Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

What is Institutional Trading Platform?

An institutional trading platform is a professional-grade system built for executing large and complex financial transactions across global markets. These platforms offer features such as Direct Market Access (DMA), FIX API integrations, Smart Order Routing, Advanced risk management tools and Access to Level 2 and 3 market data.

Unlike retail trading platforms, institutional systems connect directly to liquidity providers and offer powerful infrastructure that minimizes slippage, enhances speed, and ensures regulatory compliance.

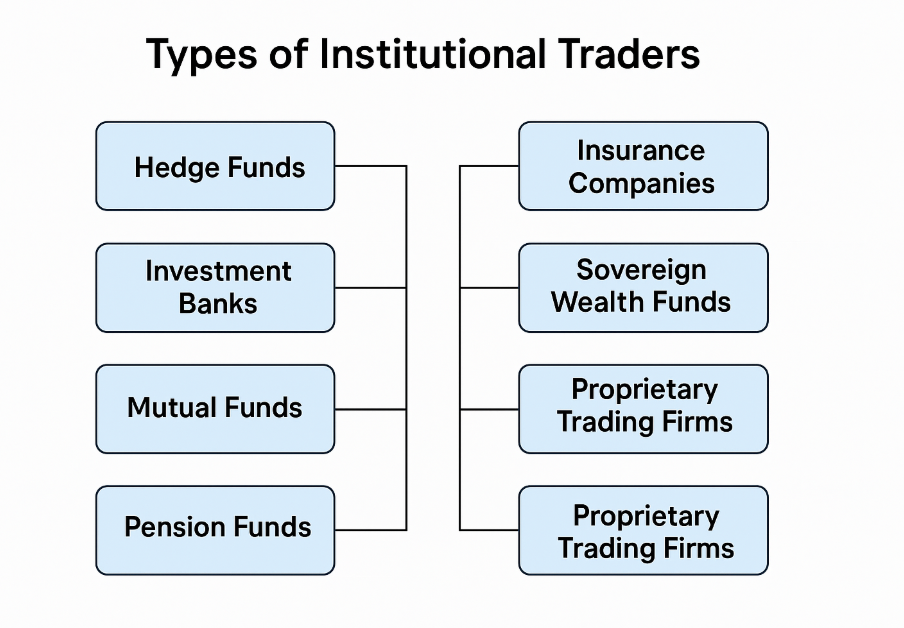

Types of Institutional Traders

Institutional traders are entities that trade large volumes of financial assets, often influencing market direction due to their size and strategy. Each type of institutional trader serves a unique function in the financial ecosystem, governed by specific mandates, risk profiles, and investment horizons.

Hedge Funds

- Goal: Maximize absolute returns using aggressive strategies.

- How They Trade: Actively trade equities, forex, commodities, and derivatives using leverage, short selling, arbitrage, and high-frequency models.

Hedge funds often cause short-term volatility due to their rapid directional bets and large block orders.

Investment Banks

- Goal: Generate profits via proprietary trading and client order flow.

- How They Trade: Engage in prop trading, market making, and liquidity provision across equities, bonds, FX, and derivatives.

Investment banks play a key role in setting bid/ask spreads and supplying liquidity, especially in FX and fixed income.

Mutual Funds

- Goal: Generate long-term capital growth for investors.

- How They Trade: Buy-and-hold strategies focusing on blue-chip stocks, ETFs, and government bonds. Trades are often executed during rebalancing.

Mutual funds are slower-moving but still move markets due to large periodic rebalancing or index-tracking flows.

Pension Funds

- Goal: Preserve capital and deliver steady returns to meet future liabilities (e.g., retirement payouts).

- How They Trade: Invest conservatively in government bonds, blue-chip equities, and real estate. Use institutional platforms for rebalancing.

While not active traders, pension funds control trillions and impact long-term yield curves and market sentiment.

Insurance Companies

- Goal: Match assets with future policy payouts and liabilities.

- How They Trade: Invest heavily in long-dated bonds, asset-backed securities, and structured products with minimal turnover.

These firms tend to be conservative, trading to hedge risk rather than chase profit.

Sovereign Wealth Funds (SWFs)

- Goal: Grow a country’s reserves and support national economic stability.

- How They Trade: Allocate across global asset classes: equities, bonds, real estate, and alternative investments.

SWFs have enormous influence due to their size and often act counter-cyclically, buying during downturns.

Proprietary Trading Firms

- Goal: Profit purely from market movements using internal capital.

- How They Trade: Employ high-frequency trading (HFT), arbitrage, and statistical models across various markets.

These firms are highly technical, using algorithmic trading to exploit micro-inefficiencies.

| Trader Type | Main Objective | Trading Style | Market Impact |

| Hedge Funds | Maximize alpha | Active, leveraged | High short-term volatility |

| Investment Banks | Profit via trading and liquidity | Market making, proprietary | Core liquidity providers |

| Mutual Funds | Long-term capital appreciation | Buy-and-hold | Medium |

| Pension Funds | Long-term stability and payouts | Conservative | Low to medium |

| Insurance Companies | Match liabilities | Very conservative | Low |

| Sovereign Wealth Funds | Grow national reserves | Multi-asset, long-term | Large, strategic |

| Prop Trading Firms | Short-term profit from inefficiencies | Quant, HFT | High in specific markets |

Example of Institutional Trading

Here’s a real-world scenario:

A hedge fund wants to buy $200 million worth of EUR/USD. Instead of placing a single large order which could move the market, it uses an institutional platform. Through algorithmic execution tools such as TWAP (Time-Weighted Average Price), the fund breaks the order into smaller trades over time.

This strategic execution reduces slippage, hides true order intent, and secures better average prices, something retail traders cannot easily replicate.

Difference Between Institutional Traders and Retail Traders

The primary difference between institutional traders and retail traders lies in their scale, resources, and market access. Institutional traders operate on behalf of large organizations such as hedge funds, banks, and pension funds that managing millions or even billions of dollars. They use advanced trading infrastructure like Direct Market Access (DMA), FIX APIs, and smart order routing to execute large trades with minimal slippage.

In contrast, retail traders trade individually using broker platforms, typically with smaller capital and limited access to real-time data or deep liquidity. Institutional traders benefit from tighter spreads, lower fees, and proprietary algorithms, while retail traders often face higher costs and slower execution. This disparity creates a strategic edge for institutions, which can influence market direction through their size and execution precision.

| Feature | Institutional Traders | Retail Traders |

| Capital Size | Millions to billions of dollars | Usually <$100,000 |

| Execution | Via DMA, FIX API, smart routing | Standard broker platforms (e.g., MT4/MT5) |

| Liquidity Access | Interbank, ECN, or dark pools | Broker-managed liquidity |

| Market Data | Level 2/3 real-time depth | Delayed or simplified view |

| Trading Costs | Low spreads, negotiated commissions | Wider spreads, retail markups |

| Regulation | Strict compliance (MiFID II, Basel III) | Less regulatory complexity |

Why Institutions Use Specialized Platforms

Institutional trading requires more than just market access. These platforms provide:

- Low latency execution for time-sensitive trades

- Access to dark pools to avoid moving the market

- Algorithmic trading for slicing orders intelligently

- Real-time analytics to monitor slippage and performance

- Custom risk controls aligned with internal policies and regulators

Such tools help institutions manage millions or even billions of dollars while minimizing execution risk.

What Can Beginners Learn from Institutional Trading?

Even though most retail traders can’t access these platforms, they can adopt an institutional mindset:

- Follow volume: Large orders often leave clues (e.g., order blocks)

- Use sentiment data: Institutional positioning (COT reports) helps spot bias

- Practice strict risk management: Like institutions, limit risk per trade

- Avoid chasing price: Institutions fade liquidity, they don’t chase trends blindly

Understanding institutional behavior offers retail traders a smarter way to trade, aligning strategies with the true market drivers.

Conclusion

Institutional trading platforms are essential infrastructure for global markets. They allow major financial players to move vast capital with precision, compliance, and cost-efficiency.

For beginners, understanding how these platforms work helps decode price behavior and shows why it’s important to align with institutional flows rather than fight them.

Ultima Markets empowers retail traders with institutional-grade education, helping bridge the gap between professional strategies and everyday execution.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.