Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

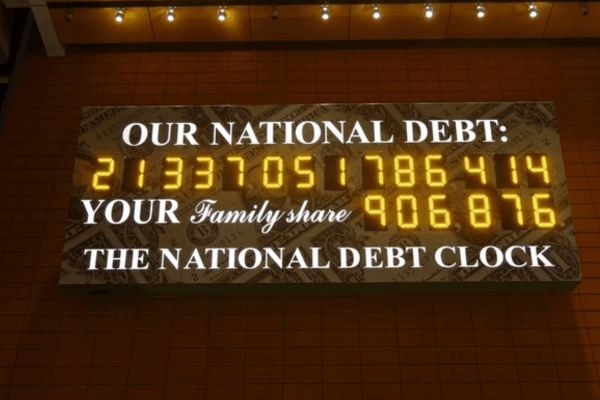

What Happens if the US Defaults on Its Debt?

The United States, the world’s largest economy, operates under a system where it borrows money by issuing government debt. The country has a long-standing reputation for paying its debts on time, which contributes to the US dollar being a global reserve currency.

However, the idea of the US defaulting on its debt has emerged as a point of concern, especially during times of political gridlock and fiscal uncertainty. But what happens if the US defaults on its debt? Let’s break it down.

Understanding US Debt and Default

Before delving into the consequences, it’s essential to understand what debt default means. When a country defaults on its debt, it means that it has failed to meet its debt obligations of either failing to make the required payments on its bonds or other debt instruments.

For the United States, this could happen if Congress fails to raise or suspend the debt ceiling, which is the limit on how much the US government can borrow to finance its operations.

The US government borrows money by issuing Treasury bonds, bills, and notes. These are considered the safest investments globally, as they are backed by the full faith and credit of the US government.

Investors around the world, including foreign governments, hold a substantial amount of US debt. If the US defaults, it would mean the government is unable to pay interest or repay the principal on its outstanding debt.

Key Consequences of a US Default

If the US defaults on its debt, the repercussions would be immediate and far-reaching. From financial market turmoil to a potential recession, here are the key consequences:

Immediate Financial Market Turmoil

The first and most immediate effect of a US default would be a profound shock to global financial markets. Treasury securities are considered a safe haven for investors during times of uncertainty. A default would shatter this trust, leading to a rapid sell-off of US bonds. This would cause bond prices to plummet, and interest rates would soar as investors demand higher yields to compensate for the increased risk.

As interest rates climb, borrowing costs for businesses and consumers would increase. Mortgages, car loans, and credit card interest rates would all rise, tightening the financial conditions for everyday Americans.

This could lead to reduced consumer spending, lower business investments, and a general slowdown in economic activity. In short, the cost of borrowing would become much more expensive, leading to a ripple effect across the economy.

The Risk of a Recession

The economic implications of a US debt default go beyond market reactions. A default could push the US economy into a severe recession. According to estimates from the White House, a protracted default could lead to a GDP contraction of up to 6%, with up to 8 million jobs lost. A recession of this magnitude would likely increase unemployment, further decrease consumer confidence, and reduce economic output.

The ripple effects wouldn’t be confined to financial markets. Job losses would be widespread as companies struggle with rising borrowing costs and a general economic slowdown. Federal government services could also be severely impacted, as the US might not be able to pay for social programs such as Social Security and Medicare, which could delay payments to millions of Americans who rely on them.

A fiscal crisis could also trigger substantial cuts to government spending, including tax hikes, as policymakers scramble to stabilize the economy. This would place further strain on an already fragile economy, potentially leading to a prolonged downturn.

The Benchmark of Global Finance

U.S. Treasury bonds are considered the safest investment globally, serving as the benchmark for almost every other financial asset, from corporate bonds to mortgages. In essence, U.S. Treasury borrowing is the gravitational center of global finance. This position gives U.S. debt an essential role in how interest rates are set worldwide.

When the U.S. defaults, the global financial system would be thrown into disarray. As the bedrock of financial markets, U.S. debt underpins many institutions, banks, and investment portfolios.

If U.S. bonds lose their status as safe assets, it would send shockwaves through markets, shaking the foundation of global finance. A default could cause a loss of investor confidence in U.S. debt, leading to market instability and a sharp increase in borrowing costs for everyone.

A Credit Rating Downgrade

One of the most immediate consequences of a default would be a downgrade of the U.S.’s credit rating. In 2011, during a previous debt ceiling standoff, Standard & Poor’s downgraded the U.S. credit rating for the first time in history. A similar situation today could prompt further downgrades by credit rating agencies.

If the U.S. were to default, Treasury securities would no longer be seen as the “safe” investment they have long been. The ripple effect would lead to even higher borrowing costs for the U.S. government and increased financial instability globally.

A default would also make borrowing more expensive for both the U.S. government and consumers. Investors would demand higher interest rates on U.S. Treasury securities, pushing rates up across all markets. This would increase borrowing costs for businesses, consumers, and even governments, making it harder to finance operations and investments.

Global Economic Fallout

The global economy would not escape the repercussions of a U.S. default. Given that U.S. Treasury bonds are at the core of global finance, many countries and financial institutions hold significant amounts of U.S. debt. A default would cause a massive ripple effect, leading to financial instability worldwide.

Countries that hold U.S. debt, such as China and Japan, would see the value of their holdings plummet, leading to a loss of foreign exchange reserves. This could further destabilize global markets and increase the pressure on emerging economies that rely on stable access to U.S. dollars for trade.

In addition, the U.S. dollar’s status as the world’s reserve currency could be jeopardized. If investors lose confidence in U.S. debt, they might seek alternatives to the dollar in international trade and finance, potentially leading to a shift in global trade dynamics.

How Default Would Impact the American People

A default would not only affect financial markets and global trade but would also disrupt essential government services. Social Security and other government programs might experience delays in payments.

Many federal employees could be furloughed, and essential services could be severely impacted. The everyday American would feel the brunt of this, with job losses, rising living costs, and fewer resources for vital government programs.

Political gridlock could also exacerbate the situation, as lawmakers fail to reach an agreement on how to address the debt ceiling crisis. If investors believe default is a legitimate possibility, interest rates would likely spike, causing even greater financial strain on families and businesses.

Could Politics Lead to Investor Panic?

As described in recent analyses, political gridlock such as failing to raise the debt ceiling could lead investors to fear a U.S. Treasury default. The consequences of a temporary debt impasse could escalate if it results in delayed payments or even a full-scale default on U.S. debt.

In the event of such a scenario, interest rates would spike, and investor panic would set in, leading to widespread financial instability.

Moreover, if investors believe that the U.S. is seriously considering a strategic default or will no longer make good on its debt, the value of U.S. Treasury bonds could collapse, and borrowing costs could rise to unmanageable levels.

The Role of Inflation in Managing Debt

High inflation could theoretically reduce the real cost of debt, but this would come with significant downsides. While inflation might lower the burden of existing debt, it would make borrowing more expensive in the future.

If inflation becomes uncontrollable, the U.S. might be forced into money printing, which could further devalue the dollar and increase the cost of U.S. debt. Inflation-driven monetary policies would destabilize global markets, making future borrowing more expensive and potentially worsening the fiscal situation.

Conclusion

So what happens if the US defaults on its debt? A U.S. default on its debt would have devastating consequences from financial market turmoil and economic recession to a loss of global confidence in U.S. debt.

The repercussions would be felt not only in the U.S. but across the globe, as U.S. Treasury securities underpin the global financial system. While the chance of a default remains low, the political risks of a gridlocked government mean the stakes have never been higher. Raising the debt ceiling and ensuring fiscal responsibility is essential not just for the U.S., but for global economic stability.

Ultimately, the U.S. must act swiftly and decisively to avoid the economic disaster that a debt default would bring. The cost of failure to do so is simply too high for the country, its citizens, and the world at large.

FAQ

A U.S. default occurs when the government fails to pay interest or repay the principal on its debt. This can cause a spike in interest rates, disrupt financial markets, and trigger an economic downturn.

A default would increase borrowing costs, reduce spending and investments, and potentially lead to a recession with significant job losses and market instability.

A default would destabilize global markets, increase borrowing costs worldwide, and harm countries holding U.S. debt, while weakening the U.S. dollar’s role in global trade.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.