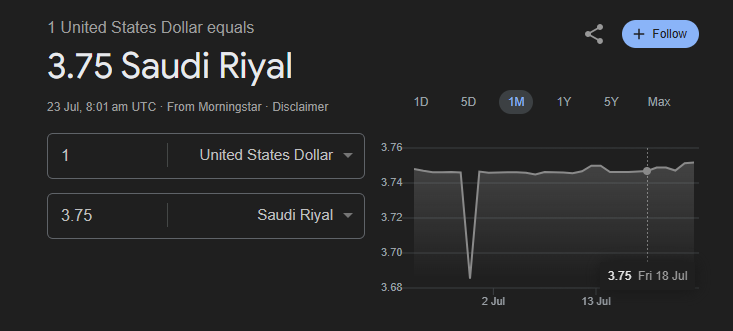

The Saudi Riyal is pegged to the U.S. Dollar at a fixed rate of 3.75 SAR per 1 USD.

Timeline of the Peg:

- Initial peg: Established in June 1986

- Formal reaffirmation: January 2003 by SAMA for long-term economic stability

Key reasons for the USD peg:

- Oil revenue stability: Oil is priced globally in USD

- Inflation control: Helps anchor domestic prices

- Monetary policy: Aligns with U.S. Fed rate moves

- Crisis resilience: Peg was briefly tested during the 2007–2008 crisis but defended by SAMA

Top SAR Currency Pairs & Popular Currency Pairs

While SAR/USD is the most traded, these SAR-based forex pairs are also tracked:

- SAR/EUR

- SAR/GBP

- SAR/JPY

- SAR/AED

- SAR/CNY

However, due to lower liquidity, spreads are typically wider than major currency pairs like EUR/USD, USD/JPY, or GBP/USD. SAR pairs appeal mostly to traders in the Gulf or institutions exposed to Saudi assets.

SAR to Dollar Forecast

The USD/SAR pair is expected to stay flat near 3.75, barring extraordinary macro shifts.

Forecast drivers:

- U.S. Fed rate policy: Directly affects SAR interest rates due to peg

- Oil prices: Saudi’s fiscal health depends on crude revenues

- SAMA reserves: Currently robust, allowing effective defense of the peg

- Geopolitical trends: While Saudi Arabia explores trade in other currencies, no official peg change has been announced

Barring a geopolitical shock or major de-dollarisation move, the USD/SAR pair will remain stable through 2025.

Conclusion

The Saudi Riyal (SAR) offers one of the most stable currency environments in the forex market, thanks to its long-standing peg to the U.S. dollar at 3.75. With modern, secure banknotes, minimal volatility, and a predictable interest rate environment tied to the U.S. Federal Reserve, SAR is ideal for traders seeking risk-managed exposure rather than speculation.

At Ultima Markets, we help traders take advantage of stable currencies like SAR in strategic ways whether through carry trade setups, hedging oil-linked assets, or monitoring macroeconomic trends like U.S. rate policy and global de-dollarisation.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.