Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

What Is Return on Capital Employed (ROCE)?

Return on Capital Employed (ROCE) is a fundamental financial metric used to assess a company’s profitability and efficiency in utilising its capital. Investors and analysts use it to determine how well the company is generating profits relative to the capital it has employed in its

operations.

A higher ROCE indicates a company is using its capital effectively, generating more returns for every dollar of capital employed. Businesses with a consistently high ROCE are often seen as financially healthy, efficient, and capable of sustained growth.

What Is the Formula or Calculation of ROCE?

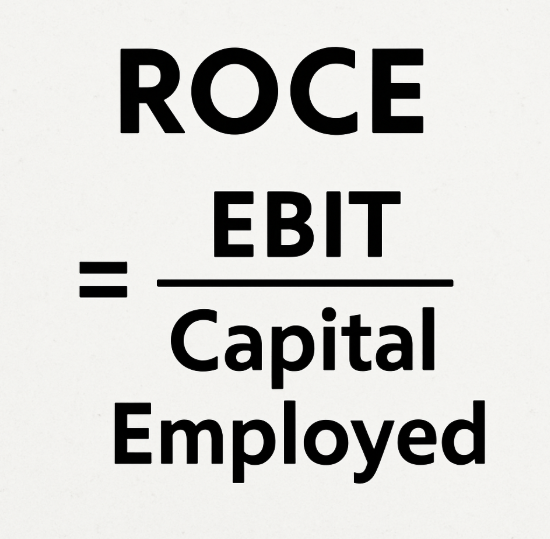

The formula to calculate ROCE is: ROCE = EBIT / Capital Employed

- Earnings Before Interest and Taxes (EBIT): Represents the operating profit before deductions of interest and taxes.

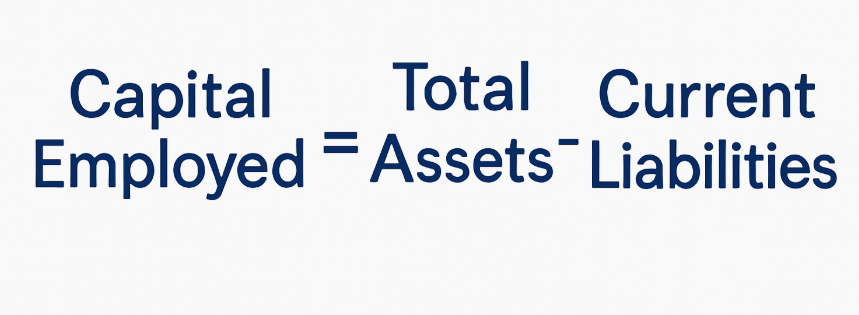

- Capital Employed: The total capital used by a company to run its operations, calculated as:

Capital Employed = Total Assets – Current Liabilities

Alternatively, it can also be represented as Capital Employed = Shareholder’s Equity + Long-Term Debt.

What Is a Healthy Percentage for ROCE?

A healthy ROCE percentage varies by industry. However, as a general benchmark:

- An ROCE above 15% is considered strong, meaning that there’s effective capital utilisation along with profitability.

- An ROCE between 10-15% suggests the company is performing reasonably well but has room for improvement.

- An ROCE below 10% may indicate inefficiencies in capital usage, potential operational issues, or a highly competitive industry.

Comparing a company’s ROCE to its industry peers provides a better perspective on its financial health. Investors prefer companies with a stable or increasing ROCE over time, as it suggests strong long-term performance.

What Is an Example of Using ROCE?

Consider a company, which is hypothetically named as A Company, with the following financial data:

- EBIT: $500,000

- Total Assets: $2,000,000

- Current Liabilities: $500,000

Using the formula:

Capital Employed = $2,000,000 – $500,000 = $1,500,000

ROCE = $500,000 / $1,500,000 = 33.3%

This means that A Company generates a 33.3% return on the capital employed, indicating strong profitability and efficient capital utilisation. Such a high ROCE suggests that the company is making effective use of its financial resources to generate earnings.

For example, if another company in the same industry has an ROCE of 20%, A Company’s 33.3% would suggest superior capital efficiency. Investors and analysts often use such comparisons to determine which companies are managing their capital most effectively. Additionally, a company with a strong and consistent ROCE may indicate sound management decisions and a sustainable competitive advantage over time.

What Are the Advantages of ROCE?

Investors and analysts widely use ROCE due to its several advantages:

- Measures Capital Efficiency: Helps determine how effectively a company is utilising its capital to generate profits.

- Industry Comparisons: Allows investors to compare companies within the same sector.

- Considers Debt and Equity: Unlike some profitability ratios, ROCE accounts for both equity and long-term debt, giving a comprehensive financial outlook.

- Assists in Long-term Analysis: A consistently high ROCE indicates financial stability and the potential for sustainable growth.

- Useful for Capital-Intensive Businesses: ROCE is particularly beneficial for businesses requiring significant capital investments, such as manufacturing and infrastructure companies.

What Are the Disadvantages of ROCE?

Despite its advantages, ROCE has certain limitations:

- Ignores Tax and Interest Costs: ROCE is based on EBIT, meaning it does not consider interest expenses or taxes, which can affect net profitability.

- Not Suitable for Short-Term Analysis: ROCE focuses on long-term capital efficiency and may not accurately reflect short-term profitability or liquidity.

- Distorted by Depreciation: Companies with high depreciation expenses may report lower capital employed, artificially inflating ROCE.

- Difficult Cross-Industry Comparisons: ROCE values can vary significantly across industries, making cross-sector comparisons less meaningful.

- Doesn’t Reflect Market Conditions: External factors, such as economic downturns, inflation, or changes in interest rates, may impact ROCE but are not accounted for in the metric.

How Can Companies Improve Their ROCE?

Companies can improve their ROCE through several strategic approaches:

- Enhance Operational Efficiency: Reducing costs, streamlining workflows, and improving productivity can increase EBIT without requiring additional capital.

- Optimise Asset Utilisation: Ensuring that assets are effectively used and not underutilised helps maximise returns.

- Invest in High-Yield Projects: Allocating capital to profitable ventures and eliminating underperforming investments enhancesoverall efficiency.

- Reduce Debt Levels: Lowering liabilities can reduce financial strain and improve profitability.

- Expand Revenue Streams: Diversifying products, entering new markets, and innovating can strengthen ROCE.

- Improve Working Capital Management: Managing inventory levels and receivables collection efficiently prevents unnecessary

capital lockup, ensuring higher returns on employed capital.

Differences Between Return on Capital Employed (ROCE) vs. Return on Invested Capital (ROIC)

Both ROCE and ROIC measure financial efficiency, but they have distinct differences:

| Aspect | ROCE | ROIC |

| Definition | Measures return on total capital employed (equity+debt) | Measures return on only invested capital (equity+debt excluding cash and non-operating assets) |

| Formula | EBIT/ Capital Employed | Net Operating Profit After Taxes (NOPAT)/ Invested Capital |

| Focus | Operational efficiency and long term profitability | True investment returns excluding excess cash |

| Best for | Capital-intensive industries and companies with significant debt | Companies with varying capital structures and investment strategies |

While both metrics are useful, ROCE provides a broader picture of how a company manages its total capital, while ROIC gives a more refined analysis of investment performance.

Conclusion

Return on Capital Employed (ROCE) is a key metric that helps investors assess how efficiently a company uses its capital to generate profits. A higher ROCE typically indicates stronger financial performance and long-term value potential.

Whether you’re analyzing stocks or evaluating business fundamentals, mastering ROCE can enhance your decision-making edge.

Ready to apply financial insights like ROCE to real trading? Join Ultima Markets and get access to powerful analytics, real-time data, and expert tools built for smarter investing.

FAQs

ROCE is a financial metric that measures a company’s profitability and the efficiency with which it uses its capital. It’s calculated by dividing earnings before interest and taxes (EBIT) by capital employed (total assets – current liabilities).

A good ROCE ratio typically ranges from 15% to 20%, indicating that the company is efficiently generating profit relative to its capital. Higher values are generally considered better.

ROCE is used to assess how effectively a company is using its capital to generate profits. It helps investors and analysts compare profitability across companies or industries and evaluate overall capital efficiency.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.