Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWhen it comes to the US stock market, most people first think of the Dow Jones Index. As one of the world’s oldest and most representative stock indices, the Dow Jones Industrial Average not only reflects the core dynamics of the US economy but also serves as an important reference for global investors to assess market trends.

So, what is the Dow Jones Index? This article will provide an in-depth analysis of its composition, operating principles, and investment methods, as well as explain how investors can effectively participate through professional platforms like Ultima Markets.

What Is the Dow Jones Index?

The Dow Jones Index, commonly referring to the Dow Jones Industrial Average (DJIA), is a US stock market indicator created in 1896 by Charles Dow and Edward Jones. Initially consisting of 12 industrial stocks, it has now expanded to 30 components and is managed by S&P Dow Jones Indices.

In simple terms, the DJIA is a price-weighted index reflecting the performance of major US corporations, with its movements quickly indicating market sentiment and significant economic events.

How To Calculate the Dow Jones Index?

Is the Dow Jones Index price-weighted or market-cap-weighted? The key is that the DJIA is not calculated based on company market capitalization but by adding up the prices of its component stocks and dividing by a denominator (the Dow divisor). This method maintains historical continuity and adjusts for corporate actions such as stock splits and dividends, making the DJIA a price-weighted index.

Whenever component stocks undergo dividend distributions, stock splits, or adjustments, the divisor is modified to ensure index continuity. As a result, the DJIA’s movements are closely tied to the performance of high-priced companies, meaning that a small-cap company with large price fluctuations may have a greater impact than a low-priced large-cap company.

What Are the Components of the Dow Jones Index?

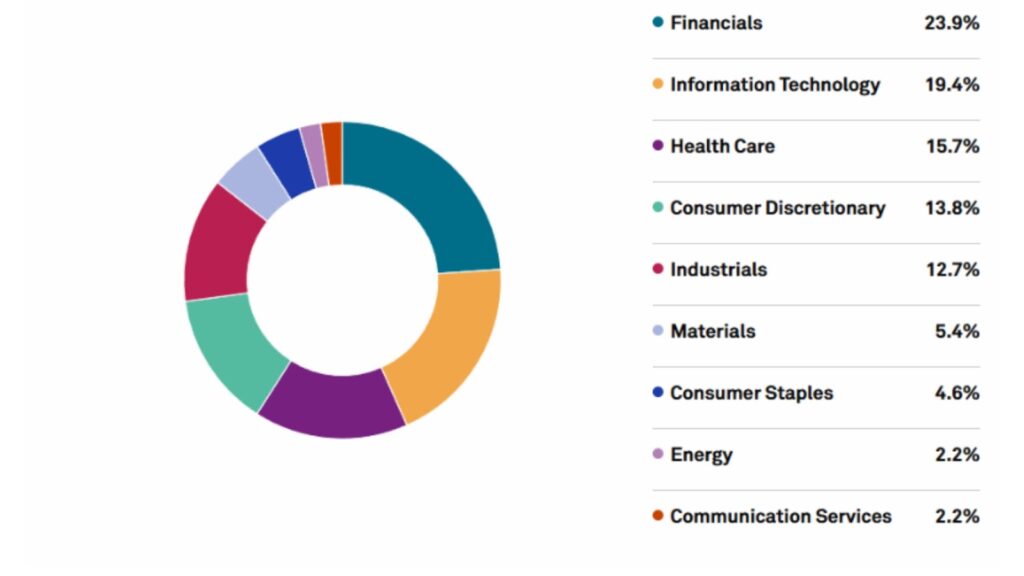

As of May 2025, the 30 component stocks and their industry distribution are as follows:

- Information Technology: Apple, Microsoft, Cisco, IBM, Salesforce, Nvidia

- Finance and Business: Goldman Sachs, JPMorgan, American Express, Visa

- Industry and Manufacturing: Boeing, Caterpillar, 3M, Honeywell

- Healthcare and Biotechnology: Johnson & Johnson, Merck, Amgen

- Others: McDonald’s, Chevron, Walmart

These companies hold different weights, with the top five (including Apple, Microsoft, and Caterpillar) accounting for around 31% of the total weight. The composition of these components directly affects the index’s sensitivity to specific industry performances.

The chart below shows the industry weight distribution of the Dow Jones Industrial Average components.

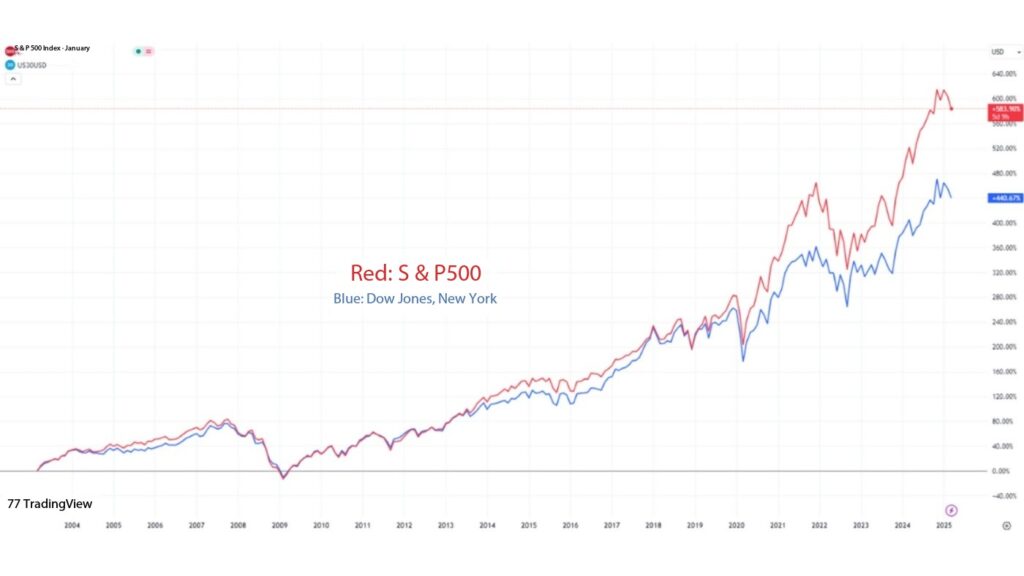

Differences Between the Dow Jones Index and S&P 500

When comparing the Dow Jones Index (DJIA) with the S&P 500, note the following points:

- Number of Components: The DJIA includes 30 companies, while the S&P 500 covers 500 companies with broader market representation;

- Weighting Method: The DJIA is price-weighted, whereas the S&P 500 is market-cap-weighted;

- Representation: The S&P 500 is considered a more comprehensive indicator of the overall US stock market, while the DJIA focuses on large, well-known companies.

If you want to track overall market trends, the S&P 500 may be more suitable. However, if you focus on the performance of major blue-chip companies, the DJIA remains valuable for reference. For Taiwanese retail investors, understanding these differences helps in selecting trading targets and strategies.

Technical Comparison Summary Table

| Index | Number of Components | Weighting Method | Suitable For |

| Dow Jones Index (DJIA) | 30 | Price-weighted | Investors focusing on major blue-chip company movements |

| S&P 500 | 500 | Market-cap-weighted | Investors tracking the overall US economy |

Dow Jones Index Historical Highs and Lows

Exploring the historical highs and lows of the Dow Jones Index not only recalls past events but also provides a basis for historical comparison:

- In the 2020 pandemic low, the index once plunged to around 19,898 (March 18, 2020).

- On April 4, 2025, due to tariff tensions and market panic, the DJIA dropped 2,231 points in a single day, closing at 38,314 points.

- As of June 25, 2025, the index closed at 42,982.43, roughly flat compared to the beginning of the year (+1%).

In early January 2025, the DJIA rebounded to over 44,500 points, turning year-to-date returns positive. Compared to the pandemic low, the index still shows a recovery trend despite mid-2025 pullbacks.

2025 Latest Forecast and Market Outlook

The 2025 Dow Jones Index (DJIA) trend has drawn significant attention, with market forecasts showing mixed opinions. Some institutions, such as Deutsche Bank, predict that if the US economy achieves a soft landing and the Federal Reserve cuts rates, the DJIA may moderately rise by 8%–10%, targeting the 45,000–46,000 range. However, policy uncertainties (such as tariff policies under the Trump administration) and inflation risks could limit gains or even trigger corrections.

From a technical perspective, breaking above 43,200 points may signal a new upward trend, while falling below 41,500 points could indicate correction risks. Investors are advised to monitor Federal Reserve rate decisions and tech stock performance, while moderately allocating safe-haven assets to manage volatility.

How Can Taiwanese Investors Participate in the Dow Jones Index?

Taiwanese investors, although unable to buy US stocks directly, can trade CFD products tracking the DJIA through overseas brokers or cross-border platforms such as UM.

1. Buying Dow Jones-Related ETFs

Investors can purchase ETFs tracking the Dow Jones Index through Taiwanese brokers, such as the SPDR Dow Jones Industrial Average ETF (DIA). This method is suitable for long-term holding but requires currency exchange and is limited by trading hours.

2. Participating in Dow Jones Futures

Dow Jones futures are traded on the Chicago Board of Trade (CBOT) and are suitable for professional investors. Although they offer high leverage and strong liquidity, they require higher margin deposits and strict risk control, making the entry threshold relatively high.

3. CFD Trading

Through Ultima Markets, Taiwanese investors can trade CFDs with leverage up to 1:2000 using small capital, enabling both long and short operations to capture short-term index fluctuations. No physical asset ownership is required, making the process more flexible.

For beginners, it is recommended to first test trading strategies and get familiar with the platform to reduce actual risks.

Operation Example: Participating in a Bullish Trend with CFDs

Suppose you expect the DJIA to rebound to 46,000 points in the second half of 2025. You can open a long position via UM:

- After account opening, select the Dow Jones Index CFD and set stop-loss/take-profit levels

- Invest USD 5,000 with 1:200 leverage, enabling a notional position of USD 1,000,000

- If the DJIA rises from 43,000 to 46,000 (approximately a 7% increase), profits will be significantly magnified after deducting fees.

Conversely, understanding how the Dow Jones Index is calculated also helps design sound stop-loss and capital management strategies.

Risk Warnings and Investment Advice

Investing in the Dow Jones Index requires attention to:

Leverage Risk Control

High leverage means high potential returns but also magnified losses. Ultima Markets provides a 50% margin call level. It is recommended to set stop-loss points and use trailing take-profit functions to effectively manage risks.

Economic and Policy Risks

In the second half of 2025, uncertainties such as trade tariffs, inflation, and labor market changes remain. It is advisable to monitor monthly non-farm payroll data, CPI, and FOMC meeting results to adjust position strategies.

Emotions and Overtrading

Market news and price swings can trigger emotional reactions such as chasing highs and panic selling. It is recommended to practice trading strategies with a demo account. UM offers a stable trading environment and professional analysis tools, helping investors develop entry strategies and manage risks effectively.

Conclusion

Understanding what the Dow Jones Index is not only provides basic knowledge of the US stock market but also serves as a starting point for global asset allocation. Whether you are a conservative investor or a trader seeking swing opportunities, understanding the DJIA’s structure, operating principles, and market trends is the first step toward becoming a mature trader.

Through Ultima Markets, you can participate in US index movements at low cost, with support for EA automated trading and multiple funding options, helping you quickly get started, build positions flexibly, and stay updated with global economic trends. Open a demo account now and start your journey into US index trading.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.