Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWhat is the Best Time to Trade Forex?

The forex market is the largest financial market in the world, with an impressive daily trading volume approaching $10 trillion. But just because the market operates 24 hours a day doesn’t mean that every moment is equally beneficial for traders.

In fact, the best times to trade can vary significantly depending on several factors, including market session activity, volatility, and liquidity.

Understanding the optimal times to trade can help traders maximize profit potential while minimizing risk. This guide explores the best times to trade forex, with insights on when volatility peaks, how different market sessions affect liquidity, and tools you can use to track key trading hours.

Why Timing Matters in Forex Trading

In forex, timing is everything. The forex market doesn’t operate at the same intensity throughout the day. Different sessions bring varying levels of activity, volatility, and liquidity.

If you trade during the wrong hours, you may miss out on high-profit opportunities or face increased risks due to low liquidity or stagnant price movement.

Key factors that influence the best time to trade include:

- Volatility: Higher volatility means larger price movements, which can lead to more opportunities for profit.

- Liquidity: Higher liquidity means tighter spreads and easier trade execution.

- Market Participation: Different sessions attract varying levels of market participants, from institutional traders to retail traders.

By timing your trades right, you can take advantage of the periods when the market is most active, giving you the best chance of success.

The Three Major Forex Market Sessions

The forex market is divided into three major trading sessions, each driven by the opening of financial centers around the world. These sessions are:

The Asian Session (Tokyo Session)

- Time Zone: 00:00 to 09:00 GMT

- Key Markets: Tokyo, Hong Kong, Singapore

The Asian session generally sees lower volatility than the other two. However, this period can still be profitable for trading pairs involving the Japanese yen (JPY), Australian dollar (AUD), and New Zealand dollar (NZD). If you’re in Asia, this session can align well with your local market.

The European Session (London Session)

- Time Zone: 07:00 to 16:00 GMT

- Key Markets: London, Frankfurt, Paris

The European session is one of the most active and liquid trading periods. As London is a major forex hub, this session tends to see significant price movements, especially in currency pairs involving the euro (EUR), British pound (GBP), and Swiss franc (CHF).

The U.S. Session (New York Session)

- Time Zone: 13:00 to 22:00 GMT

- Key Markets: New York, Chicago

The U.S. session overlaps with the European session, creating a highly liquid and volatile market environment. Pairs involving the U.S. dollar (USD), like EUR/USD, GBP/USD, and USD/JPY, are particularly active during this period.

The London-New York Overlap

The overlap between the London and New York sessions, from 13:00 to 17:00 GMT, is widely regarded as the best time to trade forex. This period sees the highest market activity, as both the European and U.S. markets are open at the same time. Here’s why:

Liquidity is at its peak

The overlap between these two major trading centers leads to more buyers and sellers in the market. This increases liquidity, which helps to narrow spreads and enables faster trade execution.

Volatility increases

With more market participants comes more volatility, making it easier to capture price movements. This is especially beneficial for intraday traders looking to take advantage of short-term trends.

Big price moves

During this period, price movements tend to be larger, giving traders more opportunities to profit from significant shifts in currency pairs.

Many professional traders consider this time window as the “sweet spot” for trading forex, where the balance of volatility and liquidity is ideal.

The London Session: Strong Market Movement

Even without the New York overlap, the London session is still one of the best times to trade, especially for currency pairs involving the euro (EUR) or British pound (GBP).

As the first major market session of the day, it kicks off the forex market’s trading activity, setting the tone for the rest of the day. Trading volumes tend to be higher during the early London hours, especially when economic news is released.

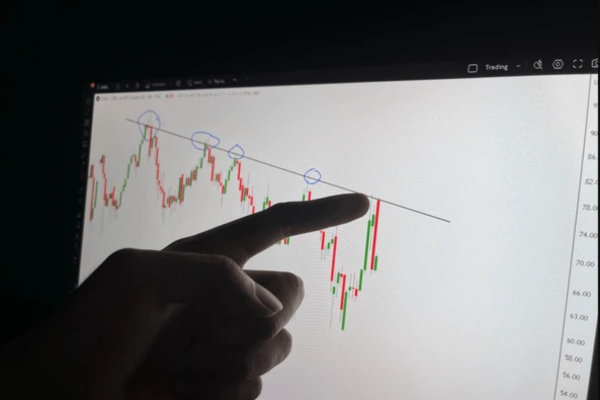

During the London session, you’ll also see more price movement compared to the quieter Asian session. For traders focused on intraday strategies, this period is perfect for trend-following and breakout setups.

The U.S. Session

The New York session has its own strengths, particularly for those trading U.S. dollar (USD) pairs. This session overlaps with the London session for four hours, during which time market liquidity and volatility surge. But even after London closes, the New York session remains highly active, especially when important economic data from the U.S. is released, such as Non-Farm Payrolls (NFP), CPI, or Federal Reserve announcements.

If you’re based in the U.S. or follow U.S. data closely, this session might align better with your trading schedule. However, for traders outside the U.S., it may require late-night trading.

Quiet Times: When to Avoid Trading

While the London and New York sessions are ideal for active traders, the Asian session (00:00 to 09:00 GMT) tends to be quieter, especially when no significant news is released. During this period, price movements can be slower, and liquidity is lower. However, this doesn’t mean there’s no opportunity:

- Range-bound trading: Some traders prefer trading during the Asian session because of its more predictable, narrow price ranges. If you’re looking to trade a range-bound strategy, this session can provide some good setups.

- Slower moves: If you’re a scalper or intraday trader, you may want to avoid the Asian session unless you’re trading pairs with high volatility like AUD/JPY or NZD/USD.

Using Trading Tools to Track Market Sessions

To make the most out of the trading day, it’s helpful to use tools like the Sessions Indicator available on platforms like TradingView. This free tool allows you to visually track the start and end of the major trading sessions, making it easier to pinpoint when to enter and exit trades.

For example, the indicator clearly marks the London and New York sessions on your charts, giving you a clear view of when market activity is about to pick up.

By combining the knowledge of session timings with the use of these tools, you can develop a better understanding of when to trade for maximum profitability.

Conclusion

The forex market operates 24/5, but the best times to trade depend largely on your strategy, preferred currency pairs, and tolerance for risk. For most traders, the London-New York overlap offers the best combination of volatility, liquidity, and trading opportunities.

However, depending on your trading style, you may find success during other sessions, such as the London session or even the quieter Asian session.

By understanding market sessions and aligning your strategy with the most favorable trading times, you can maximize your chances of success. Remember, forex trading is not about being active all day long but rather about knowing when to enter the market for the best opportunities.

FAQ

The best time to trade forex is during the London-New York overlap (13:00 to 17:00 GMT), as this period offers the highest liquidity and volatility.

This overlap combines the European and U.S. trading sessions, leading to increased market participation, tighter spreads, and larger price movements, making it ideal for intraday traders.

Popular pairs to trade during the London-New York overlap include EUR/USD, GBP/USD, and USD/JPY, as these pairs tend to experience the most volatility and liquidity during this time.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.