Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteWhat Currency Does Pakistan Use?

The official currency for Pakistan is the Pakistani Rupee (PKR), issued by the State Bank of Pakistan (SBP). The currency symbol is ₨, and its ISO code is PKR. Pakistan does not use the US dollar as legal tender, but the USD/PKR exchange rate is a key benchmark in the country’s economy and international trade.

Quick Facts:

- Currency Name: Pakistani Rupee

- ISO Code: PKR

- Central Bank: State Bank of Pakistan

- Currency Symbol: ₨

- Popular Pair: USD/PKR

How Does Pakistan Money Look Like?

Pakistani banknotes are colorful and feature national leaders, landmarks, and cultural motifs. Denominations range from Rs. 10 to Rs. 5,000, with each note incorporating:

- Security threads

- Watermarks (typically featuring Quaid-e-Azam)

- Urdu script and English denominations

Coins in circulation include Rs. 1, 2, 5, and 10.

USD to PKR: A Crucial Forex Pair

One of the most traded forex pairs in South Asia is USD/PKR. It’s popular due to:

- High demand for US dollars in Pakistan’s import sector

- Significant overseas remittances in USD

- Capital flows related to IMF programs and external debt

What Drives PKR Currency? Key Forex Insights

From a trader’s perspective, the Pakistani Rupee (PKR) is considered volatile and sensitive to macroeconomic events. Factors that impact its movement include:

Interest Rates

The State Bank of Pakistan (SBP) sets benchmark interest rates to control inflation and stabilize the currency.

- Higher interest rates attract foreign capital inflows (especially from fixed-income investors), supporting the PKR.

- However, if rates are raised reactively due to inflation, the benefit to PKR may be muted, especially if real interest rates remain negative.

When SBP raises rates ahead of expectations, it often strengthens PKR short term. If rate hikes lag inflation, markets see it as insufficient, and PKR can still weaken.

Inflation Data

High inflation erodes the purchasing power of the PKR, leading to:

- Loss of investor confidence

- Reduced foreign investment

- Greater pressure on the central bank to tighten policy

If inflation remains above 15–20% and SBP is perceived as “behind the curve,” PKR often sells off sharply. Inflation surprises can create intraday trading opportunities.

Current Account Balance

A current account deficit (CAD) means Pakistan imports more goods, services, and capital than it exports.

- This creates constant demand for foreign currency (USD) to pay for imports, weakening the PKR.

- Remittance inflows, money sent home by overseas Pakistanis help offset some of the deficit pressure.

When trade deficits widen or remittance growth slows, the USD/PKR pair usually trends upward, signaling PKR weakness. Monthly trade and remittance data are key indicators.

Political Stability

Markets seek certainty. Frequent government changes, protests, or IMF negotiation delays create:

- Uncertainty about policy direction

- Loss of investor confidence

- Delayed disbursement of external aid or loans

During election periods, budget debates, or IMF program reviews, PKR often sees increased volatility. Traders should expect risk premiums to be priced into USD/PKR during these events.

Foreign Exchange Reserves

FX reserves held by the SBP are used to:

- Defend the PKR during market pressure

- Pay external debt obligations

- Manage import bills

Low reserves (often under $10 billion) make the PKR vulnerable to external shocks, such as oil price spikes or global rate hikes.

If reserves fall sharply or are perceived as insufficient to cover three months of imports, PKR is at risk of a steep devaluation. SBP weekly reserve reports are crucial.

Did Pakistan Use the Dollar?

No, Pakistan has never adopted the US dollar as its official currency. However, the dollar plays a significant role in Pakistan’s Foreign reserves, Debt obligations and Import payments. The central bank closely monitors USD/PKR for monetary policy decisions.

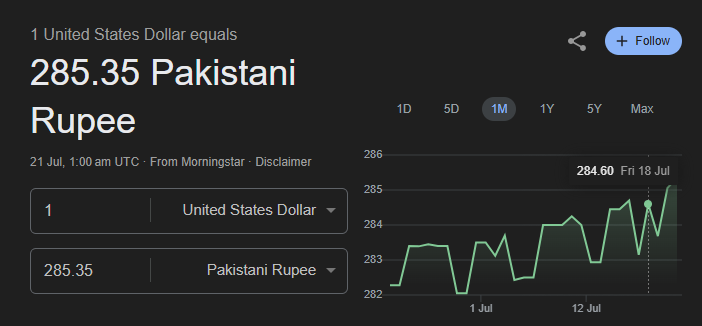

USD to PKR: Current Rate and Forex Importance

As of 21 July 2025, the USD to PKR exchange rate is 285.35. The pair is among the most actively monitored emerging market forex pairs, driven by trade flows, external debt, and remittances.

Is USD/PKR a Popular Forex Pair?

While PKR is not a major currency, USD/PKR is the most traded pair involving Pakistan, mainly due to:

- Import-heavy economy

- Dollarized remittances

- IMF and external loan influence

Traders are advised to monitor spreads and volatility, especially during geopolitical or macroeconomic events.

Key Tips for Trading PKR

Trading the Pakistani Rupee (PKR) can be rewarding but requires sharp attention to macroeconomic triggers and risk management due to its high volatility and policy-driven behavior. Below are the key tips for trade PKR that every forex trader should understand:

Track IMF Developments Closely

Pakistan frequently negotiates with the International Monetary Fund (IMF) for loan programs and fiscal support. These agreements are vital because they:

- Restore market confidence

- Boost FX reserves

- Unlock funding from other bilateral and multilateral lenders

Watch for SBP Interventions in the Forex Market

The State Bank of Pakistan (SBP) frequently intervenes in the interbank FX market to stabilize the rupee. This can involve:

- Direct selling of USD to control excessive volatility

- Implementing capital controls

- Raising policy interest rates unexpectedly

Avoid Trading During Low Liquidity Hours

Unlike major pairs like EUR/USD or USD/JPY, the USD/PKR pair has limited liquidity, especially outside Pakistani business hours (GMT+5). During off-peak hours:

- Spreads widen significantly

- Slippage increases

- Volatility becomes erratic

Only trade USD/PKR between 9:00 AM to 4:00 PM PKT, when Pakistani banks and money markets are active. Use limit orders instead of market orders during illiquid periods to avoid unnecessary losses.

Account for Political Risk and Budget Announcements

The PKR is highly sensitive to domestic politics, especially:

- General elections

- Leadership transitions

- National budget proposals

- Confidence votes or IMF-linked reforms

These events directly influence investor sentiment, foreign inflows, and fiscal credibility. Avoid placing leveraged trades in PKR pairs during election periods or fiscal budget weeks, as 3% to 5% intraday moves are common. Use options or reduce exposure size to manage political event risk.

Monitor Global Oil Prices

Pakistan is a net importer of crude oil, which means:

- Rising oil prices increase import bills, worsening the current account deficit

- Falling oil prices reduce pressure on foreign reserves and support the PKR

There’s a strong inverse correlation between oil prices and PKR strength. If Brent crude surges above $90, expect downside risk on PKR. Traders should watch global oil futures and adjust their positions accordingly.

Conclusion

Understanding what currency does Pakistan use and how PKR behaves in the forex market is essential for informed trading. With high volatility, external dependencies, and ongoing IMF engagement, the PKR is not a major currency but offers opportunities for seasoned traders who understand macro-driven trades.

For traders seeking to navigate the complexities of USD/PKR or other exotic forex pairs, partnering with a reliable broker is key.

Whether you’re watching IMF updates or tracking oil prices, Ultima Markets empowers you with the insights and tools you need to trade PKR with confidence.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.