Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWhat is Rate of Return? A Simple Guide

If you are searching what is rate of return, think of it as the simplest way to measure how much your money has grown or shrunk over a period of time. Whether you’re investing in stocks, funds, property, or savings, the rate of return turns all your gains, losses, and income into one clear percentage.

This article will explain what is rate of return, how to calculate it step by step, the difference between total and annualised returns, and how factors like inflation, fees, and risk can change the real picture of your performance.

What Does Rate of Return Mean

Before we jump into the calculations, it’s essential to define what is rate of return.

The rate of return (RoR) measures the percentage gain or loss on an investment over a specific period. A positive rate of return means you made a profit, while a negative rate of return signals a loss.

It captures two things:

- The price change of your investment (how much the value rose or fell).

- Any income earned during the period (dividends, interest, or rent).

In short, it shows how efficiently your money worked for you, whether it grew faster than inflation, kept pace with your goals, or underperformed.

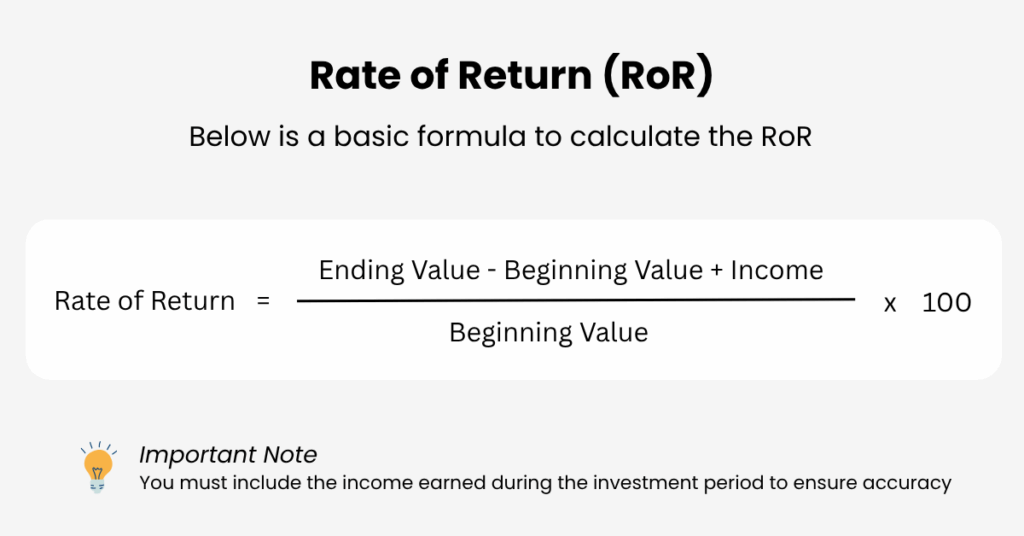

The Basic Formula

The rate of return is calculated using a simple formula:

Always include any income you earned during the investment period. Ignoring dividends or interest will understate your true gain.

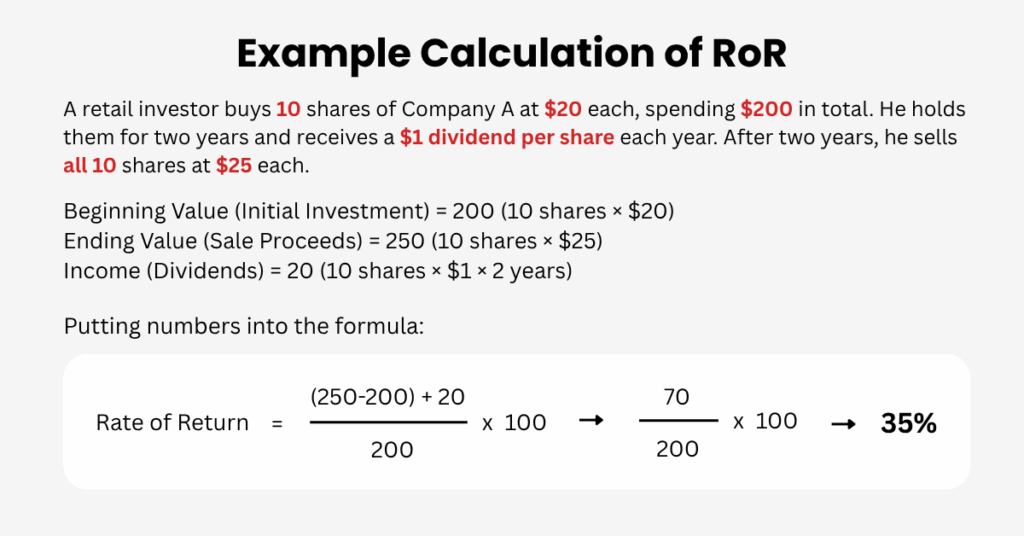

Step-by-Step Example

Let’s look at an example to make this clearer.

The investor earned a 35 % total return over two years, showing clear profit. If the result had been negative, it would have meant a loss.

Why Rate of Return Matters

Understanding your rate of return helps you see whether your money is truly working for you. It allows you to:

- Compare performance between different investments on an equal basis.

- Track progress toward financial goals.

- Measure efficiency over time to how much return you earn for every dollar invested.

But to fairly compare investments that run for different time periods, you need to convert that total figure into a yearly rate.

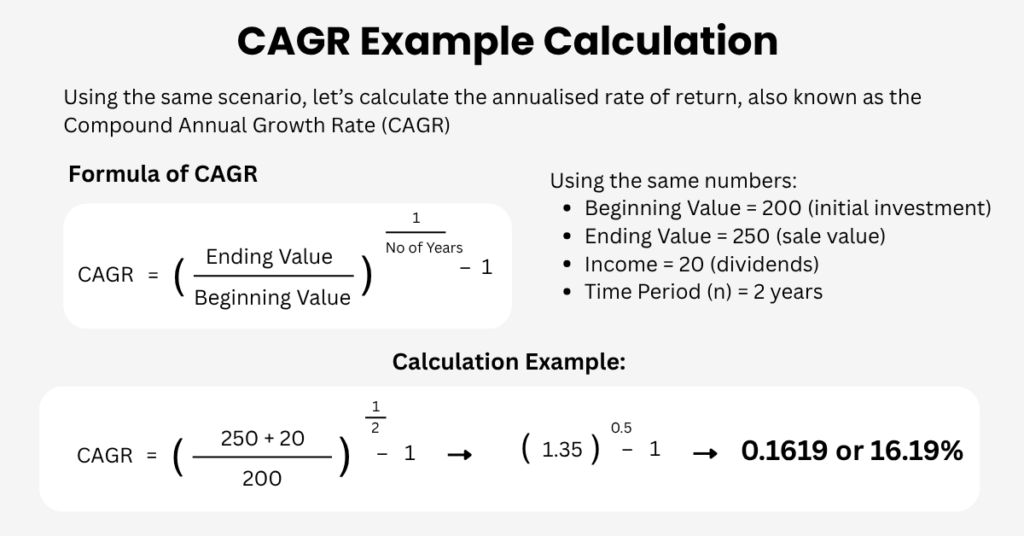

From Total to Annualised Returns

A 35 % return over two years sounds strong, but it doesn’t mean the investment grew by 35 % each year. To compare fairly with other one-year investments, we calculate the annualised rate of return, also known as the Compound Annual Growth Rate (CAGR).

That equals an annualised rate of return of 16.19 %, meaning the investment effectively grew by about 16 % per year.

By annualising, you can compare any investment, whether held for months or years, on the same one-year scale.

Handling Deposits and Withdrawals

In real-world investing, you might add more funds to your portfolio or take some out during the investment period. These cash flows can directly impact your rate of return.

When there are deposits or withdrawals, you need to choose the right method for calculating the return:

- Time-Weighted Return (TWR): Removes the effect of cash flows, best for judging a fund manager’s performance.

- Money-Weighted Return (MWR or IRR): Includes the timing of deposits and withdrawals, best for measuring your own actual experience.

Think of it this way: TWR shows how the investment performed; MWR/IRR shows how you performed.

These methods help ensure that your rate of return accurately reflects the true performance of the investment or your personal investment strategy.

Nominal vs Real Returns

While the rate of return tells you how much your investment has grown, it’s important to also consider the effect of inflation on your returns.

The nominal return is the raw return calculated based on the market price changes or dividends. However, inflation can erode the true purchasing power of your returns.

The real rate of return adjusts for inflation, showing you the actual growth of your investment in terms of purchasing power.

For example, if your investment earned 6% and inflation was 3%, your real return would be roughly 3%.

This is crucial because even if you see a high nominal return, inflation can significantly impact your purchasing power over time.

Gross vs Net Returns

When you see a rate of return, it’s often expressed as a gross return, the raw return before any costs. However, net return is the figure you should focus on because it reflects what you actually keep after fees, taxes, and transaction costs are deducted.

Even small annual fees can reduce your long-term returns due to compounding. Always calculate performance based on net returns to get a true understanding of how your investments are performing.

For example, a 1% annual fee may not seem like much, but over 10 years, it can substantially reduce your net return. This is why it’s important to account for costs when comparing different investment options.

Common Mistakes to Avoid

Below are a few mistakes that traders might encounter:

- Forgetting to include income such as dividends or interest.

- Comparing total multi-year returns with one-year results.

- Ignoring inflation or taxes.

- Starting your measurement at a convenient market high or low.

- Judging returns without considering volatility or benchmarks.

Conclusion

What is the rate of return? In conclusion, the rate of return is a fundamental metric for evaluating how well an investment has performed. By calculating it correctly and considering factors like deposits, inflation, and fees, you can get a more accurate picture of your investment’s true value.

Remember, the rate of return is just the starting point. To make the best investment decisions, always consider how cash flows (deposits/withdrawals) influence your returns, adjust for inflation to see true growth, and account for costs to understand your real earnings.

By understanding what is rate of return and all the factors that influence your RoR, you’ll be better equipped to compare different investments and choose the right strategy for your financial goals.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.