Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWhat is Smart Order Routing?

Smart Order Routing (SOR) is a trading technology that automatically routes orders across multiple exchanges or liquidity venues to achieve the best possible execution. It analyzes factors such as price, liquidity, fees, and execution speed to determine the optimal venue for each order or part of an order.

This technology is essential in today’s fragmented markets where no single venue offers the best pricing all the time. SOR ensures traders, both retail and institutional, access the most competitive prices with reduced slippage and higher fill rates.

How Does Smart Order Router Work?

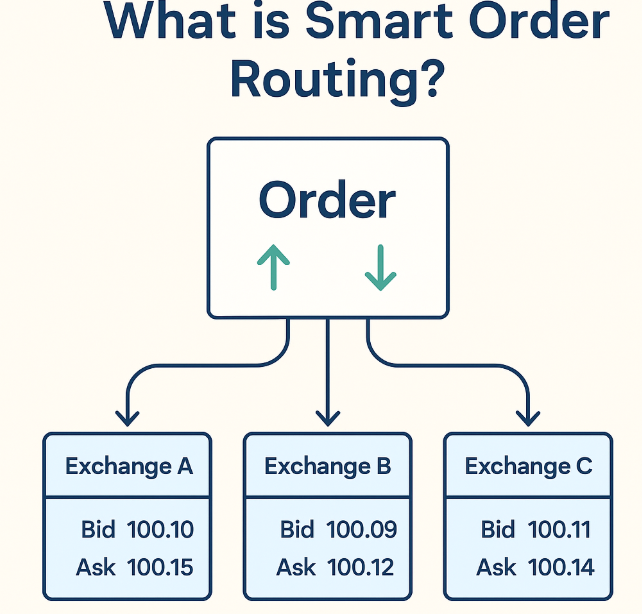

A Smart Order Router (SOR) scans multiple trading venues including exchanges, liquidity providers, and market makers before routing an order to the one offering the best execution. It evaluates price (bid/ask), liquidity availability, transaction cost, latency and order type compatibility.

Once these variables are evaluated, the SOR either sends the order to the most optimal venue or splits it into smaller parts (child orders) across several venues to minimize market impact and slippage.

For example, if ETH/USDT is priced slightly differently, an SOR will route portions of the order to venues offering the best execution conditions automatically and within milliseconds.

Smart Order Routing Strategy

A Smart Order Routing strategy is the logic or rule set used by the router to determine where, when, and how to execute an order across multiple trading venues. These strategies are designed to optimize for price, speed, cost, and liquidity depending on the trader’s objective.

In high-frequency, institutional, or algorithmic trading, the routing strategy can dramatically impact trade performance, especially in fast-moving or fragmented markets.

Best Execution Strategy

This is the most common objective. The router continuously scans multiple venues and sends the order (or parts of it) to the venue with the best price while also factoring in:

- Available liquidity

- Trading fees/rebates (maker vs taker)

- Fill probability

- Latency or order matching speed

This ensures compliance with regulatory frameworks like MiFID II (Europe) or Reg NMS (U.S.), which mandate best execution policies for brokers.

Example: A stock is priced at $100.05 on Exchange A and $100.02 on Exchange B. SOR routes the order to Exchange B to reduce cost.

Liquidity-Seeking Strategy

This strategy prioritizes venues with deep liquidity or hidden orders, even if the price is slightly less favorable. The goal is to maximize the fill without revealing the full order size to the market (reducing market impact).

It often includes:

- Accessing dark pools or hidden liquidity providers

- Avoiding aggressive market orders on thin books

- Splitting orders in time or volume slices

Cost-Aware Strategy

Here, the router focuses on minimizing total transaction cost, not just execution price. It evaluates:

- Exchange fees (some charge more for taker orders)

- Potential rebates (e.g., maker rebates)

- Latency or infrastructure cost

- Slippage risks

A cost-aware router might choose a slightly worse price on a venue that offers better fee terms or faster execution, resulting in a lower net cost to the trader.

Latency-Optimized Strategy

In fast markets or arbitrage trades, time is critical. This strategy routes orders to exchanges with the lowest latency, even if the price difference is small.

It benefits:

- High-frequency traders (HFTs)

- Arbitrage strategies across crypto or stock exchanges

- Events-based scalping

Example: If an asset price changes rapidly due to news, the router sends the order to the fastest-executing venue to lock in price before slippage occurs.

Custom Rule-Based Strategy

Advanced trading desks or hedge funds often design custom SOR strategies that blend multiple objectives. For example:

- “Route to venue with best price if spread > 0.2%, else route based on fill rate.”

- “Avoid venues with >2 seconds latency or below 70% historical fill rate.”

- “Split order over 3 exchanges if volume > 100K shares.”

These strategies use historical data, live market depth, and machine learning to continuously optimize routing performance.

Advantages and Disadvantages of Smart Order Routing

Understanding the advantages and disadvantages of Smart Order Routing is essential for traders aiming to improve execution quality, reduce trading costs, and comply with best execution standards. While Smart Order Routing (SOR) offers powerful tools for automation and efficiency, it also introduces certain risks and complexities.

Advantages of Smart Order Routing

Smart Order Routing offers several key benefits that enhance the trading process, particularly in markets that are fragmented or fast-moving.

Best Price Execution Across Multiple Venues

One of the most significant advantages of Smart Order Routing is its ability to scan multiple trading venues in real-time and automatically route orders to the one offering the best available price. This improves trade execution and ensures traders aren’t limited to a single exchange.

Reduced Slippage and Market Impact

By intelligently splitting large orders into smaller blocks and routing them across venues, SOR helps minimize slippage, the difference between expected and executed prices. This also reduces the chance of moving the market against your own trade, especially in illiquid assets.

Higher Fill Rates Through Liquidity Access

Smart Order Routing accesses both visible and hidden liquidity sources, including dark pools and ECNs. This increases the chance of full order execution, a critical factor for institutional traders managing large positions.

Faster and More Efficient Execution

SOR systems operate in milliseconds, enabling traders to capitalize on real-time opportunities before prices shift. This speed is especially useful for high-frequency or arbitrage trading strategies.

Regulatory Compliance with Best Execution

Many financial regulations, such as MiFID II in Europe and Reg NMS in the U.S., require brokers to provide “best execution” for client orders. SOR ensures that orders are routed in a way that satisfies these legal and compliance obligations.

Customizable Strategy Integration

Advanced SOR systems allow traders to customize their routing logic, choosing between strategies like cost minimization, latency optimization, or liquidity seeking. This adaptability supports both institutional and algorithmic trading needs.

Disadvantages of Smart Order Routing

Despite its many benefits, Smart Order Routing also comes with certain drawbacks that traders and firms need to consider.

Technical Complexity and Infrastructure Cost

SOR systems require sophisticated infrastructure, including:

- Real-time market data feeds

- Low-latency execution engines

- Integration with multiple APIs and trading venues

This makes implementation resource-intensive, particularly for smaller brokers or independent traders.

Latency and Routing Delays

Although SOR is designed for speed, routing decisions still take time—typically milliseconds. In highly volatile markets, even minor delays can result in missed opportunities or suboptimal prices if the market moves during routing.

Limited Venue Access

Not all exchanges or brokers support Smart Order Routing. For example, some decentralized crypto platforms, certain derivatives markets, or regional stock exchanges may not be connected to SOR networks, limiting its effectiveness.

Opaque Execution Logic

Some SOR providers or brokers may use proprietary routing algorithms without full transparency. This can make it difficult for traders to audit or understand the exact logic behind each execution path, which may conflict with their strategy or cost expectations.

Potential Over-Reliance on Automation

While automation offers efficiency, over-reliance on Smart Order Routing without manual oversight can expose traders to unexpected behavior during system outages, data feed errors, or extreme market volatility.

SOR Order Is Not Allowed Meaning

“SOR Order is not allowed” means the trading platform or broker does not support Smart Order Routing (SOR) for the selected asset, order type, or account. This message typically appears when:

- The asset or market does not qualify for SOR execution (e.g. some crypto or OTC products).

- The selected order type (e.g. stop loss, GTC) is not compatible with SOR.

- The trading venue is not linked to a Smart Order Router.

- The broker requires manual activation or permission to use SOR.

To fix this, check your platform settings, order type, or contact your broker to verify if SOR is supported for your trading account or the instrument you’re trading.

Conclusion

Smart Order Routing is a vital tool in modern trading. It helps reduce costs, improve execution quality, and provide traders with access to the best available prices across fragmented markets. Whether you trade stocks or cryptocurrencies, using platforms with advanced SOR capabilities can significantly enhance performance, especially in volatile conditions.

For optimal results, choose brokers or exchanges that offer real-time routing, access to multiple venues, and customizable order execution logic.

Ultima Markets provides advanced Smart Order Routing across global markets, combining institutional-grade infrastructure, deep liquidity, and low-latency execution, all tailored for both retail and professional traders.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.