Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

What Is a Reverse Stock Split?

A reverse stock split is a corporate action where a company reduces the number of its outstanding shares by combining them into fewer, higher-priced shares. While the share price rises in proportion to the split ratio, the company’s overall market value (market capitalization) does not change.

How Does a Reverse Stock Split Work

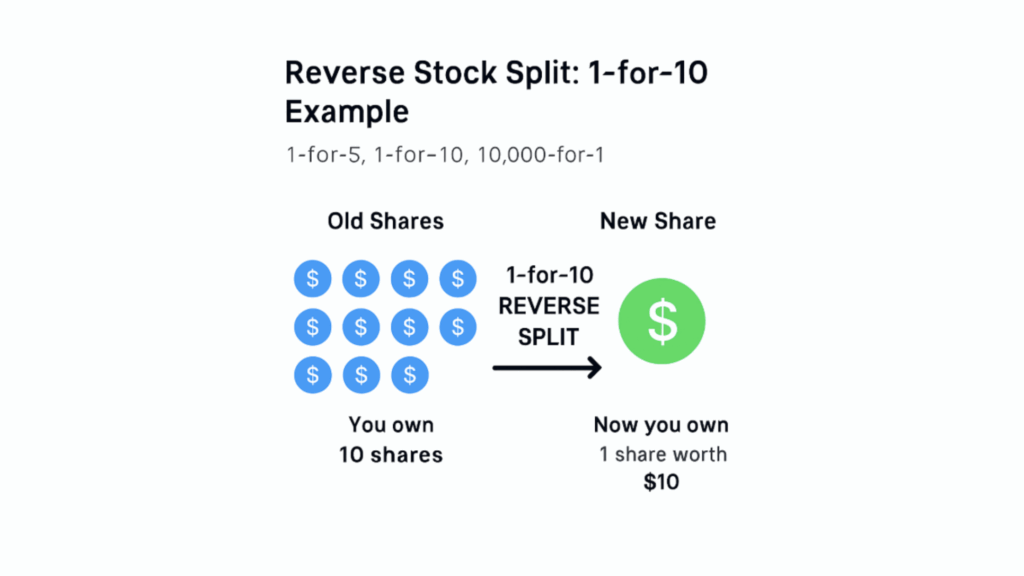

A reverse stock split is essentially a share consolidation. Here’s how the process works step by step:

Company Announces the Split Ratio

The board of directors decides on a ratio such as 1-for-5, 1-for-10, or even larger like 10,000-for-1. This ratio determines how many old shares will be merged into one new share. Example: In a 1-for-10 split, 10 existing shares become 1 new share.

Shareholder Holdings Are Adjusted

On the effective date, every shareholder’s account is recalculated based on the ratio. If you had 1,000 shares at $1 each, after a 1-for-10 split you’ll have 100 shares at $10 each. Your total holding value is still $1,000 (before market movement).

Stock Price Adjusts Automatically

The stock price rises in proportion to the split ratio. This adjustment happens instantly once trading resumes on a split-adjusted basis. A $0.50 stock in a 1-for-20 split becomes a $10 stock. Importantly, the company’s market capitalization (shares × price) does not change.

Stock Price Adjusts Automatically

The stock price rises in proportion to the split ratio. This adjustment happens instantly once trading resumes on a split-adjusted basis. A $0.50 stock in a 1-for-20 split becomes a $10 stock. Importantly, the company’s market capitalization (shares × price) does not change.

Fractional Shares Are Handled

Reverse splits rarely result in perfect round numbers:

- Some companies round up fractional shares so investors keep at least one whole share.

- Others pay cash in lieu of fractions, removing very small investors if their holdings are too small to survive the split.

Regulatory Oversight and Exchange Rules

In the U.S., reverse stock splits require proper disclosure through the SEC and often shareholder approval. Exchanges like NASDAQ and NYSE have rules:

- In 2025, the SEC approved new rules limiting how often companies can use reverse splits to stay compliant.

- Nasdaq now requires at least 10 calendar days’ notice before the split takes effect.

- Certain automatic delisting appeal protections were removed, meaning compliance matters more than ever.

Effective Date and Trading Impact

When the split becomes effective:

- Trading starts at the new price, adjusted by the ratio.

- Ticker symbols sometimes change temporarily (adding a “D” on NASDAQ to indicate a split).

- A new CUSIP number is assigned to identify the split-adjusted shares.

Real-World Investor Impact

For investors, the economic value does not change at first. What matters is how the market interprets the move:

- Positive View: Regaining compliance, attracting institutions, restoring credibility.

- Negative View: Seen as a signal of weakness or financial distress.

For example:

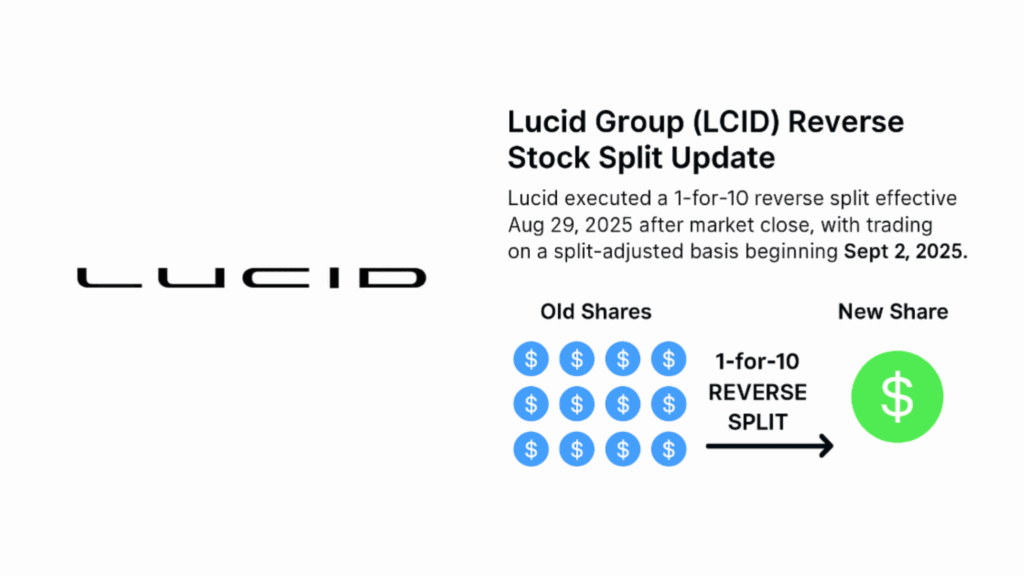

- Lucid (LCID) did a 1-for-10 reverse split in August 2025 to raise its price above $5.

- Atos (France) launched a massive 10,000-for-1 split in April 2025 as part of restructuring.

A reverse stock split works by reducing share count, raising the stock price, and leaving market cap unchanged. It’s a technical fix, not a business solution, the fundamentals of the company remain the same, so investors should look at why the split is happening.

Advantages of Reverse Stock Splits

Regain Listing Compliance

Exchanges like NASDAQ require a minimum bid price (often $1). A reverse stock split boosts the share price, helping companies avoid delisting.

Improved Perception

Very low-priced “penny stocks” carry stigma. A higher share price may signal stability and attract a wider base of investors.

Institutional Investor Access

Some funds and brokers have policies against buying stocks under a certain price. Raising the stock above that threshold can expand the potential shareholder base.

Reduced Volatility

Low-priced shares often swing wildly. Fewer shares trading at higher prices may reduce speculative volatility.

Disadvantages of Reverse Stock Splits

Negative Market Signal

Often, companies turn to reverse splits after their stock price has dropped sharply. Investors may see it as a red flag for underlying weakness.

Liquidity Concerns

With fewer shares available, trading volume may shrink and bid-ask spreads may widen, making trades less efficient.

No Change in Fundamentals

A reverse split does not solve business challenges. If a company’s financial problems persist, the stock can continue to decline even after the split.

Fractional Share Issues

Small shareholders may be cashed out if their holdings don’t fit the split ratio, inconvenient if they wish to stay invested.

Real-World Examples of Reverse Stock Splits

These cases show reverse splits are often linked to financial stress, but also to strategic restructuring.

Lucid Group (LCID)

Lucid executed a 1-for-10 reverse split effective Aug 29, 2025 after market close, with trading on a split-adjusted basis beginning Sept 2, 2025. The action was part of efforts to raise its share price and improve market positioning amid financial challenges.

Atos (France)

French IT group Atos launched a 10,000-for-1 reverse split in March–April 2025, effective Apr 24, 2025, consolidating its stock to support restructuring and restore investor confidence.

Key Rule Updates for Reverse Stock Splits

In early 2025, the U.S. Securities and Exchange Commission (SEC) approved new rules for NASDAQ and NYSE that directly affect reverse stock splits:

Frequency Restrictions

Companies can no longer repeatedly reverse split shares within short periods to regain minimum bid compliance.

Advance Notice Requirements

Nasdaq now requires at least 10 calendar days’ notice before a reverse split takes effect.

Delisting Appeals

Exchanges eliminated certain automatic stays during appeals, making delisting faster if compliance isn’t met.

These changes were introduced to prevent overuse of reverse stock splits as a quick fix, ensuring companies focus on fundamentals rather than technical maneuvers.

Examples of Ratios and Shareholder Impact

| Split Ratio | Pre-Split Shares | Post-Split Shares | Pre-Split Price | Post-Split Price* | Investment Value |

| 1-for-5 | 500 | 100 | $2 | $10 | $1,000 |

| 1-for-10 | 1,000 | 100 | $1 | $10 | $1,000 |

| 10,000-for-1 | 10,000,000 | 1,000 | €0.0001 | €1 | €1,000 |

Conclusion

A reverse stock split is a mechanical adjustment that changes how shares are counted and priced, but it doesn’t alter a company’s fundamentals. While it can help firms maintain compliance and attract new investors, it also signals that deeper business challenges may exist. For traders, the key is not just understanding how a reverse split works, but also why it’s happening.

At Ultima Markets, we believe informed trading decisions start with clear, reliable education. Through our market insights and trading academy, we help investors navigate complex financial events from reverse stock splits to central bank policies with transparency and purpose. With us, you trade with knowledge, confidence, and responsibility.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.