Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteTrading in the forex market requires a clear understanding of margin. Margin is the capital that a trader must set aside to open and maintain a position. A forex margin calculator simplifies this process by giving instant and accurate results, helping traders avoid mistakes and manage risk effectively.

What Is a Forex Margin Calculator?

A forex margin calculator is a risk management tool that tells you how much margin is needed to open a position. It uses variables such as:

- Trading instrument (e.g., forex, indices, commodities)

- Lot size (volume of your trade)

- Leverage (the multiplier applied to your capital)

- Account base currency (USD, EUR, GBP, etc.)

Instead of manually applying formulas, which can be complex and error-prone, the calculator provides precise results in seconds.

How Does a Forex Margin Calculator Work?

The standard margin calculation formula is:

Margin = (Lot Size × Contract Size × Market Price) ÷ Leverage

- Lot Size: Standard forex contracts are 100,000 units of the base currency.

- Market Price: The current exchange rate of the pair.

- Leverage: The ratio that determines how much capital is required upfront.

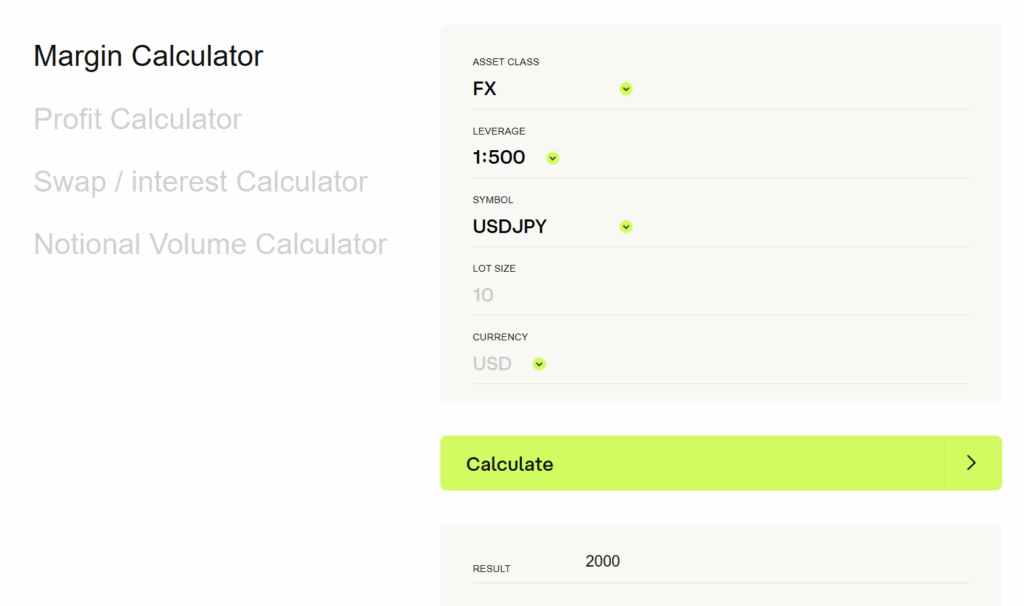

Example Using Ultima Markets’ Margin Calculator

Let’s calculate using the Ultima Markets Trading Calculator:

- Asset Class: FX

- Symbol: USD/JPY

- Leverage: 1:500

- Lot Size: 10

- Base Currency: USD

Result: 2,000 USD

This means you need $2,000 margin to open a position of this size. Without leverage, the margin would have been much higher, demonstrating how leverage reduces the upfront capital required.

Importance of Leverage in Margin Calculations

Leverage determines how much of your own capital you need to commit as margin. It is essentially a multiplier that allows traders to control positions larger than their account balance. The higher the leverage, the smaller the margin requirement.

How Leverage Affects Margin

High Leverage (e.g., 1:500):

- Requires less margin for the same trade size.

- Example: A $100,000 trade with 1:500 leverage needs only $200 margin.

- Increases potential profit, but also magnifies losses.

Low Leverage (e.g., 1:50):

- Requires more margin for the same trade size.

- Example: A $100,000 trade with 1:50 leverage needs $2,000 margin.

- Reduces risk exposure but ties up more capital.

Let’s look at the previous example again

Asset Class: FX, Symbol: USD/JPY, Lot Size: 10, Base Currency: USD

| Leverage | Require Margin |

| 1:50 | $20,000 |

| 1:100 | $10,000 |

| 1:200 | $5,000 |

| 1:500 | $2,000 |

This table shows how leverage drastically changes margin requirements for the same trade.

A margin calculator helps traders visualise this trade-off, empowering them to make informed decisions about risk and capital allocation.

Advantages of Using Trading Calculators

A forex margin calculator offers several benefits:

- Accuracy: Eliminates manual errors in margin calculations.

- Efficiency: Provides instant results for different instruments and trade sizes.

- Risk Control: Helps traders anticipate margin calls by knowing exact requirements.

- Multi-Asset Capability: Advanced calculators, like Ultima Markets’, work across forex, indices, and commodities.

Conclusion

A forex margin calculator is not just a convenience tool. It is a core part of risk management. By showing the exact margin required for each trade, it helps traders plan better, avoid costly mistakes, and maintain discipline.

With tools like the Ultima Markets Margin Calculator, you can calculate requirements instantly across forex, indices, and commodities, making it easier to focus on strategy while keeping your capital protected.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.