Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomUnderstanding pips is essential for any forex or commodity trader, especially when trading XAUUSD, which represents the price of gold in US dollars. In this guide, we’ll explore what a pip is in the context of XAUUSD, how it affects your trades, and how to calculate it accurately. By the end of this article, you’ll have a clearer understanding of pips and how they impact your trading strategy in the gold market.

Key Takeaways:

- 1 pip in XAUUSD is equivalent to a 0.01 price movement.

- The value of a pip depends on your lot size, with standard lots, mini lots, and micro lots having different pip values.

- Market conditions, economic events, and geopolitical factors can cause fluctuations in XAUUSD and impact pip movements.

What Is a Pip in XAUUSD?

A pip, short for “percentage in point,” is the smallest price move that an asset’s price can make based on market convention. When trading XAUUSD (the price of gold against the US dollar), understanding the concept of a pip is crucial, as it determines how much your position will gain or lose with price fluctuations.

What Is the Standard Value of 1 Pip in XAUUSD?

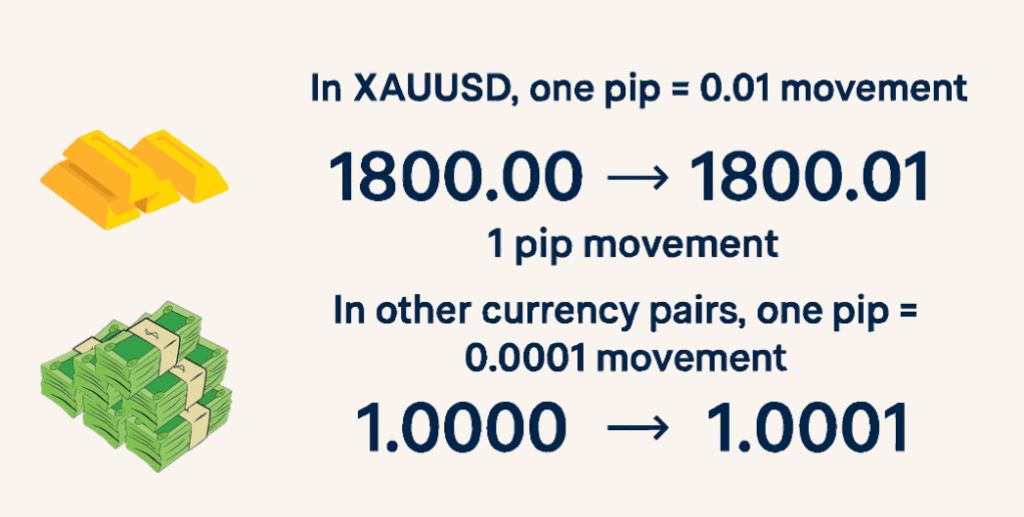

In the case of XAUUSD, one pip is typically equivalent to a 0.01 movement in the price of gold. So, for instance, if the price of XAUUSD moves from 1800.00 to 1800.01, that represents a 1 pip movement. This is different from other currency pairs, where one pip usually represents a movement of 0.0001.

Example: Calculating 1 Pip in XAUUSD

Let’s say the current price of XAUUSD is 1800.50. If the price increases to 1800.51, the price has moved by 1 pip. It’s important to note that gold is a highly volatile commodity, so understanding how pips affect your trading positions will allow you to manage your risk effectively.

Why Is Understanding Pips in XAUUSD Important?

Knowing how to calculate pips in XAUUSD helps traders gauge the potential profit or loss from a trade. It also allows for more accurate risk management and position sizing, both of which are crucial to successful trading.

For example, if you are trading with leverage and you open a position of 1 lot in XAUUSD, a 1 pip move in the price of gold will impact your profit and loss. Understanding the value of a pip allows you to anticipate the impact of small price movements and adjust your strategy accordingly.

How Does a Pip Affect Your Trading?

The impact of a pip movement in XAUUSD varies depending on the lot size you are trading. The larger the position, the more you stand to gain or lose with each pip movement.

- Standard Lot (100 ounces of gold): If you are trading a standard lot (100 ounces) in XAUUSD, a 1 pip movement is equal to $1.00 per pip.

- Mini Lot (10 ounces of gold): For a mini lot (10 ounces), a 1 pip movement would be worth $0.10.

- Micro Lot (1 ounce of gold): A micro lot (1 ounce) would mean a 1 pip movement is worth $0.01.

Understanding the pip value for each type of lot is key to managing your trades effectively.

How to Calculate Pips in XAUUSD?

Calculating pips in XAUUSD is simple once you know how the price moves in increments. Here’s how you can do it:

- Identify the price change: For example, if XAUUSD moves from 1800.50 to 1800.75, that’s a 25 pip change.

- Calculate the pip difference: Subtract the initial price from the new price (1800.75 – 1800.50 = 0.25).

- Multiply by your lot size: Depending on the lot size (standard, mini, or micro), you can multiply the pip change by the respective value (1 pip = $1 for a standard lot, $0.10 for a mini lot, etc.).

This straightforward calculation can help you assess the profitability of your trade.

Factors Affecting XAUUSD Price Movements

Several factors can influence the price of XAUUSD and the resulting pip movements:

- Global Economic Events: Economic reports, geopolitical tensions, and market sentiment can all cause significant fluctuations in gold prices.

- Interest Rates: Central bank decisions, particularly from the Federal Reserve, can have a direct impact on the value of gold and, subsequently, the pip movements in XAUUSD.

- Supply and Demand: The physical supply of gold and demand from central banks and industries play a critical role in determining gold’s price.

- Market Volatility: Gold is often seen as a “safe haven” asset, and its price can change rapidly during times of economic uncertainty or financial crisis, leading to larger pip movements.

Conclusion

Understanding how pips work in XAUUSD is essential for managing risk and maximizing profit potential when trading gold. By knowing the pip value and how to calculate it based on your lot size, you can make more informed decisions in your commodity trading and create a strategy tailored to your risk tolerance and trading goals.

Whether you’re a beginner or an experienced trader, mastering the concept of pips will improve your ability to navigate the gold market and make smarter trading decisions. Keep an eye on the factors that influence gold prices, and always be ready to adjust your positions based on the changing market conditions.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.