Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

What Is a Spread in Trading? A Simple Guide

If you’ve ever opened a trading platform, you’ve likely seen two prices for the same asset — one for buying and one for selling. This difference between the prices is called the spread. But you might be asking, what is a spread in trading and why does it matter?

For beginners, spreads may seem like just another market term. In reality, they influence every trade you make, affecting costs, timing, and even strategy. This guide explains what a spread is, why it exists, why it matters, and how you can manage it to keep costs low.

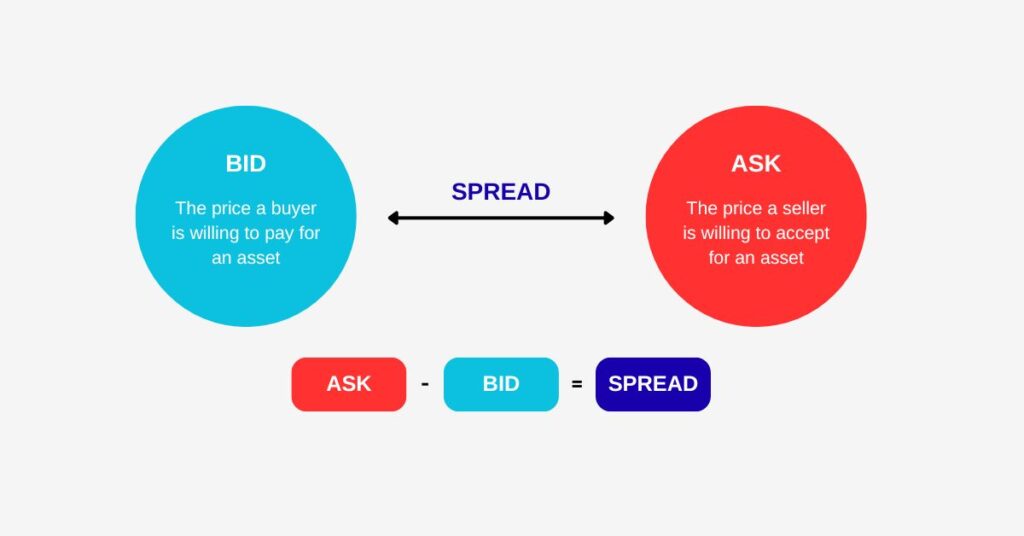

What Is a Bid Ask Spread in Trading?

A spread is simply the difference between two related prices, rates, or yields.

In most day-to-day trading, when people talk about the spread, they mean the bid–ask spread — the difference between the price you can buy an asset for (ask price, also known as the buy price) and the price you can sell it for (bid price (the price at which you can sell the asset, also known as the sell price)). Understanding both the buy and sell price is essential for analyzing trading costs.

Example:

If EUR/USD is quoted at 1.1000 / 1.1002, the spread is 0.0002 — that’s 2 pips in forex terms. The spread depends on factors such as market liquidity, volatility, and the asset being traded.

Why Do Spreads Exist?

Many beginners think spreads are just a hidden fee. In reality, they are a normal part of how markets work.

Broker Compensation

“No commission” brokers earn money through the spread instead of charging a separate fee. They sell currency to you for slightly more than they bought it and buy from you for slightly less than they can sell it for.

Transaction Immediacy

The spread is the price for getting your trade executed instantly. Without it, you’d have to wait for a buyer or seller to meet your exact price.

Market-Making Costs

Market makers take on risk by holding currency positions to keep the market liquid. The spread compensates them for this service.

Think of it like selling a used phone to a shop: they’ll buy it for less than the price they plan to sell it for. That small difference is their profit — just like the spread for your broker.

How Is the Spread Measured?

Spreads in forex are measured in pips — the smallest unit of price movement.

- For most currency pairs, 1 pip = 0.0001.

- For pairs with the Japanese yen, 1 pip = 0.01.

Example:

- EUR/USD at 1.1051 / 1.1053 → spread = 2 pips.

- USD/JPY at 110.00 / 110.04 → spread = 4 pips

Types of Spreads

Fixed Spread

Fixed spreads remain the same regardless of market volatility, typically being offered by market maker (dealing desk) brokers.

- Pros: Predictable costs. Fixed spreads provide traders with consistent transaction costs, especially during normal market conditions.

- Cons: May be slightly higher than variable spreads during calm markets.

Variable (Floating) Spread

Variable spreads changes depending on market conditions. They are usually offered by non-dealing desk brokers using multiple liquidity providers.

- Pros: Can be very low during periods of high liquidity.

- Cons: Subject to spread fluctuations, and can result in a wider spread during volatility or low trading volume.

What Affects the Size of a Spread?

Several factors can influence how tight or wide a spread is:

| Factor | Impact |

| Liquidity | High liquidity = tighter spreads; low liquidity = wider spreads. Fewer market participants can lead to wider spreads. |

| Volatility | Sudden market moves often cause spreads to widen. Economic uncertainty can also cause spreads to widen. |

| Asset Type | Major forex pairs like EUR/USD usually have lower spreads than exotic pairs. A forex pair’s spread is influenced by currency exchange rates and the asset’s price. In futures contracts, the spread is often the price difference between two contracts. |

| Trading Hours | Spreads are narrower during major market overlaps (e.g., London–New York). Tight spreads are more common when there are more market participants. |

The spread depends on a combination of these factors.

How to Calculate the Cost of the Spread

Now that you understand what a spread in trading is and why it matters, let’s see how to calculate the actual cost so you can factor it into your trades. All you need are:

- Spread size (in pips)

- Pip value for your trade size

Pip value examples:

- Standard lot (100,000 units) – 1 pip ≈ $10

- Mini lot (10,000 units) – 1 pip ≈ $1

- Micro lot (1,000 units) – 1 pip ≈ $0.10

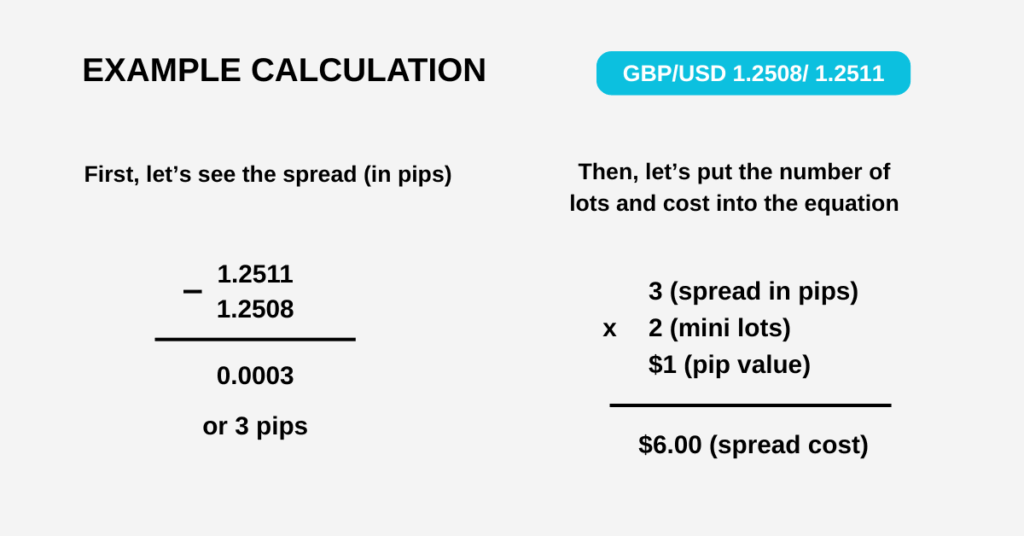

Example calculation:

GBP/USD quoted at 1.2508 / 1.2511 → spread = 0.0003 = 3 pips

Trading 2 mini lots (pip value $1):

Cost = 3 × $1 × 2 = $6.00

If you trade a standard lot instead:

Cost = 3 × $10 = $30.00

As you can see, the bigger your trade size, the more the spread cost impacts your bottom line — a key reason why traders aim for tighter spreads whenever possible.

How to Reduce Spread Costs

Reducing transaction costs is a key goal for traders.

Trade During High Liquidity – For forex, this is often the London–New York overlap.

Avoid Low-Liquidity Times – Such as just before market close or during major holidays.

Compare Brokers – Look for competitive spreads for your preferred trading instruments. Choosing brokers with a tighter spread can help minimize transaction costs.

Use Limit Orders – Especially during volatile periods to avoid paying extra when spreads widen.

Conclusion

The spread may seem small, but over time it can make a big difference to your trading results. By understanding what it is, why it exists, and how to calculate its cost, you’ll be better equipped to choose the right broker, trade at the right times, and keep more of your profits to yourself!

Key Takeaways

- A spread in forex is the difference between the bid (sell) and ask (buy) price.

- It’s a built-in cost, measured in pips, and varies by market conditions.

- Fixed spreads offer predictability; variable spreads can be lower but less stable.

- Understanding how to calculate spread costs helps you manage risk and keep trading expenses low.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.