Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteExchange-traded funds (ETFs) have grown into one of the most popular investment tools in global markets. They combine diversification, liquidity, and accessibility. But for traders who want to amplify short-term returns, there is a more advanced version: the leveraged ETF.

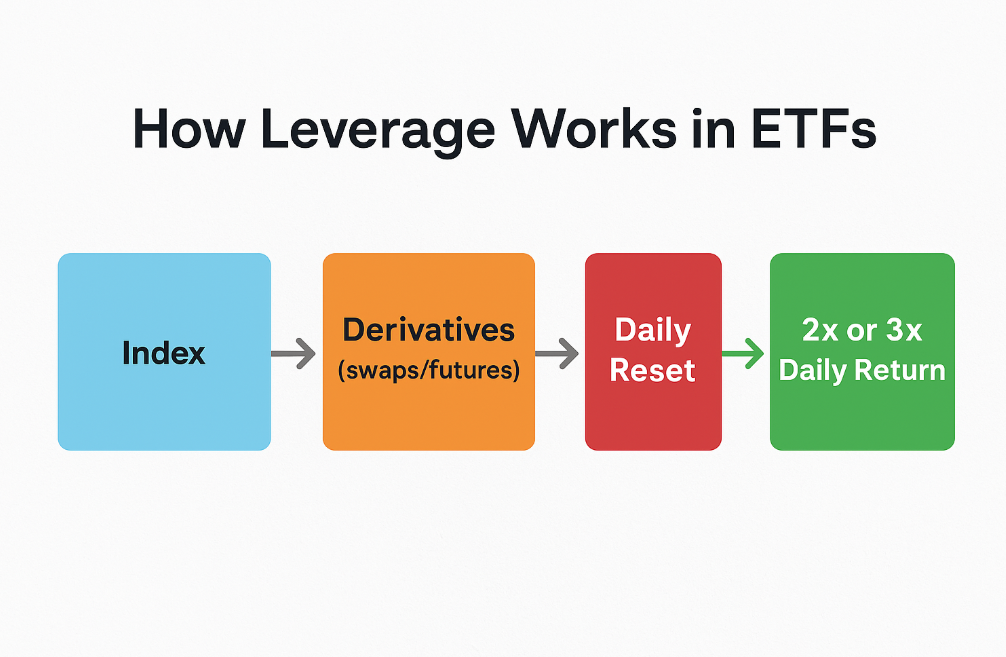

A leveraged ETF uses financial engineering to magnify the daily performance of an index or asset. These funds can deliver double or triple the movement of their benchmark, but the same leverage also multiplies risk. Before trading them, investors should understand how leverage works, the cost of leverage, and why these products are best suited for short-term strategies.

What Is a Leveraged ETF?

A leveraged ETF is an exchange-traded fund that uses derivatives such as futures and swaps to amplify the daily performance of an index, usually by 2x or 3x. These funds allow traders to magnify gains but also increase losses, making them short-term tools for experienced investors rather than long-term holdings.

For example:

- If the S&P 500 rises 1% in a day, a 3x leveraged ETF tracking the index may rise about 3%.

- If the index falls 1%, that same ETF may fall about 3%.

Because the leverage resets daily, long-term performance often diverges from expectations. A leveraged ETF held for weeks or months can deliver very different results compared to simply multiplying the benchmark’s return.

The Leverage in Leveraged ETF

The “leverage” in a leveraged ETF comes from using financial derivatives such as swaps, futures, and options combined with borrowing strategies to magnify daily exposure to an index. Instead of directly holding all the stocks in the index, the fund uses these instruments to achieve two times (2x) or three times (3x) the benchmark’s daily return.

Fund managers rebalance positions at the end of each trading day to maintain the promised leverage ratio. For example, if a 3x ETF tracks the S&P 500, the portfolio is adjusted daily to stay close to three times the index’s daily move.

This daily reset is critical:

- In a strong trending market, the compounding effect of daily gains can boost returns beyond expectations.

- In volatile markets, however, frequent ups and downs can cause the ETF to lose value even if the index ends flat over time.

This phenomenon is known as volatility decay or compounding drag, and it explains why leveraged ETFs behave very differently from simply multiplying the index’s long-term performance.

For traders, this means leveraged ETFs are best suited for short-term directional bets, not for passive investing.

Cost of Leverage

While leveraged ETFs offer the appeal of amplified returns, the cost of leverage can eat into performance over time. These costs are not always obvious, but they are significant:

Management Fees

Leveraged ETFs typically charge higher expense ratios compared with traditional ETFs. For example, many plain-vanilla index ETFs have fees under 0.10%, while leveraged ETFs often range between 0.90% and 1.00% annually.

Derivative Costs

Since leveraged ETFs rely on swaps, futures, and other contracts to gain exposure, the fund must pay financing costs and roll over contracts, which adds to expenses.

Compounding Drag

The biggest hidden cost comes from the daily reset. In volatile markets, the compounding effect can reduce returns, even if the underlying index ends flat. This “volatility decay” is a direct cost to long-term holders.

Trading Costs

Leveraged ETFs tend to have wider bid-ask spreads than high-volume ETFs, meaning traders can lose value simply from entering and exiting positions.

Liquidity Risks

While many leveraged ETFs are liquid, some niche products may have lower trading volumes. Thin liquidity can increase slippage and further raise trading costs.

While these costs may appear small on a single day, they accumulate quickly, especially if positions are held for weeks.

Traditional ETF vs Leveraged ETF

Traditional ETFs are designed for long-term investors who want to track an index at low cost, while leveraged ETFs are built for traders seeking amplified daily returns. The key difference lies in holding period, risk, and cost, making it important to understand how these two products serve very different purposes.

Leveraged ETFs reset daily, so compounding effects can distort long-term performance. They’re not ideal for buy-and-hold investors due to volatility decay. Best used with tight risk controls, especially in volatile markets.

| Feature | Traditional ETF | Leveraged ETF |

| Objective | Match index performance | Amplify daily index returns (2x, 3x) |

| Holding Period | Long-term | Short-term (days) |

| Risk Level | Moderate | High |

| Costs | Low expense ratio | Higher expense ratio + derivative costs |

| Effect of Volatility | Minimal | Volatility decay over time |

- Traditional ETF: $VOO tracks the S&P 500. If the index rises 1%, VOO rises ~1%.

- Leveraged ETF: $SPXL aims for 3× the S&P 500’s daily return. If the index rises 1%, SPXL rises ~3% but if it drops 1%, SPXL drops ~3%.

Leveraged ETFs Are Short-Term Instruments

Leveraged ETFs are designed to achieve their stated objective 2x or 3x the return of an index on a daily basis. This daily reset makes them effective for short-term trades but risky as long-term investments.

Here’s why they are considered short-term instruments:

Daily Reset and Compounding

Every day, the ETF rebalances to maintain its leverage ratio. Over multiple days, the effect of compounding means returns may diverge significantly from the index. For instance, an index that rises 10% over a month does not guarantee a 3x ETF will rise 30%.

Volatility Decay

In choppy or sideways markets, leveraged ETFs can lose value even when the index ends flat. This happens because each swing up or down, is magnified, and the compounding effect chips away at performance.

Issuer Guidance

Most fund providers clearly state in their prospectuses that leveraged ETFs are not intended for buy-and-hold strategies. They recommend these products only for traders who can monitor positions closely.

Practical Trading Use

Traders often use leveraged ETFs for day trading, swing trading, or tactical hedging. For example, a trader expecting a short-term rally in technology stocks may use TQQQ (3x Nasdaq-100 ETF) to capture that move. But holding TQQQ for months exposes them to unnecessary volatility decay.

Pros and Cons of Leveraged ETFs

Like any trading instrument, leveraged ETFs have both advantages and disadvantages. Understanding both sides helps traders decide whether these products fit their strategies.

Pros

- Amplified returns – capture 2x or 3x the daily move of an index.

- Capital efficiency – achieve larger exposure with less invested cash.

- Liquidity – listed on major exchanges and trade like regular ETFs.

- Hedging opportunities – inverse leveraged ETFs allow traders to profit in down markets.

Cons

- High risk – losses are magnified in the same way as gains.

- Not long-term friendly – performance can erode over time due to compounding.

- Higher costs – both in management fees and derivative expenses.

- Volatility drag – choppy price action can quickly reduce fund value.

Example of Leveraged ETF

One of the most widely traded leveraged ETFs is the ProShares UltraPro QQQ (TQQQ). This fund seeks to deliver 3x the daily performance of the Nasdaq-100 Index.

Here’s how it works:

- If the Nasdaq-100 rises 2% in a single day, TQQQ aims to rise around 6%.

- If the Nasdaq-100 falls 2%, TQQQ could drop about 6%.

This makes TQQQ attractive to traders who expect strong short-term trends in technology stocks, but it can also lead to rapid losses if the market turns volatile.

Conclusion

Leveraged ETFs are powerful but complex trading instruments. They allow investors to magnify daily returns of an index through the use of derivatives, but this leverage also increases costs, risks, and the chance of compounding losses. For that reason, they are best treated as short-term tactical tools, not long-term investments.

For traders looking to explore advanced products like leveraged ETFs, choosing a trusted and regulated broker is essential. At Ultima Markets, we are committed to providing transparent education, reliable trading platforms, and regulatory security so you can trade with confidence. With us, you don’t just trade, you trade with purpose.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.