Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWhat Is Mark to Market (MTM) For Traders

What is Mark to Market? Mark to Market (MTM) is an accounting method that values assets and liabilities based on their current market price, rather than their original purchase price. This method provides an accurate and real-time snapshot of the value of assets, which is essential for financial institutions, traders, and investors.

For traders, understanding what is Mark to Market is critical as it directly impacts how positions are valued and managed on a daily basis. In this article, we will explore how MTM works, its benefits, and how it influences trading strategies and decision-making.

How Does Mark to Market Work in Trading?

Mark to Market accounting involves adjusting the value of an asset or liability regularly to reflect its current market price. It’s particularly relevant in markets where asset prices change frequently, such as stocks, commodities, bonds, and derivatives.

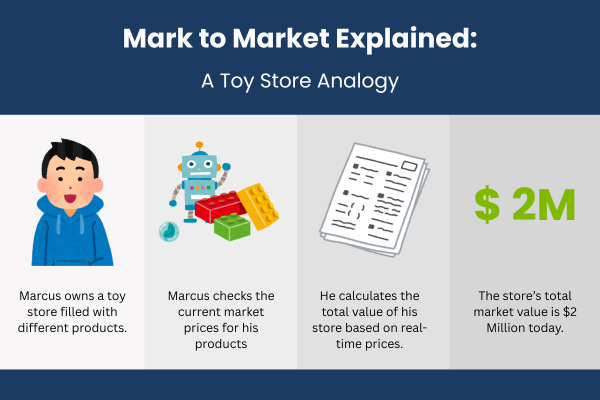

To better understand what is Mark to Market, let’s start with a simple analogy. Imagine a toy store owned by Marcus, who has various products such as toys, marbles, and Legos. If Marcus wants to determine the current value of his store, he adds up the market prices of each of these items based on real-time price discovery. He checks how much buyers are willing to pay for each toy at this moment.

For example, if Marcus purchased his toys for a total of $2 million but today, after checking the market, he finds that the toys are now only worth $1 million, this is a Mark to Market adjustment. In real-time accounting, the toys’ value is adjusted downward to reflect market conditions, and Marcus records the $1 million.

This is exactly how MTM works in the financial markets. It ensures that the value of assets reflects the current market price and is updated regularly.

Why is Mark to Market Important?

For traders, MTM accounting is essential because it provides an accurate reflection of the real-time value of their positions. Here’s how it impacts traders:

- Real-Time Valuation:

MTM ensures that a trader’s position is valued based on current market prices. For example, a trader holding gold CFDs will see their position’s value adjusted whenever the market price of gold changes. If gold prices drop, the trader will see a loss recorded in their account immediately. - Profit and Loss Calculation:

MTM directly influences the profit and loss (P&L) calculations for traders. For instance, if a trader buys a stock at $100 per share and the price falls to $90 due to market changes, the value of the trader’s position will be marked down to $90. This allows the trader to track unrealized gains or losses in real time.Similarly, if the stock price rises back to $100 or higher, the trader’s position will reflect the increase in value, offering an up-to-date account of the P&L. - Risk Management:

MTM provides traders with essential information to manage risk. For example, a trader may be holding a futures contract for oil, and the price of oil may drop sharply. MTM will immediately reflect this price drop, helping the trader decide whether to exit the position to limit losses or take other risk-management actions.In volatile markets, MTM can act as an early warning system, allowing traders to react quickly to sudden price changes.

Mark to Market vs Historical Cost Accounting

To better understand what is Mark to Market and why it’s so significant for traders, let’s compare it to historical cost accounting.

- Historical Cost Accounting:

Historical cost accounting records assets based on the price at which they were originally purchased, and this value doesn’t change over time, even if the market conditions do. For example, if a trader buys a bond for $1,000, historical cost accounting would continue to show the bond as being worth $1,000 on their balance sheet, regardless of changes in interest rates or market conditions. - Mark to Market Accounting:

MTM, however, updates the value of assets to reflect their current market price. If that same bond’s price drops to $950 due to interest rate changes, MTM forces the trader to record the bond’s new value of $950. This provides a more accurate picture of the asset’s current worth.

For traders, MTM is more dynamic because it reacts to changes in the market, providing real-time updates on the value of positions, while historical cost ignores market fluctuations, giving a less accurate picture of the asset’s value at any given time.

Advantages and Risks of Mark to Market

Advantages of Mark to Market in Trading

- Real-Time Snapshot:

MTM gives traders an up-to-date view of their positions, helping them make quick decisions in volatile markets. - Improved Risk Management:

By reflecting the current market value, MTM helps traders assess their exposure and take immediate action to manage risks. - Accurate P&L Reporting:

MTM allows for real-time tracking of both realized and unrealized profits and losses, helping traders stay informed on the status of their positions.

Risks of Mark to Market in Trading

- Market Volatility:

MTM can introduce significant volatility in financial statements, especially during market fluctuations, reflecting paper losses even if assets may recover long-term. - Liquidity Issues:

MTM relies on market prices, and for illiquid or complex assets, accurate valuation can be challenging, leading to potential errors. - Short-Term Focus:

MTM focuses on immediate market prices, which may not represent the true long-term value of an asset, potentially distorting a trader’s view of its future potential.

The Debate: Is Mark to Market Always the Right Approach?

While some argue that MTM provides transparency and reflects the true market value of assets, others argue that it causes undue volatility and forces financial institutions to record losses they may not actually realize. This debate became particularly prominent during the 2008 financial crisis when many banks had to mark down the value of their mortgage-backed securities, leading to massive paper losses.

Critics of MTM argue that it’s not always appropriate to mark assets down in this way, especially for instruments like bonds that may recover their value over time. Proponents, however, contend that MTM ensures that assets are valued at their true market price, helping to reflect any potential risks to investors and financial stability.

Conclusion

For traders, Mark to Market accounting offers a real-time, transparent view of asset values, which is crucial for risk management, decision-making, and accurately tracking profits and losses. While MTM reflects market volatility, understanding what is mark to market helps traders stay aligned with current market conditions, ensuring that they can react quickly to changes and protect their portfolios.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.