Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWhat is a Break of Structure (BOS)?

A break of structure (BOS) happens when price moves beyond a key swing high or swing low, showing that the market trend is either continuing or shifting.

- In an uptrend, a close above the last swing high confirms buyers are still in control.

- In a downtrend, a close below the last swing low shows sellers remain dominant.

Unlike minor fluctuations, a BOS signals a meaningful shift in momentum. Traders use it to time entries and exits, manage risk, and align their trades with the broader market flow.

Market Structure: The Foundation

Before applying BOS, it’s important to understand market structure, which is the way price movements are organised on a chart. Market structure reveals whether the market is trending, ranging, or preparing for a shift.

Key elements such as support and resistance levels, trend lines, and swing highs/lows help traders interpret price action. By recognising structure, traders can make more informed decisions, spot high-probability setups, and adapt their strategy across different market, from forex to stocks to crypto.

How Market Structure Relates to the Break of Structure

Market structure describes the rhythm of price movement. Whether the market is trending upward, trending downward, or moving sideways. Within this rhythm, a break of structure (BOS) is one of the clearest signals of change.

When price breaks above a previous swing high in an uptrend or below a swing low in a downtrend, it confirms that the existing structure is intact and the trend remains valid. In other words, BOS acts as proof that the market structure is continuing in its current direction.

At the same time, when a BOS fails to hold or is followed by a change of character (CHOCH), it may suggest the structure is weakening and a reversal could be forming.

This is why BOS cannot be studied in isolation. It is a tool for reading market structure in real time, helping traders distinguish between simple noise and meaningful shifts in supply and demand.

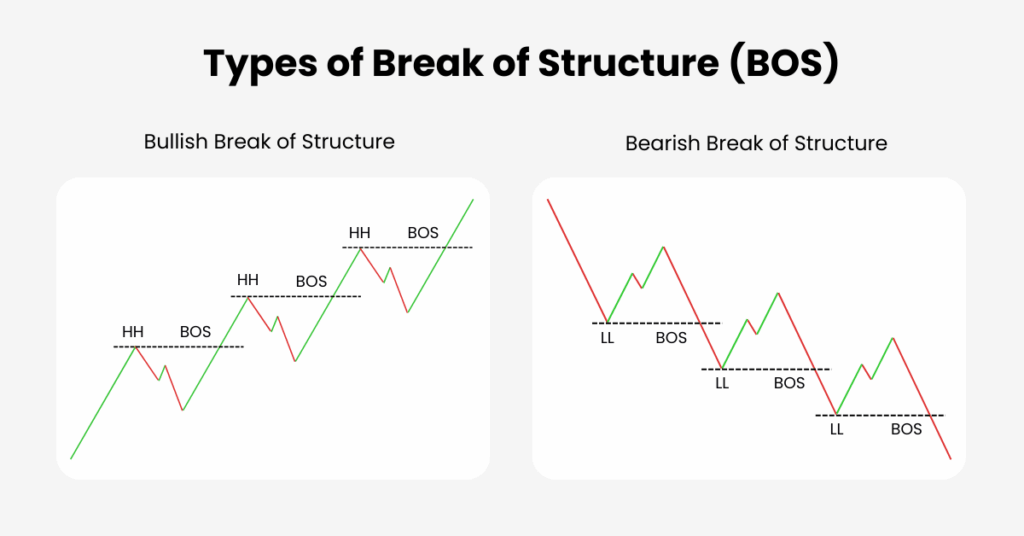

Types of BOS

There are three main types of BOS that traders should understand:

- Bullish BOS occurs when price breaks above a previous high, confirming upward momentum.

- Bearish BOS occurs when price breaks below a previous low, reinforcing downward pressure.

- False BOS (Fakeout) happens when price briefly breaks a level but quickly returns, often trapping traders who enter too early.

To avoid being caught in fakeouts, many traders wait for confirmation, such as a strong candle close or a retest of the level.

From BOS to CHOCH

Once you understand BOS as a signal of continuation, the natural next question is: what if the structure doesn’t hold? This is where the change of character (CHOCH) comes in.

While BOS shows the trend is intact, CHOCH warns that momentum may be shifting. For example:

- In a downtrend, a bullish CHOCH occurs when price breaks above the last lower high — the first sign that sellers are losing control.

- In an uptrend, a bearish CHOCH happens when price breaks below the last higher low — a warning that buyers may be weakening.

BOS helps you trade with the trend. CHOCH helps you anticipate reversals. Together, they provide a complete view of how market structure evolves.

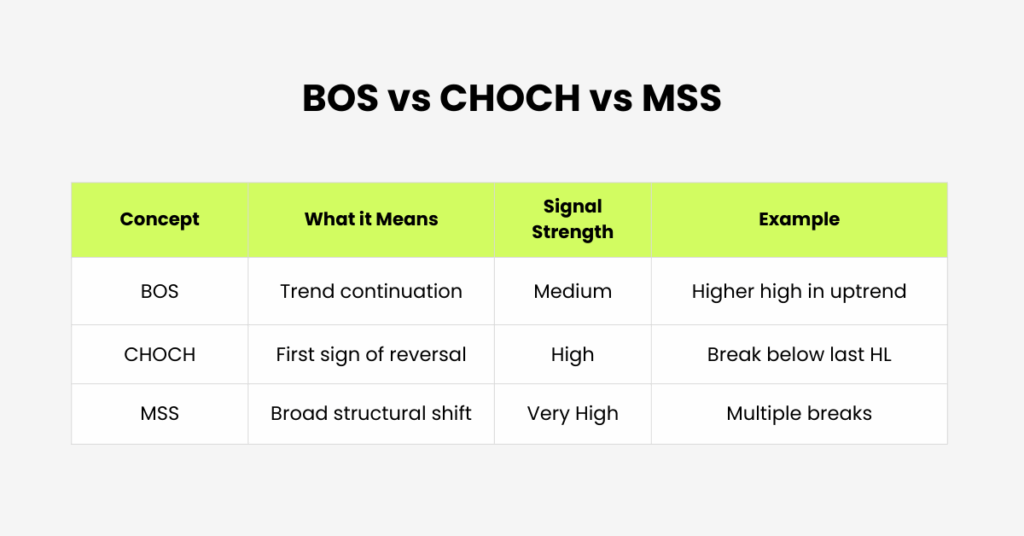

BOS vs CHOCH vs Market Structure Shift (MSS)

It’s easy to confuse these concepts, but they serve different roles in market structure trading. A break of structure (BOS) confirms that the trend is continuing. A CHOCH suggests the first crack in the current direction and a potential reversal. A Market Structure Shift (MSS) goes one step further, describing a broad and more permanent change in direction that usually requires multiple breaks before being confirmed.

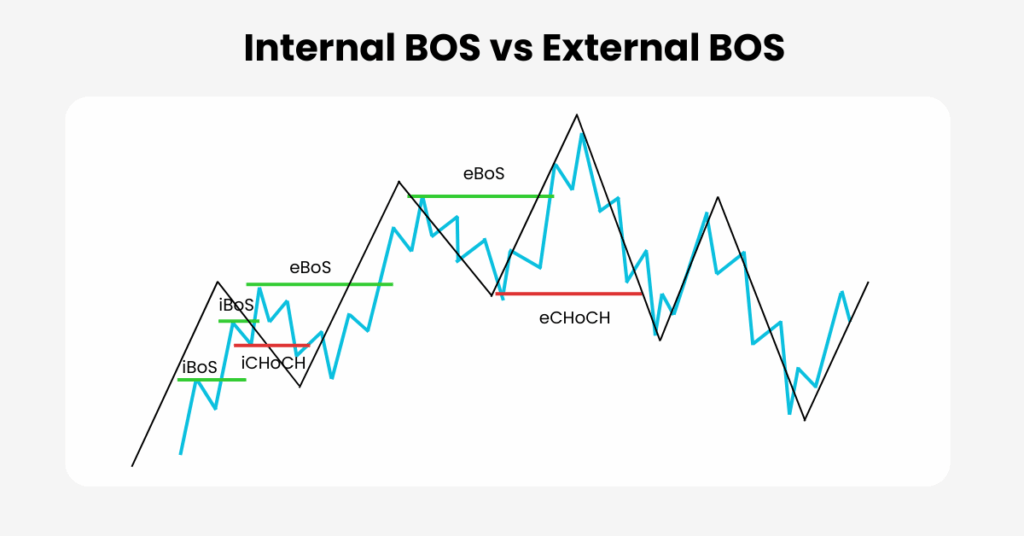

Internal vs External BOS and CHOCH

Not all structure breaks carry the same weight. External BOS/CHOCH on higher timeframes such as daily or weekly charts tend to be stronger signals, pointing to major market shifts. Internal BOS/CHOCH, on lower timeframes such as the 15-minute or hourly charts, are weaker but provide early warnings and precise entry timing. Combining both views allows traders to match long-term direction with short-term execution.

Trading Strategy with BOS and CHOCH

A structured approach to BOS and CHOCH trading typically follows these steps:

- Identify the prevailing trend.

- Watch for BOS in the direction of that trend.

- Be alert to CHOCH as the first warning of a reversal.

- Use confirmations such as retests, strong closes, or additional indicators.

- Place stop losses beyond the invalidation point.

- Take profit at the next structure level or scale out gradually.

Some traders prefer waiting for a retest of the broken level, which often provides a safer entry. Others may enter aggressively on momentum after a strong break, though this requires tighter risk control.

Best Timeframes and Markets

The break of structure approach works across forex, stocks, and cryptocurrencies, because structure is universal. Lower timeframes like M5 or M15 are useful for scalpers and day traders, while higher timeframes such as H4, daily, or weekly charts give stronger, more reliable signals for swing and position trading.

Common Mistakes in Structure Trading

Many traders stumble when applying BOS and CHOCH because they fall into predictable traps. Some of the most common mistakes include:

- Entering every small break without waiting for confirmation, leading to false entries.

- Ignoring higher timeframe structure and trading against the bigger trend.

- Placing stop losses too close to the level, or worse, skipping them altogether.

- Over-leveraging trades and risking too much on one setup.

- Relying solely on indicators instead of using them as support for price action.

By being aware of these pitfalls, traders can approach BOS and CHOCH with more discipline and improve their long-term consistency.

Why Market Structure Matters

Market structure is the language of price action. By learning to read the break of structure (BOS) and CHOCH, traders can filter out noise and focus on the most meaningful shifts in supply and demand. This gives clarity when planning trades, improves timing for entries and exits, and provides a framework for managing risk.

In short, structure trading is not about predicting every tick of movement but about recognising when the market shows its hand.

Key Takeaways

A break of structure confirms continuation, while a change of character often marks the first step toward reversal. False BOS events are common, which makes confirmation essential. Internal and external breaks provide both short-term precision and long-term context. Above all, BOS and CHOCH give traders a structured way to understand market behaviour and trade with more confidence

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.