Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteIn today’s derivatives and forex markets, the introducing broker (IB) model remains a cornerstone of market access. An IB bridges the gap between traders and executing firms, helping clients access futures, swaps, and retail forex contracts without directly handling funds or clearing trades. Understanding the responsibilities, compliance obligations, and benefits of IBs is vital for traders, brokers, and institutions alike.

This guide explains what an introducing broker is, outlines their role and responsibilities, details registration requirements, clarifies the relationship between IBs and futures commission merchants (FCMs), and explores who needs an introducing broker.

What Is an Introducing Broker?

An introducing broker (IB) is a person or firm that solicits or accepts customer orders for futures, commodity options, swaps, or retail forex contracts. Unlike a futures commission merchant (FCM), the IB does not hold client money or assets. Instead, all customer accounts and funds are carried with an FCM or a retail foreign exchange dealer (RFED).

Key points:

- IBs maintain the client relationship: onboarding, advisory, and education.

- IBs pass all trade orders to an FCM (or RFED in forex).

- IBs generate income through commission-sharing or referral agreements with their clearing partner.

- Under U.S. law, all IBs must register with the Commodity Futures Trading Commission (CFTC) and become members of the National Futures Association (NFA).

Role and Responsibilities of an Introducing Broker

The role of an introducing broker goes far beyond simply “bringing clients” to a futures commission merchant (FCM). Their responsibilities span client service, compliance, operational standards, and relationship management, all of which are essential for trust and long-term business sustainability. Below is a detailed breakdown:

Client Acquisition and Onboarding

- Marketing and Prospecting: IBs actively market trading services through seminars, digital marketing, referrals, and education.

- Suitability Checks: They assess clients’ trading knowledge, risk tolerance, and financial background to ensure products are appropriate.

- Account Opening: While the actual account is held at the FCM, the IB assists with paperwork, KYC (Know Your Customer), and disclosures.

Education and Advisory Support

- Market Education: IBs provide research reports, webinars, and tutorials to help clients understand futures, options, and forex markets.

- Trading Tools: They often supply charting software, order platforms, or signal services, even though execution occurs at the FCM.

- Personalized Service: Smaller clients benefit from the “human touch”, IBs offer tailored advice and ongoing communication.

Order Solicitation and Transmission

- Soliciting Orders: IBs encourage clients to trade but must do so transparently, avoiding misleading claims.

- Routing Orders: Once received, client orders are transmitted to the FCM for execution.

- Fair Order Handling: Under 17 CFR 155.4, IBs must establish and enforce procedures to ensure that customer orders are handled properly and are not disadvantaged compared to proprietary orders.

Compliance and Record-Keeping

- Regulatory Registration: All IBs must register with the CFTC and become NFA Members in the U.S.

- AML Program: They must maintain a written Anti-Money Laundering program as required by 31 CFR 1026.210.

- Customer Identification Program (CIP): IBs verify the identity of clients at onboarding under 31 CFR 1026.220.

- Record-Keeping: They are responsible for maintaining records of customer interactions, communications, and order transmissions for regulatory inspections.

Supervision of Associated Persons (APs)

- Associated Persons (APs): These are employees or contractors who solicit business on behalf of the IB. They must be individually registered with the NFA.

- Supervision: IBs must monitor AP conduct, ensuring compliance with marketing rules, fair dealing, and customer disclosure standards.

Relationship Management with FCMs

- Introducing Broker Agreement: IBs must sign a contractual agreement with their FCM partner that defines duties, commissions, and compliance expectations.

- Revenue Sharing: They are typically compensated through a portion of the commission generated by client trades.

- Operational Coordination: IBs and FCMs work together on reporting, margin calls, and client communications.

Business Ethics and Client Protection

- Avoiding Conflicts of Interest: IBs must disclose if they receive compensation arrangements that may bias product recommendations.

- Risk Disclosure: They must provide clear information on the risks of futures, swaps, or forex trading.

- Fiduciary Duty (in some jurisdictions): While not always legally binding, many IBs adopt a “duty of care” standard to build trust and longevity with clients.

Registration of Introducing Brokers

U.S. Registration Rules

- IBs must register with the CFTC and become NFA Members.

- Associated persons (APs) and principals of the IB must also register.

- Applications involve submitting Form 7-R (for the firm) and Form 8-R (for individuals).

- Registration requires background checks, fee payments, and completion of proficiency exams (such as the Series 3 exam in the U.S.).

Compliance Obligations

- AML and CIP programs must be implemented.

- Supervisory frameworks and internal controls must be documented.

- IBs must undergo periodic NFA audits to verify compliance with record-keeping and customer-protection standards.

Exemptions

- Certain IBs may qualify for limited exemptions (e.g., foreign IBs not soliciting U.S. clients).

- However, in most cases, solicitation of U.S. persons for futures or forex requires full registration.

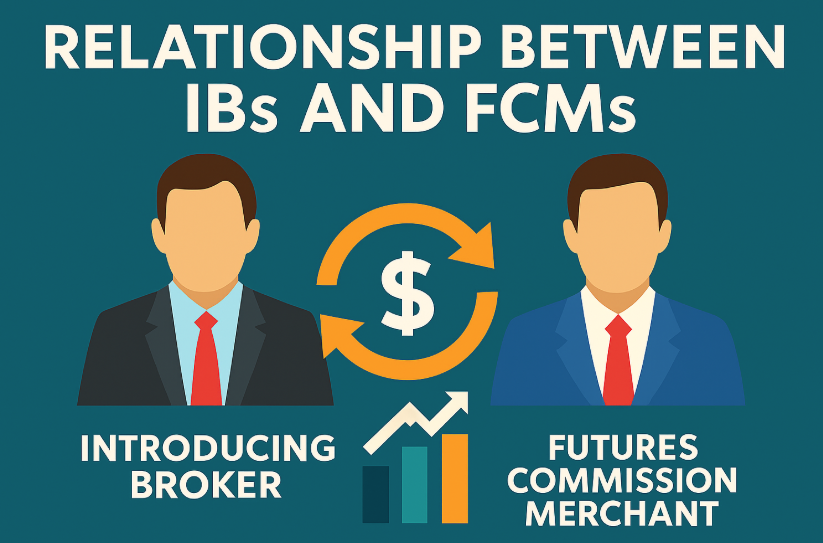

The Relationship Between IBs and FCMs

An introducing broker (IB) and a futures commission merchant (FCM) work hand in hand to service traders. The IB focuses on client acquisition, support, and education, while the FCM handles the heavy lifting of execution, clearing, and custody of funds. This partnership allows clients to receive personalized service without sacrificing the security and infrastructure of a regulated clearing firm.

| Function | Introducing Broker (IB) | Futures Commission Merchant (FCM) |

| Client Relationship | Direct contact: onboarding, education, advice | Holds the trading account, reports balances, handles funds |

| Order Handling | Solicits and transmits orders | Executes and clears trades |

| Custody of Funds | Cannot accept customer funds | Accepts deposits, maintains margin, segregates funds |

| Regulatory Oversight | Client-facing compliance, AML, CIP | Capital adequacy, clearing risk, custody, reporting |

| Revenue | Commission/referral fee from FCM | Execution and clearing fees |

This structure allows IBs to scale client relationships without the heavy infrastructure and capital requirements of an FCM.

Who Needs an Introducing Broker?

An introducing broker (IB) is best suited for retail traders, small funds, or regional clients who want personalized support and market access without directly dealing with a clearing firm. IBs are also valuable to futures commission merchants (FCMs) seeking to expand their client base.

Typical users of IBs include:

- Retail traders needing education and guidance.

- Small hedge funds or commodity trading advisors (CTAs) outsourcing execution.

- Regional clients preferring local service and language support.

- FCMs and clearing firms looking for broader distribution networks.

Conclusion

An introducing broker plays a vital role in modern trading by connecting clients to regulated clearing firms, offering education, guidance, and personalized support while leaving execution and custody to futures commission merchants (FCMs). For traders, IBs can provide the confidence of local expertise with the safety of global infrastructure.

At Ultima Markets, we work with trusted partners and adhere to strict regulatory standards to ensure transparency, security, and fair dealing. Whether you are a new trader seeking guidance or an experienced investor looking for professional support, our goal is to provide an environment where you can trade with purpose and confidence.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.