Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

What is Sales and Trading in Finance?

Sales and trading is a core function within investment banks and large financial institutions that connects market liquidity with client demand. It involves advising clients on financial products, executing trades across global markets, and managing risk in real time.

Unlike long-term investing, sales and trading focuses on short-term market activity, fast execution, and price discovery across assets such as forex, equities, bonds, commodities, derivatives, and structured products.

What is Sales and Trading

Sales and trading is the part of a financial institution that helps clients buy and sell financial products like currencies, stocks, bonds, and commodities, while making sure trades happen smoothly and prices stay fair in the market.

Sales and trading refers to the division of a financial institution that:

- Sells financial instruments and market ideas to institutional clients

- Trades those instruments by executing orders or taking positions

The function acts as a bridge between buyers and sellers, ensuring markets remain liquid and efficient.

Sales teams communicate with clients such as hedge funds, asset managers, corporations, and pension funds. Trading desks execute trades, manage exposure, and quote prices. Sales and trading operates across both primary markets (new issuance) and secondary markets (ongoing trading).

How Sales and Trading Works

Sales and trading works by connecting clients to the market and executing trades efficiently, often in fast-moving conditions.

Step 1: Clients Share What They Need

Institutional clients such as hedge funds, asset managers, or companies contact the sales team. They may want to:

- Buy or sell a currency, stock, bond, or commodity

- Hedge risk from price changes

- Get market insight on upcoming events like interest rate decisions

The sales team listens, understands the client’s goal, and suggests suitable market ideas or products.

Step 2: Sales Provides Market Insights

Sales professionals explain:

- Current market conditions

- Prices, spreads, and liquidity

- Possible risks and timing

This helps clients decide when and how to place their trades.

Step 3: Traders Execute the Trade

Once the client confirms, the order goes to the trading desk. Traders:

- Quote a price or find the best available price in the market

- Execute the trade quickly to reduce market impact

- Use technology or algorithms for large or complex orders

Speed and accuracy are critical at this stage.

Step 4: Risk Is Managed in Real Time

After execution, traders manage risk by:

- Hedging positions if needed

- Monitoring exposure as prices move

- Keeping trades within strict risk limits

This ensures the institution does not take on excessive risk while serving clients.

Step 5: Ongoing Support and Follow-Up

Sales teams continue to:

- Update clients on market movements

- Share new trade ideas

- Help adjust or close positions when conditions change

This ongoing process keeps markets liquid and helps clients trade more efficiently.

In short, sales and trading works by combining client communication, fast execution, and disciplined risk control, allowing financial markets to function smoothly every day.

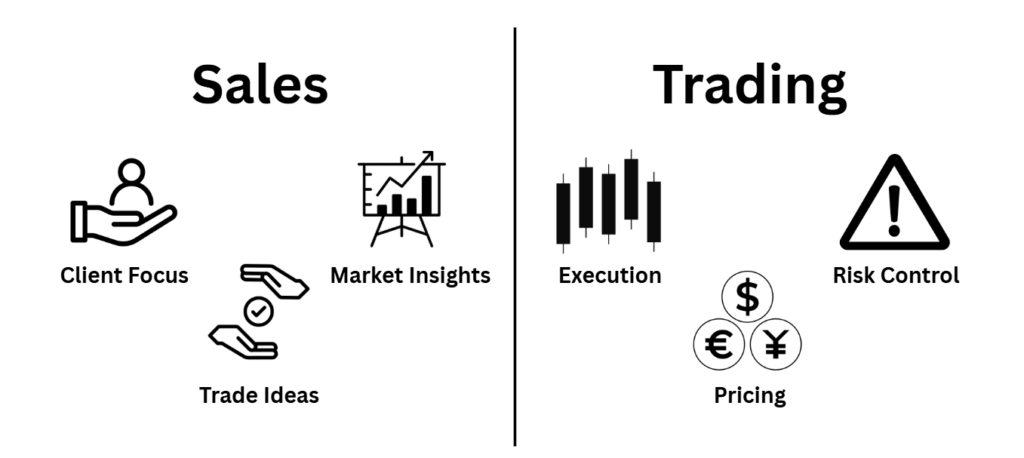

Sales vs Trading: What’s the Difference?

Sales and trading work closely together, but their roles are very different.

Sales

Sales professionals focus on clients. Their main job is to help clients understand the market and access trading opportunities.

They typically communicate with institutional clients like hedge funds, asset managers, and corporations. Share market insights, pricing information, and trade ideas. Help clients decide when and how to trade. Act as the main contact between the client and the trading desk.

Sales does not usually place trades themselves. Instead, they guide and support the client’s decision-making.

Trading

Traders focus on the market and execution. Their role is to turn client orders into real trades.

They typically execute buy and sell orders at the best possible prices. Quote prices and provide liquidity. Manage market risk and exposure in real time. React quickly to price movements and news.

Traders are responsible for speed, accuracy, and risk control once a trade is approved.

Together, sales and trading ensure that clients can trade efficiently while markets remain liquid and stable.

Key Products Traded in Sales and Trading

Sales and trading desks typically cover:

- Forex: Spot, forwards, swaps, and options

- Equities: Cash equities, equity derivatives, ETFs

- Fixed income: Government bonds, credit, rates products

- Commodities: Energy, metals, agricultural products

- Derivatives: Futures, options, swaps

In recent years, desks have also expanded into carbon markets and ESG-linked derivatives, reflecting structural shifts in global finance.

Proprietary Trading vs Flow Trading

Proprietary trading and flow trading are two different ways trading desks operate. The key difference is whose money is being traded and why.

Proprietary Trading

Proprietary trading, often called prop trading, is when a financial institution trades using its own capital to make a profit from market movements.

Key characteristics:

- Trades are based on the firm’s own market views

- Profits and losses belong entirely to the firm

- Higher risk and higher return potential

- Significantly restricted at most major banks due to regulations

Today, proprietary trading mainly exists at specialised trading firms and hedge funds, rather than traditional banks.

Flow Trading

Flow trading is driven by client activity, not speculation.

Key characteristics:

- Trades are executed to meet client demand

- Risk is usually held only for a short time

- Revenue comes from spreads and trading volume

- Closely linked to sales teams and client orders

Most sales and trading desks at banks focus on flow trading because it supports market liquidity and aligns with regulatory requirements.

Sales and Trading vs Investment Banking

Sales and trading and investment banking are both key functions within financial institutions, but they serve very different purposes.

Sales and trading focuses on the day-to-day movement of financial markets, helping clients buy and sell products such as currencies, stocks, bonds, commodities, and derivatives. Its work is fast-paced and continuous, with traders executing orders, managing short-term risk, and providing liquidity as market conditions change throughout the day.

Revenue in sales and trading mainly comes from trading volume, spreads, and commissions, making it closely tied to daily market activity.

Investment banking, on the other hand, is centred on long-term corporate transactions rather than daily market movements. Investment bankers advise companies on major financial decisions such as initial public offerings (IPOs), bond issuance, mergers, and acquisitions.

Their work is project-based and can take weeks or months to complete, involving financial modelling, negotiations, regulatory filings, and strategic planning. Income in investment banking is primarily earned through advisory and deal-completion fees.

In simple terms, sales and trading keeps markets running smoothly every day, while investment banking helps companies raise capital and execute large strategic deals over time.

Conclusion

Sales and trading plays a vital role in keeping financial markets liquid, efficient, and accessible. It brings together client needs, market expertise, fast execution, and disciplined risk management to ensure trades happen smoothly across global markets.

At Ultima Markets, this same principle is reflected in how traders access the markets. By combining deep market insight, advanced trading technology, and a strong focus on execution quality, Ultima Markets helps traders navigate fast-moving conditions with clarity and confidence.

FAQs

A Sales Trader bridges the gap between clients and the trading desk, advising clients on market conditions, executing trades, and providing investment recommendations.

Market trends influence the decision-making process, as traders adjust their strategies based on market conditions to optimize profits while managing risks for clients.

Strong analytical skills, market knowledge, effective communication, and the ability to make quick decisions under pressure are essential for success in sales and trading.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.