Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWhat Is EBITA? A Clear Guide For Traders

Financial statements can feel crowded with metrics, but some numbers give a cleaner view of a company’s true business performance. One of the most useful among them is EBITA. Whether you analyse stocks, compare companies across markets, or review earnings reports, EBITA helps you focus on the profitability that actually comes from running the core business.

This article breaks down what EBITA means, how it is calculated, where it is useful, and how investors apply it in real-world analysis.

Definition of EBITA in Simple Terms

EBITA stands for “Earnings Before Interest, Taxes and Amortisation.”

It measures how much profit a company generates from normal operations, before the effects of:

- Financing decisions (interest)

- Tax structures

- Amortisation of intangible assets

Unlike EBITDA, EBITA still includes depreciation, which means it reflects the cost of using physical assets, giving a more realistic picture for businesses with factories, equipment, or logistics fleets.

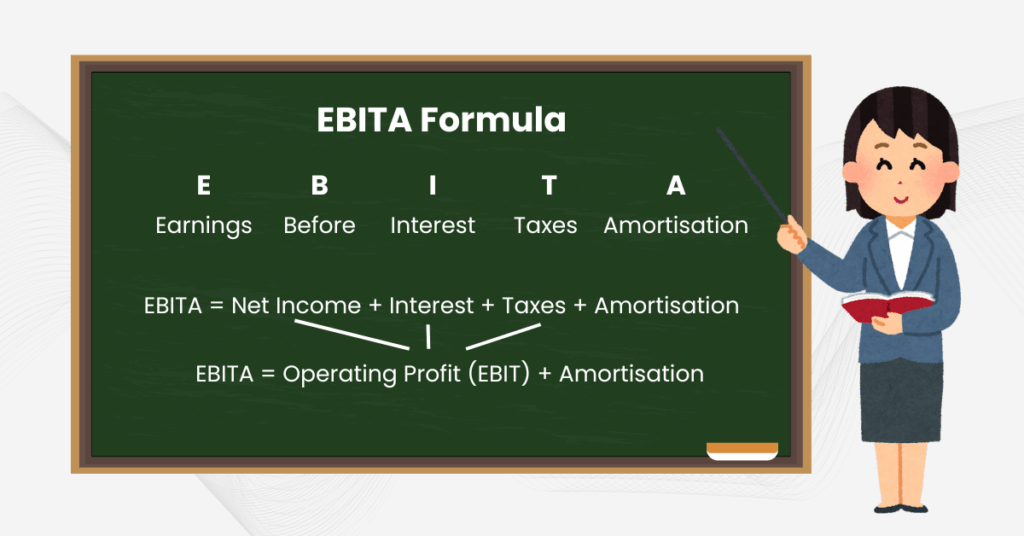

The EBITA Formula

Most analysts use:

EBITA = Operating Profit (EBIT) + Amortisation

Operating profit already excludes interest and taxes. Adding back amortisation strips out non-cash charges related to intangible items like acquired trademarks, software, and licences.

Why Investors and Traders Care About EBITA

A cleaner picture in intangible-heavy industries

Today’s corporate landscape includes more intangible assets than ever. Software, customer lists, patents, and digital IP. These amortise over time, sometimes creating large accounting expenses that don’t reflect actual cash movements.

EBITA removes that distortion, making operating performance easier to judge.

Better comparisons across borders

Companies operating in different countries face different tax rules and interest environments. By excluding both, EBITA allows for more accurate cross-market comparisons.

Still grounded in reality

Unlike EBITDA, EBITA retains depreciation. This matters because depreciation captures wear-and-tear on real assets. For manufacturers, airlines, logistics companies, or energy firms, ignoring depreciation can paint too rosy a picture.

EBITA strikes a balance: it removes non-cash amortisation but keeps the cost of physical assets visible.

EBITA vs EBITDA vs EBIT: What’s the Difference?

Although these metrics look similar, each highlights a different dimension of profitability.

| Metric | Excludes | Includes | Useful When |

| EBIT | Interest, Taxes | Depreciation + Amortisation | Checking full operating income |

| EBITDA | Interest, Taxes, Depreciation + Amortisation | None | You want a cash-flow style comparison |

| EBITA | Interest, Taxes, Amortisation | Depreciation | You want to neutralise amortisation while keeping asset costs |

When EBITA is the better choice

- Tech or software companies with large amortisation expenses

- Firms that recently made acquisitions (amortisation spikes after deals)

- Businesses where depreciation is a meaningful economic cost

EBITA removes the noise without ignoring the real cost of maintaining assets.

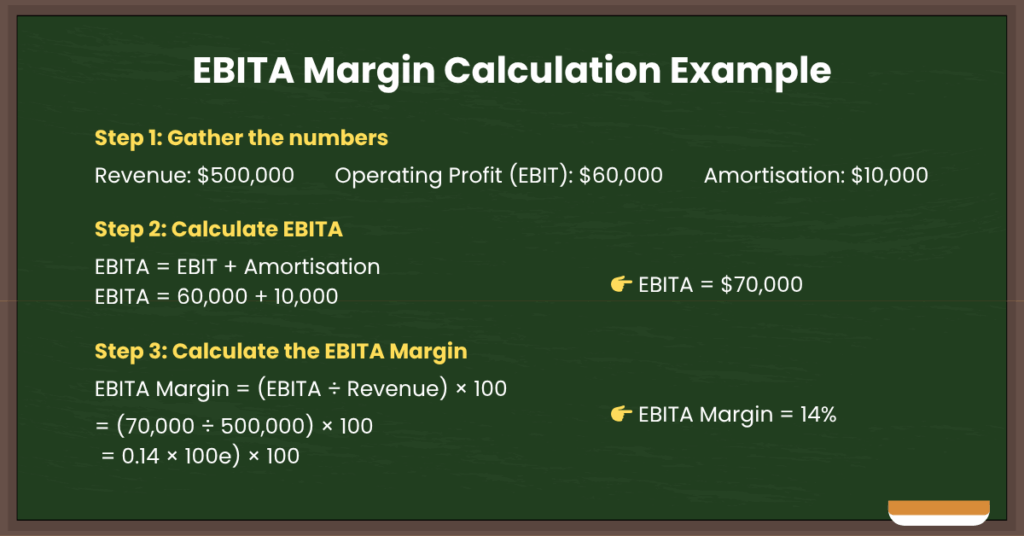

Introducing the EBITA Margin

Beyond absolute numbers, analysts look at:

EBITA Margin = EBITA ÷ Revenue

This percentage shows how much of every revenue dollar turns into operating profit before interest, taxes, and amortisation. Higher margins mean the business is more efficient or has strong pricing power.

Examples of typical ranges:

- Software / digital services: 15–35%+

- Consumer goods: 10–20%

- Manufacturing / industrials: 5–15%

(actual benchmarks vary by sub-sector)

How Investors Use EBITA in Real-World Analysis

1. Valuation (EV/EBITA Multiples)

When amortisation is unusually large, analysts prefer EV/EBITA instead of EV/EBITDA.

It gives a fairer valuation for companies with acquired intangible assets.

2. Earnings quality checks

If EBITA is stable but net income swings wildly, it may signal the impact of taxes, interest, or acquisition-related amortisation. Not a change in core performance.

3. Cross-company comparisons

Two businesses may have similar operations but different funding strategies. EBITA allows investors to compare them without the influence of debt levels or tax optimisation.

4. M&A and deal modelling

Acquired companies often carry significant amortisable intangibles. EBITA reveals underlying profitability before those accounting effects show up.

Where EBITA Is Especially Relevant

Industries with high intangible amortisation

- Software

- Telecom

- Media

- Pharmaceuticals

- Fintech

These companies often amortise large intangible assets from acquisitions or product development.

Businesses that rely on physical assets

Even though EBITA removes amortisation, keeping depreciation makes it more realistic than EBITDA for:

- Manufacturing

- Automotive

- Logistics

- Utilities

Markets with different tax regimes

Cross-border investors use EBITA to normalise results between companies in different jurisdictions.

Limitations You Should Not Ignore

EBITA is helpful, but not perfect:

- It excludes financing costs, so it does not show whether a company can handle its debt load.

- It is a non-GAAP metric, meaning companies have flexibility in how they calculate it.

- Depreciation profiles differ widely, affecting comparability in asset-heavy sectors.

- Large capital expenditure needs will not be visible in EBITA. You must check cash flow, capex, and free cash flow.

EBITA should be part of the analysis, not the entire story.

Is EBITA a Good Indicator of Performance?

EBITA gives a practical, balanced view of operational profitability. It is more realistic than EBITDA and cleaner than EBIT when intangible amortisation distorts the bottom line. For anyone reviewing earnings, comparing industries, or analysing acquisitions, EBITA helps reveal the true strength of the business running beneath the accounting layers.

Used together with cash flow, debt metrics, and margins, it becomes a powerful tool in any investor or trader’s toolkit.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.