Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteWhat is the Currency of Mexico?

The currency of Mexico is the Mexican Peso (MXN). It is issued by the Bank of Mexico and is symbolized by $ or MX$ to distinguish it from the U.S. dollar. For traders, it’s more than just the Mexican Peso (MXN). It’s one of the most actively traded EM (emerging market) currencies, known for its volatility, yield appeal, and sensitivity to global risk sentiment.

How Much is 1 Dollar Currency in Mexico

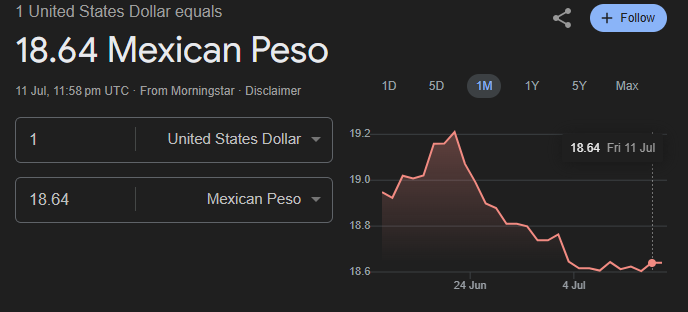

As of July 11, 2025, 1 U.S. dollar equals 18.64 Mexican pesos. The USD/MXN exchange rate has eased from a recent high of over 19.18 pesos in late June, reflecting a period of moderate peso strength or declining dollar momentum.

Over the past month, the pair has traded within a range of approximately 18.60 to 19.20, offering opportunities for range-bound forex strategies. Traders closely monitor this level as it reflects short-term shifts in interest rate expectations, U.S. economic data, and Banxico’s monetary policy.

USD/MXN: Why the Pair Matters for Forex Traders

The USD/MXN pair is one of the top EM forex pairs in global volume, sitting alongside USD/ZAR and USD/BRL. It’s heavily influenced by interest rate differentials, oil exports, and broader risk appetite, making it a prime candidate for both carry trades and event-driven strategies.

Current Snapshot (July 2025):

- USD/MXN Spot Rate: ~18.67

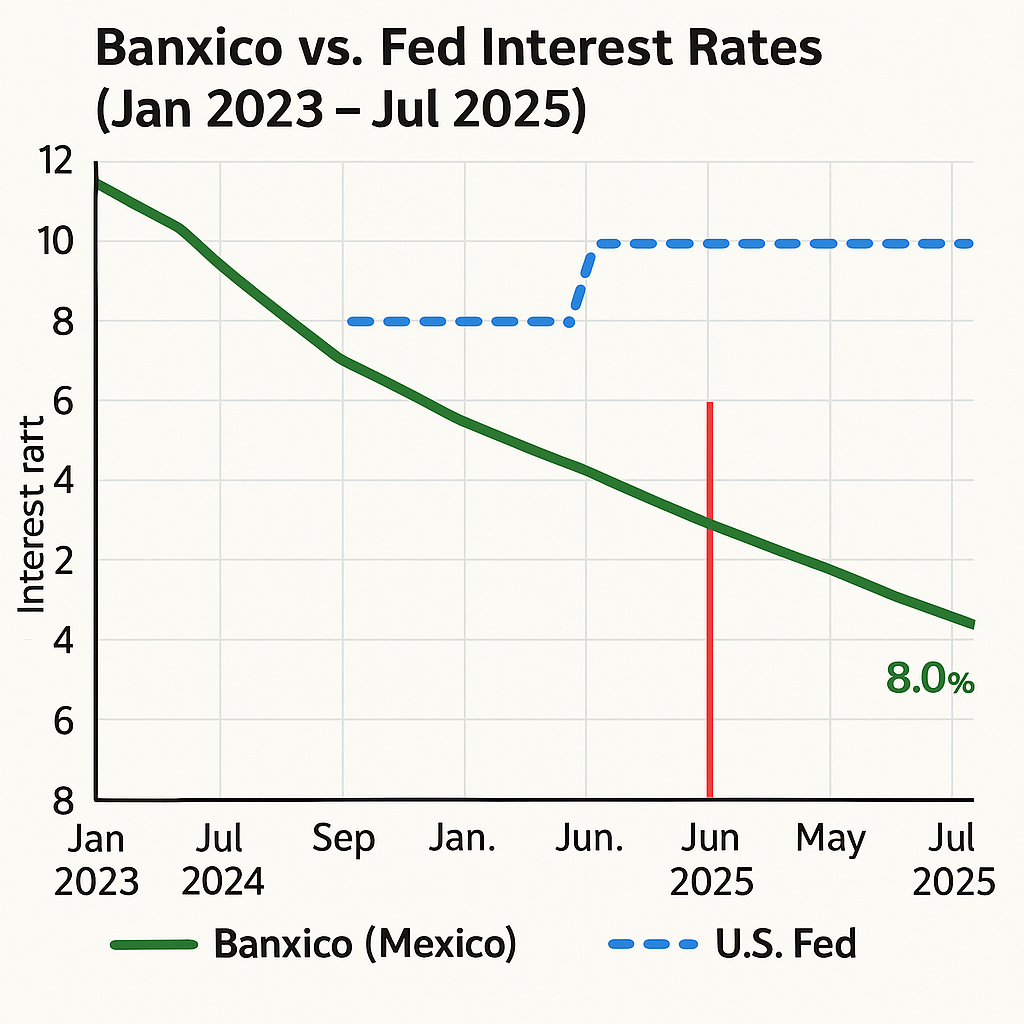

- Banxico Interest Rate: 8.0%

- U.S. Fed Funds Rate: 5.25%

- Inflation (Mexico): 4.1% YoY

- WTI Crude Oil: ~$78/barrel

Key Factors That Affect USD/MXN in 2025

Interest Rate Differentials

Mexico’s central bank, Banxico, recently cut rates to 8.0%, down from 8.5%. While this narrows the carry advantage, the spread over the U.S. Fed rate (5.25%) remains wide enough to attract capital into Mexican assets—especially government bonds (Bonos).

As long as rate cuts remain gradual and inflation stable, the carry trade favoring MXN remains intact. However, expectations of accelerated easing will trigger peso weakness.

U.S. Dollar Strength and Fed Policy

The U.S. dollar direction remains the macro driver. Any hawkish surprise from the Fed (e.g., stronger-than-expected CPI or NFP) can fuel USD/MXN upside. Conversely, signs of U.S. recession or dovish Fed tilt pressure the greenback and support MXN.

Inflation and Banxico’s Path Forward

Mexico’s inflation has cooled to 4.1%, nearing Banxico’s 3% target. If inflation continues easing, Banxico may lower rates again, possibly by 25 bps increments.

Crude Oil and Commodity Sensitivity

As a net oil exporter, Mexico benefits from higher crude prices. Oil above $75/barrel typically supports fiscal revenues and MXN stability.

Remittances and Structural USD Inflows

Mexico consistently receives $60+ billion annually in remittances from the U.S., largely in dollars. This provides a natural USD supply, helping offset current account pressures.

While not a short-term catalyst, this flow helps stabilize the peso during high-volatility periods.

USD/MXN Trading Strategies for 2025

Range Trading (17.50–18.70)

Since early 2024, USD/MXN has largely respected a technical range between 17.50 support and 18.70 resistance.

- Buy zone: Near 17.50 with stop below 17.30

- Sell zone: Near 18.70 with stop above 18.90

- Indicators: RSI, Bollinger Bands, Fib retracement levels

Suggest use this in a low-volatility macro backdrop, ideal for range scalpers and swing traders.

Carry Trade (Long MXN / Short USD)

Even after the June cut, Mexico’s real interest rates remain attractive. Going long MXN (via spot or forwards) can generate yield for longer-term positions, especially if Banxico pauses easing.

- Best used when: U.S. rate cuts begin or global risk sentiment is bullish

- Risk: Sudden Banxico dovish pivot or oil collapse

Breakout Momentum Trade

Break above 18.70 or drop below 17.50 with volume can signal a directional breakout.

- Bullish breakout: Above 18.70 – target 19.10+

- Bearish breakdown: Below 17.50 – target 17.10

- Tools: ATR + Volume + News Catalyst (e.g., rate decision)

Avoid false breakouts, wait for confirmation candle and volume spike.

Conclusion

The Mexican Peso (MXN) remains a key emerging market currency, and the USD/MXN pair continues to offer actionable opportunities in 2025, especially as Banxico adjusts its policy amid moderating inflation. With interest rate differentials, oil prices, and U.S. economic signals all in play, traders must stay sharp and data-driven.

At Ultima Markets, we provide real-time analysis, competitive spreads on USD/MXN, and advanced tools tailored for forex traders navigating volatility. Whether you’re range trading, executing carry strategies, or reacting to central bank policy, Ultima Markets gives you the platform, insights, and execution speed you need to trade with confidence.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.