Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWhat is Mitigation Block in Trading?

A mitigation block in trading is a zone where institutional traders return to the market to mitigate risk or rebalance unfilled orders after initiating a large position. These blocks typically appear after a displacement move when price breaks structure with strong momentum and then retraces into a previously formed order block.

In simple terms, mitigation blocks represent continuation zones used by smart money to rejoin a trend after a structural shift. Unlike breaker blocks, mitigation blocks do not sweep liquidity but instead show where price failed to create a new high or low.

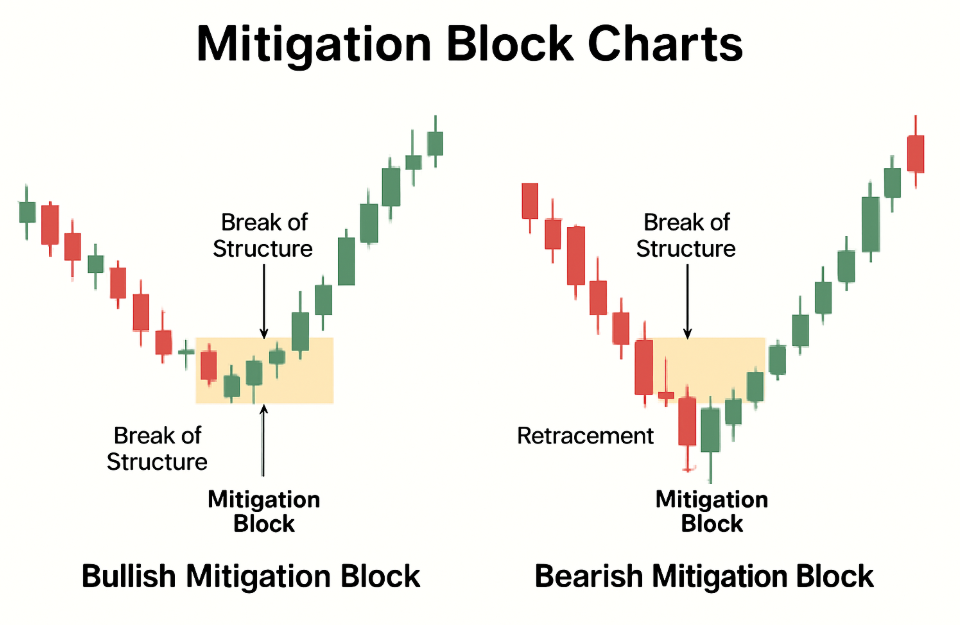

Types of Mitigation Blocks

There are two main types of mitigation blocks depending on the market direction:

Bullish Mitigation Block

A bullish mitigation block is a zone where smart money re-enters the market with long (buy) orders after price fails to continue making lower lows and instead breaks above a previous high, signaling a bullish market structure shift.

This typically forms after a displacement move upward, where the market breaks a bearish trend, then retraces into the last bearish candle before the breakout. This candle becomes the bullish mitigation block.

To identify a bullish mitigation block:

- Look for a Failed Downtrend: Price stops making lower lows and instead forms a higher high.

- Mark the Last Bearish Candle: Identify the final bearish candle before the bullish breakout or structure break.

- Watch for Retracement: Price retraces into the body or wick of this bearish candle.

- Confirm Entry Signal: Look for a reaction like bullish rejection, break of structure on lower timeframes, or fair value gap (FVG) alignment.

The bullish mitigation block acts as a demand zone, where institutions re-enter long after mitigating risk or filling unexecuted buy orders.

Bearish Mitigation Block

A bearish mitigation block is the opposite. It forms when price fails to continue an uptrend, fails to make higher highs, and then breaks below a recent low, shifting market structure bearish.

The last bullish candle before this break becomes the bearish mitigation block. This zone represents where institutions mitigate or rebalance short (sell) positions during a pullback.

To identify a bearish mitigation block:

- Identify a Failed Uptrend: Price stops making higher highs and breaks below a previous low.

- Locate the Last Bullish Candle: This is the candle just before the bearish structure break.

- Monitor the Retracement: Price moves back into this candle, showing institutional re-entry into shorts.

- Look for Rejection or Confirmation: Ideal setups include bearish engulfing, break of structure (BoS), or rejection from an imbalance.

The bearish mitigation block serves as a supply zone, where smart money reactivates selling pressure after a brief pullback.

Mitigation Block vs Breaker Block

A mitigation block is a zone where institutions re-enter the market to mitigate previous exposure and continue the trend, usually after a structure shift without a liquidity sweep. In contrast, a breaker block forms after a liquidity grab, signaling a reversal as smart money traps retail traders.

Mitigation = trend continuation, Breaker = trend reversal.

| Criteria | Mitigation Block | Breaker Block |

| Formation | After structure shift without a liquidity sweep | After liquidity sweep (stop-hunt) and reversal |

| Trend Direction | Trend continuation | Trend reversal |

| Smart Money Behavior | Rebalancing or mitigating risk | Trapping weak hands and reversing position |

| Price Reaction | Mild rejection and continuation | Strong rejection and reversal |

How to Spot a Mitigation Block

To identify a mitigation block, follow these key steps:

- Look for Structure Break (BoS): Identify where price fails to make a new high or low and breaks the opposite side.

- Mark the Last Opposing Candle: This is usually the last bullish (for bearish setup) or bearish candle (for bullish setup) before the break.

- Wait for Price Retracement: Price should revisit the block zone before continuing the trend.

- Confirm with Confluences: Use fair value gaps (FVG), imbalance, or liquidity zones to validate the block.

This process helps ensure you’re trading in alignment with institutional footprints.

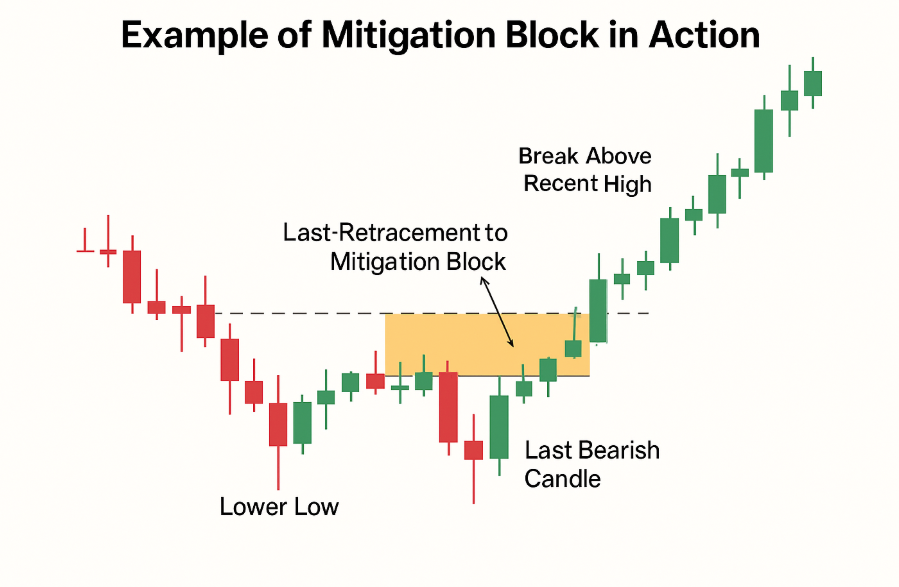

Example of Mitigation Block in Action

Let’s look at a bullish mitigation block example:

- On the H1 chart, price creates a lower low, then fails to make a new low and breaks above the recent high, signaling a bullish structure shift.

- The last bearish candle before the break is marked as a mitigation block.

- Price retraces into the block, rejects it, and continues upward, confirming institutional re-entry.

This setup illustrates how smart money reuses key zones to enter the market with reduced risk.

How to Trade Using Mitigation Block

Here’s how to build a solid strategy using mitigation blocks:

Use Higher Timeframes

Start with H1 or H4 charts to find strong mitigation blocks. These zones offer more reliable signals than lower timeframes.

Refine Entry on Lower Timeframes

Drill down to M5 or M15 to spot entry confirmations like:

- Break of structure (BoS)

- Change of character (ChoCH)

- Fair value gap (FVG) alignment

Entry & Stop-Loss

- Enter when price retraces and shows rejection within the block.

- Set your stop-loss just beyond the block’s high (for bearish) or low (for bullish).

Take-Profit Strategy

- Use recent swing highs/lows or liquidity zones as targets.

- Consider partials at 1:2 or 1:3 RR for secure profit locking.

Trading mitigation blocks helps you minimize drawdown and maximize reward by following institutional logic.

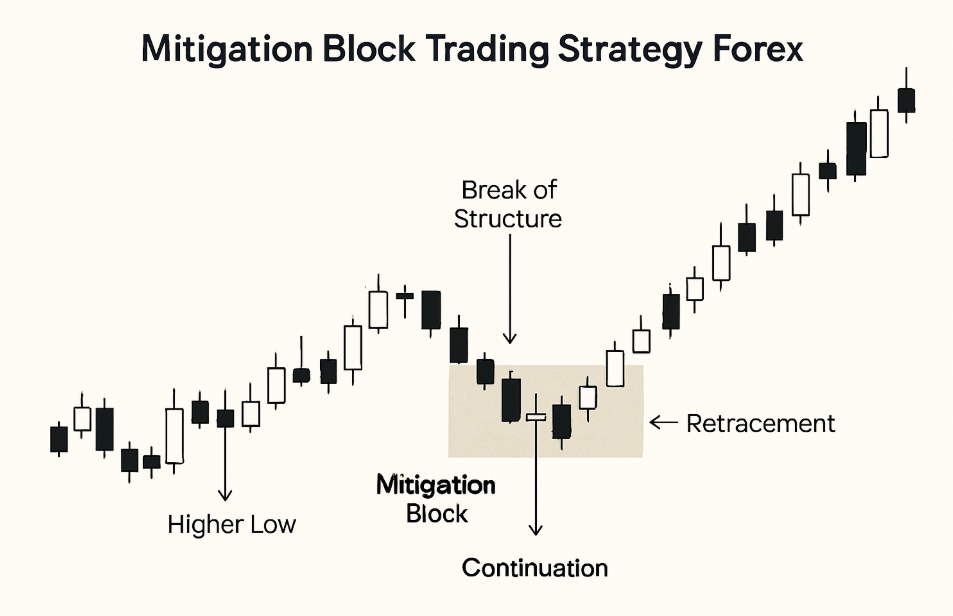

Mitigation Block Trading Strategy Forex

The Mitigation Block Trading Strategy in Forex is a precise entry technique based on institutional price behavior and market structure. This strategy identifies a shift in trend such as a failed high or low and marks the last opposite candle before the breakout as a mitigation block. In forex markets, these zones often appear during high-liquidity sessions like London or New York, where price pulls back to the block area, allowing institutions to rebalance orders before continuation. Traders often combine this method with fair value gaps (FVGs), break of structure (BoS), and session timing to enhance entry accuracy and improve risk-reward ratios.

Conclusion

Mitigation blocks serve as powerful zones where price often retests before continuing its trend. By identifying these blocks early especially after a break of structure, traders can position themselves more efficiently with tighter stops and improved risk-reward setups.

Whether you trade Forex majors or indices, mastering mitigation block strategy enhances your ability to read institutional footprints and act with precision. With Ultima Markets, you gain access to fast execution, institutional-grade liquidity, and trading tools that help you spot these zones in real time turning analysis into opportunity.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.