Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

What is SONIA Interest Rate?

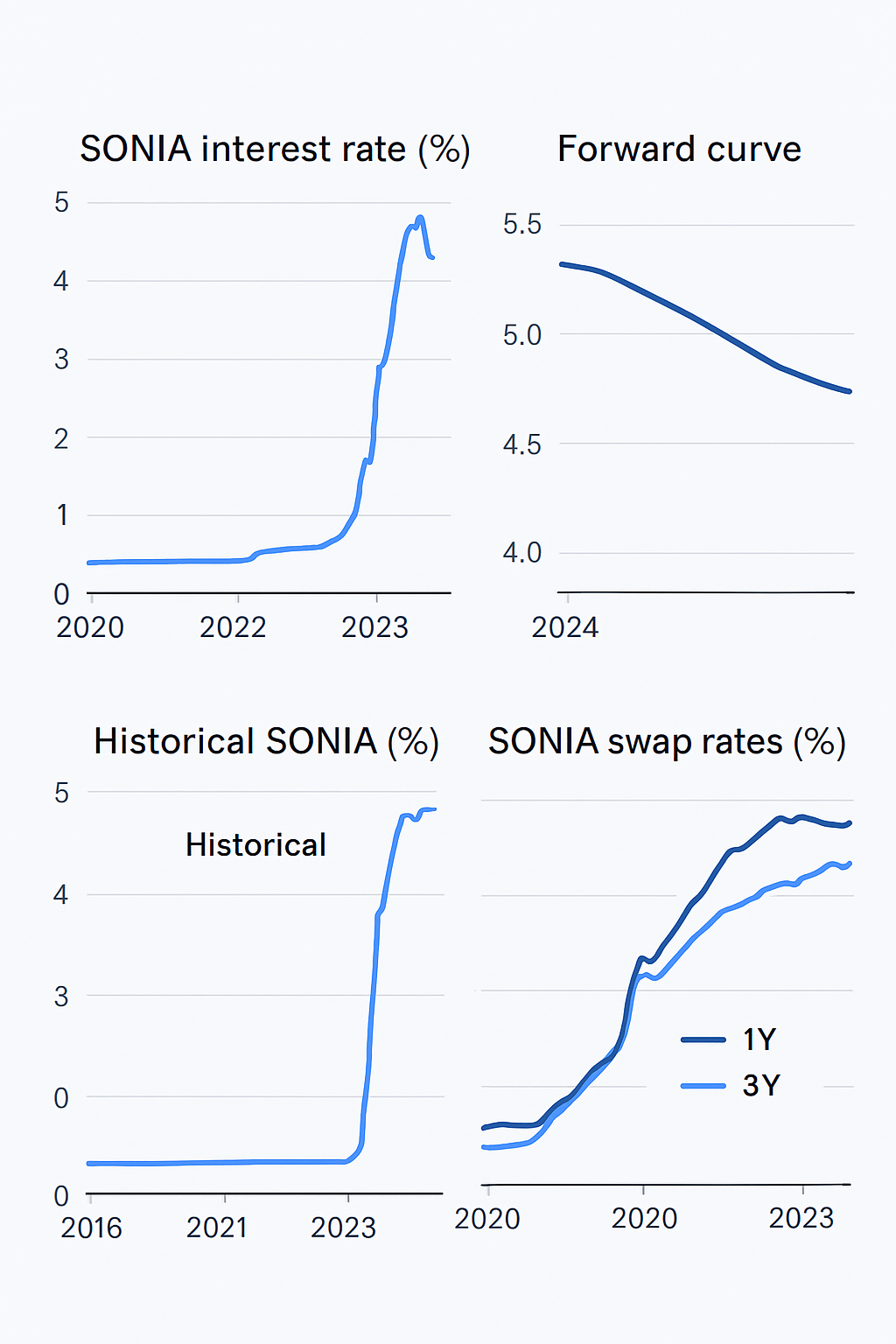

The SONIA Interest Rate (Sterling Overnight Index Average) is a crucial benchmark for overnight borrowing costs in the UK financial market. This rate reflects the average interest rate at which banks lend to each other on an overnight basis. As a key indicator of the UK’s short-term borrowing costs, SONIA serves as a foundational rate for various financial instruments, including derivatives, loans, and securities.

What is SONIA Interest Rate Benchmark?

SONIA is the Sterling Overnight Index Average, a leading benchmark interest rate for overnight transactions in the UK. Administered by the Bank of England, SONIA reflects the actual cost of borrowing on an overnight basis between financial institutions. As a key interest rate benchmark, it’s essential for pricing a wide range of financial products such as swaps, futures, and even bonds.

The SONIA rate was introduced in 1997 and has replaced LIBOR (London Interbank Offered Rate) as the primary reference point for overnight lending rates in the UK.

How Does SONIA Work?

SONIA operates as an overnight benchmark rate, calculated from actual transactions that occur in the UK money market. The Bank of England calculates the SONIA rate daily by considering the weighted average of eligible transactions conducted by banks on the previous business day. This approach ensures that SONIA accurately reflects the real-time cost of borrowing.

Published at 9:00 AM UK time each business day, SONIA is critical for a wide range of financial products such as interest rate swaps, futures, and derivatives, as it provides a reliable measure of overnight borrowing costs.

SONIA vs LIBOR: What’s the Difference

The key difference between SONIA and LIBOR lies in how they’re calculated. While LIBOR was based on estimated submissions from a panel of banks, SONIA is calculated from actual market transactions, making it more transparent and reliable. Additionally, SONIA is an overnight rate, whereas LIBOR was available for various maturities, including 1-month, 3-month, and 6-month rates.

With LIBOR being phased out due to manipulation scandals and credibility concerns, SONIA has emerged as the UK’s preferred reference rate. Many financial products, including derivatives and bonds, have transitioned to using SONIA instead of LIBOR.

Key Differences:

- Calculation: SONIA uses real transaction data; LIBOR relied on bank submissions.

- Tenor: SONIA is strictly an overnight rate, while LIBOR offered multiple maturities.

- Reliability: SONIA is considered more transparent and accurate than LIBOR

Pros and Cons of SONIA

Pros of SONIA:

- Transparency: Unlike LIBOR, SONIA is calculated based on actual market transactions, offering greater transparency.

- Accuracy: By using real data, SONIA provides a more accurate reflection of overnight borrowing costs, ensuring market participants can trust the rate.

- Replacement for LIBOR: With the phasing out of LIBOR, SONIA has become the go-to benchmark for overnight borrowing costs in the UK.

Cons of SONIA:

- Limited Scope: SONIA is strictly an overnight rate, which means it doesn’t cover longer maturities like LIBOR.

- Market Activity Dependence: SONIA’s calculation is based on market transactions. During times of low trading volume, the rate may not fully reflect market conditions.

- Transition Period: The shift from LIBOR to SONIA created temporary operational challenges for institutions relying on LIBOR for pricing.

How SONIA Affects GBP Currency Pairs

The SONIA Interest Rate (Sterling Overnight Index Average) can have a significant impact on forex traders who are involved in trading the British Pound (GBP) and other currencies linked to the UK’s monetary policy and financial markets. Here’s a breakdown of how SONIA affects forex traders:

Impact on GBP Currency Pairs

Forex traders closely monitor interest rate benchmarks like SONIA as they can influence the GBP/USD and other GBP-based currency pairs. Since SONIA represents the cost of overnight borrowing between UK banks, fluctuations in SONIA can signal changes in the cost of capital, which directly impacts the value of the British Pound.

When SONIA increases, it suggests tighter monetary conditions (possibly due to higher Bank of England rates), which can strengthen the British Pound. Conversely, if SONIA decreases, it signals easier monetary conditions, potentially weakening the Pound.

Effect on Forex Market Sentiment

The SONIA rate is closely related to the Bank of England’s monetary policy decisions, as it reflects the underlying interest rate environment in the UK. Traders often watch SONIA to gauge future monetary policy actions.

If SONIA rises due to increased demand for overnight borrowing or expectations of a rate hike by the Bank of England, forex traders may anticipate stronger GBP performance. This can lead to increased buying of GBP in the forex market.

Conversely, a decrease in SONIA could signal dovish market conditions and potentially lead to GBP depreciation against other currencies, especially if it’s seen as a sign that the central bank may adopt a more accommodative monetary stance.

Impact on Volatility and Market Liquidity

The SONIA rate can also affect volatility in the forex market. If there is significant movement in SONIA, such as a sharp rise or fall, it can signal changing conditions in the UK financial markets, which can lead to increased volatility.

This volatility can present opportunities for forex traders who trade on short-term movements or trends. For instance, if SONIA increases and the Bank of England signals a future rate hike, traders might look to buy GBP in anticipation of future price rises.

Similarly, lower SONIA levels may lead to lower volatility and potentially narrower trading ranges, impacting day traders and scalpers who rely on quick price movements.

Influence on Interest Rate Differentials

Interest rate differentials are a critical factor for forex traders. The SONIA rate, as a reflection of overnight borrowing costs in the UK, influences the rate differential between the GBP and other currencies like the USD or EUR.

When SONIA rises in response to tighter UK monetary policy, the interest rate differential between GBP and other currencies may widen, making GBP-denominated assets more attractive and leading to capital inflows into the UK. This could strengthen the Pound.

Conversely, a decrease in SONIA may narrow the interest rate differential and make the GBP less attractive to investors, which could lead to GBP weakening against other currencies.

Trading Strategies Based on SONIA

Carry Traders: Forex traders who engage in carry trading may look at SONIA to gauge potential profit from interest rate differentials. When SONIA is higher, it may signal better returns for holding GBP-denominated assets versus currencies with lower interest rates.

Fundamental Analysis: Traders using fundamental analysis will factor in SONIA when evaluating UK economic data, as it’s an important indicator of the UK banking system’s health and the broader economy. If SONIA signals tightening conditions, traders may adjust their positions on GBP pairs to account for potential rate hikes by the Bank of England.

Market Expectations and SONIA

Forex traders often pay close attention to market expectations of future SONIA movements, especially in relation to Bank of England announcements. If traders expect a shift in SONIA, they might adjust their positions ahead of time, creating pre-event volatility in the forex market.

A surprise increase in SONIA may cause a sharp upward movement in GBP, while a surprise decrease could lead to a quick sell-off.

Conclusion

In conclusion, the SONIA Interest Rate plays a crucial role in the UK financial market, directly influencing forex traders who are involved in GBP and related currency pairs. By understanding how SONIA impacts currency values, market sentiment, and interest rate differentials, traders can make more informed decisions and adjust their strategies accordingly. Whether it’s anticipating Bank of England policy changes, responding to market volatility, or engaging in carry trading, SONIA offers valuable insights for effective forex trading.

At Ultima Markets, we understand the importance of staying informed about key benchmarks like SONIA. Our platform provides real-time market data, advanced charting tools, and educational resources to help traders navigate interest rate fluctuations and make strategic moves in the forex market. With our secure and regulated trading environment, you can confidently trade with purpose, staying ahead of market trends and capitalizing on opportunities driven by rate movements.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.