What Is the Currency of Guatemala?

The official currency of Guatemala is the Guatemalan Quetzal (GTQ). Introduced in 1925, the GTQ has remained the national legal tender for nearly a century. If you’re wondering what currency does Guatemala use, the answer is straightforward: Guatemala uses the Quetzal (GTQ).

Understanding the USD to GTQ exchange rate and the broader forex landscape is vital, especially for traders or investors considering exposure to emerging market currencies.

Historical Overview of the Guatemalan Quetzal (GTQ)

The Guatemalan Quetzal was introduced in 1925 to replace the peso, originally pegged to the U.S. dollar at par. The peg was abandoned in the 1980s, and the country adopted a managed float exchange rate system, still in place today.

Despite periods of economic uncertainty, especially during the Guatemalan Civil War (1960–1996), the GTQ has remained relatively stable, supported by remittance inflows and conservative monetary policy.

USD to GTQ Exchange Rate 2025

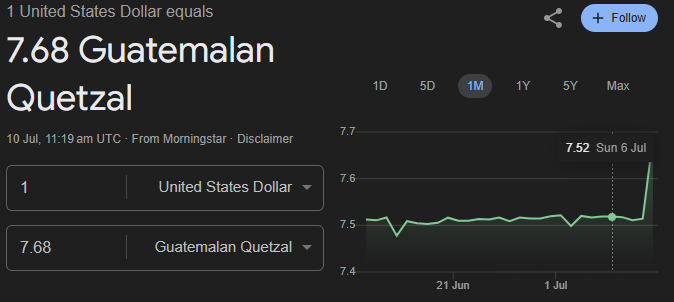

As of July 2025, the real-time exchange rate is 1 USD = 7.68 GTQ, based on real-time spot rates. The recent spike to 7.68 reflects typical market fluctuations. The GTQ has remained relatively stable throughout the year, indicating low volatility compared to other emerging market currencies.

Reasons for Guatemala Quetzal (GTQ) Stability in 2025

The Guatemalan Quetzal has maintained its value well in 2025, thanks to:

- Strict monetary policy by Banco de Guatemala

- Robust remittance flows (over 19% of GDP)

- Stable GDP growth, forecast at 3.5%

- Controlled inflation, around 4.1%

- Favorable trade balance, particularly with the U.S.

Together, these factors limit large exchange rate swings and help preserve purchasing power for both local citizens and foreign investors.

Popular Currency Pairs with Guatemala Quetzal (GTQ)

Although the Guatemalan Quetzal (GTQ) is not a major global trading currency, it is involved in several common currency pairs, particularly for regional trade and remittance purposes.

| Currency Pair | Liquidity Level | Key Use Cases |

| USD/GTQ | High | Remittances, trade, central bank reserves |

| EUR/GTQ | Moderate | Trade with EU, currency conversion |

| GBP/GTQ | Low | Tourism, expat transfers |

| JPY/GTQ, INR/GTQ, AUD/GTQ, ZAR/GTQ, RUB/GTQ | Low | Rare, available via fintech or P2P services |

| GTQ/MXN | Moderate | Regional trade between Guatemala and Mexico |

Factors That Affect GTQ in the Forex Market

The Guatemalan Quetzal (GTQ), though not widely traded on major forex platforms, is influenced by several domestic and international forces. Understanding these factors is crucial for traders, investors, and anyone analyzing emerging market currencies.

U.S. Monetary Policy (Especially Federal Reserve Decisions)

When the U.S. Federal Reserve raises interest rates, the USD becomes more attractive, leading to capital outflows from emerging markets like Guatemala. This puts downward pressure on the GTQ, as demand for dollars increases.

Conversely, if the Fed signals a dovish stance (e.g., rate cuts), capital may flow into riskier assets, supporting emerging market currencies like GTQ.

Example: In 2023–2024, the Fed’s aggressive rate hikes caused regional currencies to weaken slightly, but the GTQ remained relatively resilient due to strong fundamentals.

Inflation and Interest Rates in Guatemala

- Higher domestic inflation erodes the real value of the Quetzal and may trigger depreciation.

- If Banco de Guatemala raises interest rates to combat inflation, it can attract foreign capital, supporting GTQ demand.

Remittance Inflows

Remittances from Guatemalans working abroad, primarily in the U.S., inject steady demand for GTQ as USD is converted into local currency. This provides a stable source of foreign currency reserves and supports the GTQ exchange rate.

Inflows exceed 19% of Guatemala’s GDP, acting as a cushion against external shocks.

Trade Balance and Export Performance

A favorable trade balance (more exports than imports) increases foreign demand for GTQ, as trading partners need the local currency to pay for Guatemalan goods like coffee, sugar, and textiles.

- Positive trade balance → demand for GTQ ↑ → GTQ strengthens

- Trade deficit → demand for foreign currency ↑ → GTQ weakens

Guatemala’s strong export relationship with the U.S. supports consistent currency demand.

Global Commodity Prices

Since Guatemala is a commodity exporter (e.g., coffee, bananas, sugar), rising global prices increase export revenues, strengthening GTQ.

Conversely, if commodity prices fall, export earnings drop, weakening the Quetzal and increasing dependency on imports.

Political and Fiscal Stability

Stable governance and credible fiscal management reduce country risk, boosting investor confidence and demand for GTQ assets.

- Political unrest or fiscal deficits often lead to capital flight and GTQ depreciation

- Stable budgets and anti-corruption reforms can support currency appreciation

Guatemala has shown relatively low political volatility post-2020s, contributing to GTQ’s steady profile.

Emerging Market Risk Sentiment

GTQ, like other EM currencies, is influenced by global appetite for risk. During risk-on sentiment, investors seek higher-yielding EM assets, supporting GTQ. In risk-off periods (e.g., geopolitical tensions, recession fears), safe-haven currencies like USD are favored, leading to GTQ selling pressure.

Traders often watch the U.S. Dollar Index (DXY), VIX, and EM currency indexes to gauge this.

Is Guatemala Quetzal Good for Investment or Saving?

The Guatemalan Quetzal (GTQ) maintains stability through controlled inflation, consistent remittance inflows, and monetary policy by Banco de Guatemala. It is not widely available on global forex platforms and has limited international liquidity. GTQ-denominated assets are primarily accessed through local financial institutions.

| Advantages | Disadvantages |

| Stability and predictability | Not easily accessible to international traders |

| Moderate interest rates (currently around 4.25%) | Lower liquidity and FX hedging options |

| Inflation-managed environment | Currency risk during external shocks |

Conclusion

While not a high-volume forex pair, the Guatemalan Quetzal offers insights into Central American economic health and provides value to macro-level traders or those hedging regional investments.

At Ultima Markets, we help traders stay informed with accurate data and in-depth market analysis—even for under-the-radar currencies like the GTQ.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.

![[MetaTrader 5 Mobile Trading Complete Guide] 7 Key Advantages for Real-Time Market Access](https://www.ultimamarkets.com/wp-content/uploads/2025/04/mt5_mobile_trading_card.jpg)