Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWhen learning about options trading, one of the most important concepts to understand is Out of the Money (OTM). Traders often ask, “What is Out of the Money (OTM)? Meaning & Examples?” because knowing whether an option is in the money or out of the money directly impacts risk, cost, and potential profit. In this article, we’ll explain exactly what OTM means, how out of the money call and put options work, and provide real examples to help you see the difference between in the money vs out of the money options.

What is Out of the Money (OTM)? Meaning

Out of the money (otm) is a term used in options trading to describe an option that has no intrinsic value.

For a call option, this happens when the strike price is higher than the current market price of the underlying asset.

For a put option, it means the strike price is lower than the market price. Because out of the money options only carry time value, they are cheaper to buy but also riskier, as they require significant price movement before expiration to become profitable.

Because OTM options are cheaper than in-the-money (ITM) options, they attract traders looking for leveraged exposure with lower upfront costs.

Out of the Money Examples

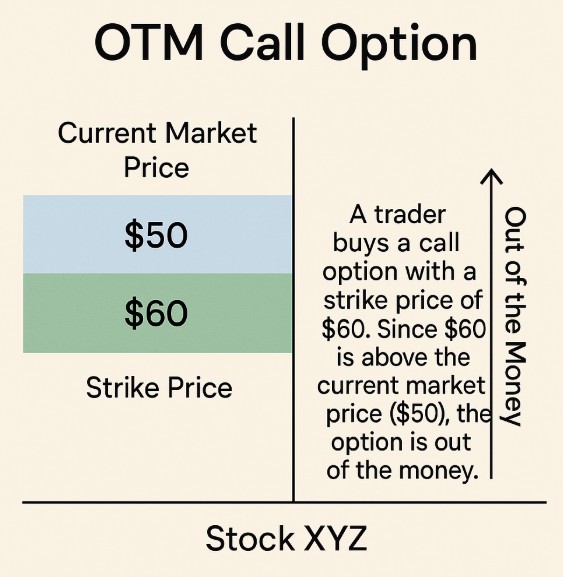

Example of an OTM Call Option

- Stock XYZ trades at $50.

- A trader buys a call option with a strike price of $60.

- Since $60 is above the current market price ($50), the option is out of the money.

- For the option to become profitable, XYZ must rise above $60 before expiration.

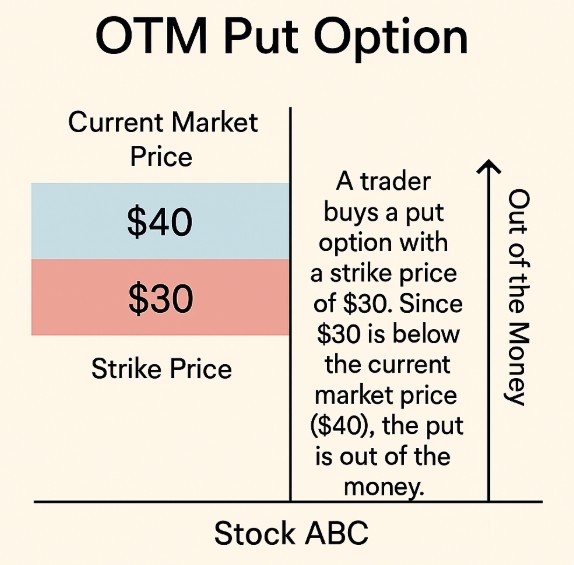

Example of an OTM Put Option

- Stock ABC trades at $40.

- A trader buys a put option with a strike price of $30.

- Since $30 is below the current market price ($40), the put is out of the money.

- For the option to gain intrinsic value, ABC must fall below $30.

Out of the Money Call Options vs Put Options

Out of the Money (OTM) options can be either calls or puts, and the difference comes down to the relationship between the strike price and the current market price of the underlying asset.

Out of the Money Call Options

- A call option gives the buyer the right (but not the obligation) to purchase the underlying asset at the strike price.

- A call is OTM when the strike price is higher than the current market price.

- Example: If Apple stock is trading at $150, a call option with a strike price of $170 is OTM. The buyer would not exercise this option today, because buying at $170 makes no sense when the stock is available in the market for $150.

- Traders buy OTM calls if they believe the stock will rise sharply above the strike before expiration, offering high upside potential with limited risk (the premium paid).

Out of the Money Put Options

- A put option gives the buyer the right (but not the obligation) to sell the underlying asset at the strike price.

- A put is OTM when the strike price is lower than the current market price.

- Example: If Tesla stock is trading at $250, a put option with a strike price of $220 is OTM. The buyer would not exercise this option now, because selling at $220 makes no sense when the stock can be sold at $250 in the market.

- Traders use OTM puts when they expect a strong decline in the asset’s price, or as a cheaper way to hedge portfolios against downside risk.

| Feature | OTM Call Options | OTM Put Options |

| Condition | Strike price > market price | Strike price < market price |

| Profit If | Asset price rises above strike | Asset price falls below strike |

| Typical Use | Bullish speculation, leveraged upside | Bearish speculation, downside protection |

| Risk | Can expire worthless if price doesn’t rise | Can expire worthless if price doesn’t fall |

In the Money vs Out of the Money

When trading options, one of the most common comparisons is between in the money (ITM) and out of the money (OTM). The distinction lies in whether the option has intrinsic value at the current market price.

In the Money (ITM) Options

- An option is in the money when exercising it right now would generate a profit.

- ITM Call Option: The strike price is below the current market price.

- Example: Stock is at $100, call strike = $90 → already profitable, since buying at $90 and selling at $100 creates value.

- ITM Put Option: The strike price is above the current market price.

- Example: Stock is at $80, put strike = $90 → profitable, since selling at $90 when the market is only offering $80 has value.

- ITM options are more expensive because they contain intrinsic value + time value.

Out of the Money (OTM) Options

- An option is out of the money when exercising it now would not be profitable.

- OTM Call Option: Strike price is above the current market price.

- Example: Stock is at $100, call strike = $120 → worthless today, since buying at $120 makes no sense when stock is $100.

- OTM Put Option: Strike price is below the current market price.

- Example: Stock is at $100, put strike = $80 → worthless now, since selling at $80 is worse than selling at $100.

- OTM options are cheaper, carrying only time value, but riskier because they may expire worthless.

Are Out of the Money Options Worth Buying?

Yes, but it depends on your strategy. OTM options are cheaper than in-the-money options and can deliver high percentage gains if the underlying asset makes a strong move. However, they also have a higher chance of expiring worthless.

Why do traders buy out of the money call options?

Traders buy OTM calls when they believe the underlying asset’s price will rise sharply before expiration. It allows them to gain leveraged exposure at a lower cost compared to ITM calls.

Why do traders buy out of the money put options?

OTM puts are often used when traders expect a significant decline in the underlying asset. They are also popular for hedging portfolios against potential downside risk.

Conclusion

Understanding the difference between in the money vs out of the money options is essential for every trader. While OTM options offer lower costs and higher leverage, they also carry more risk of expiring worthless. On the other hand, ITM options provide intrinsic value and a safer approach, but at a higher premium. Knowing when to use each type depends on your trading strategy, risk tolerance, and market outlook.

At Ultima Markets, we make learning and trading options easier with access to advanced tools, real-time market insights, and educational resources designed for traders of all levels. Whether you’re exploring out of the money call options for speculation or in the money puts for hedging, Ultima Markets provides the support you need to make informed decisions.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.