Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWhat is a Carry Trade and How it Works

Carry trading is a popular strategy among forex traders that allows them to profit from interest rate differentials between two currencies. The concept of a carry trade is simple: borrow money in a currency with a low interest rate and invest it in a currency that offers a higher interest rate. This strategy can lead to steady returns, but it also comes with risks that traders must manage carefully.

In this article, we’ll explore how carry trades work, the potential advantages and risks, and how recent developments in global monetary policies are shaping the future of carry trading.

What Is a Carry Trade?

A carry trade involves borrowing money in a currency with a low-interest rate, known as the funding currency, and using it to invest in a currency with a higher interest rate, referred to as the target currency. Traders profit from the interest rate differential, which is the difference between the rate paid on the borrowed currency and the rate earned on the invested currency.

For example, suppose a trader borrows Japanese yen (JPY), which historically has low interest rates, and uses the funds to buy Australian dollars (AUD), which offer higher interest rates. The trader earns interest on the AUD position while paying a lower rate on the borrowed yen. If the AUD appreciates against the yen, the trader can also benefit from the capital gain in addition to the interest differential.

How Does Carry Trade Work?

The mechanics of a carry trade can be broken down into a few simple steps:

- Borrow in a low-interest-rate currency: Currencies such as the Japanese yen (JPY), Swiss franc (CHF), and European euro (EUR) are popular choices due to their historically low interest rates.

- Invest in a high-interest-rate currency: The borrowed funds are used to buy a currency that offers a higher yield, such as the Australian dollar (AUD), New Zealand dollar (NZD), or other emerging market currencies.

- Earn the interest differential: The trader earns interest on the higher-yielding currency while only paying interest on the borrowed funds. The difference between these two is the trader’s profit, known as the carry.

- Currency appreciation: If the target currency appreciates relative to the funding currency, the trader can also profit from the currency movement in addition to the interest differential.

Let’s consider an example:

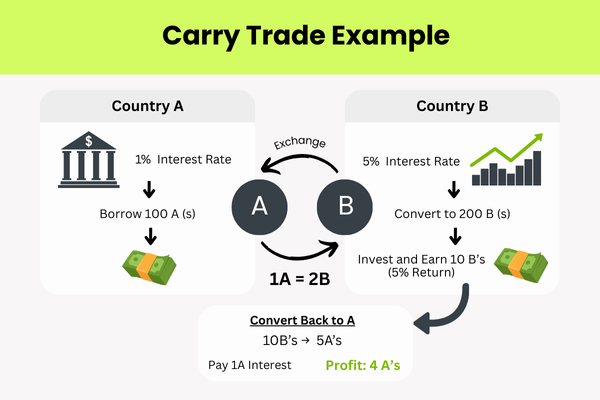

Example of a Carry Trade in Action

Imagine that country A is experiencing economic stagnation, with low-interest rates set by its central bank (1% interest rate). Meanwhile, in country B, interest rates are much higher (5%). A trader can borrow 100 units of country A’s currency (let’s call it “A”) and exchange it for 200 units of country B’s currency (let’s call it “B”), based on the current exchange rate of 1 A = 2 B.

The trader then invests the 200 B’s and earns 5% interest on the investment, which equals 10 B’s annually. If the exchange rate remains constant, the trader can convert the 10 B’s into 5 A’s at the same exchange rate. However, the trader only owes 1 A in interest for the borrowed currency, resulting in a profit of 4 A’s (the carry).

This simple process of borrowing in a low-interest-rate currency and investing in a high-interest-rate currency, while also benefiting from any currency appreciation, is the core of the carry trade strategy.

Advantages and Risks of Carry Trading

Carry trades are attractive because they offer the potential for steady returns through interest rate differentials. However, they also come with several risks that traders need to manage. Below is a comparison of the advantages and risks of carry trading, followed by detailed explanations.

| Advantages | Risks |

| Steady Returns: Traders can generate consistent returns from the interest rate differential, especially when the difference between the two currencies is large. | Currency Risk: If the funding currency appreciates against the target currency, the trader’s profits can be wiped out, even with a favorable interest rate differential. |

| Leverage: Carry trades allow traders to leverage borrowed capital, controlling larger positions and amplifying potential profits. | Interest Rate Changes: A change in central bank policies could alter the interest rate differential, impacting profitability. For example, if the funding currency’s rate rises, the cost of borrowing increases. |

| Diversification: Carry trading offers a way to diversify portfolios. Profits are generated from interest rate differences and currency movements, which do not always correlate with other market assets. | Market Volatility: Carry trades perform best in stable, low-volatility markets. Sudden geopolitical events or financial crises can lead to rapid currency fluctuations and potential losses. |

| Exposure to Emerging Markets: Traders can gain exposure to emerging market currencies that often offer higher interest rates than developed market currencies. | Liquidity Risk: During periods of market stress, liquidity can dry up, making it harder to exit positions at favorable prices. This can result in slippage and increased trading costs. |

How Global Monetary Policies Impact Carry Trades

The success of carry trades is heavily influenced by global monetary policies. Central banks set interest rates and determine monetary policy, which can create or reduce interest rate differentials.

Central Bank Moves: The Case of Japan

In recent years, the Bank of Japan (BoJ) has maintained ultra-low interest rates to stimulate its economy. This has made the Japanese yen a popular funding currency for carry traders.

However, with Japan’s increasing pressure to raise rates due to inflationary pressures, the profitability of yen-funded carry trades may diminish. If the BoJ raises rates, the interest rate differential between Japan and other countries could narrow, reducing the attractiveness of borrowing in yen.

Federal Reserve and US Dollar

The US Federal Reserve’s rate decisions also have a significant impact on carry trading strategies. In 2025, the US saw a weakening dollar, which further encouraged carry trades using higher-yield currencies. However, the Fed’s policies are unpredictable, and any significant changes in the US interest rate policy could alter the profitability of dollar-based carry trades.

Key Strategies to Maximize Carry Trade Profits

To increase the chances of success with carry trading, traders should focus on:

- Interest Rate Monitoring: Keep a close eye on central bank decisions and interest rate movements. Large interest rate differentials between countries drive the profitability of carry trades.

- Risk Management: Carry trades can be highly volatile. Traders should implement stop-loss orders, monitor exchange rate fluctuations, and ensure proper position sizing to manage risk effectively.

- Diversification: Avoid concentrating on a single currency pair. Diversify across different currency pairs to spread risk and capture opportunities in various markets.

- Stay Informed: Keep track of economic indicators and geopolitical events that could impact exchange rates. Central bank policies and market conditions can change rapidly, so it’s essential to stay flexible.

Conclusion

Carry trading remains a powerful strategy for traders looking to profit from interest rate differentials between currencies. By borrowing in low-interest-rate currencies and investing in higher-yielding currencies, traders can earn a stable return while potentially benefiting from favorable currency movements. However, the strategy is not without risks, especially when it comes to exchange rate fluctuations and changes in central bank policies.

By carefully monitoring interest rate movements, central bank decisions, and currency markets, traders can successfully navigate the complexities of carry trading. As global economic conditions evolve in 2025 and beyond, the opportunities and risks associated with carry trades will continue to shape this strategy’s future.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.