Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWhat Are Soft Commodities?

Soft commodities often called softs. Soft commodities are agricultural goods that are grown, not mined. In futures markets this usually means coffee, cocoa, sugar, cotton, and frozen concentrated orange juice (FCOJ), which trade primarily on ICE exchanges. Unlike metals or energy, softs swing with weather, pests, disease, and harvest timing so prices can move fast.

Why Soft Commodities Are Important

Through 2024–2025, cocoa showed how sensitive softs are to supply shocks. Poor West African harvests and disease pushed prices to records, before easing as rainfall improved and forward crop expectations recovered. Even after the pullback, costs for manufacturers remain higher than normal, proof that softs can affect real-world prices.

Weather regimes also matter. FAO briefings highlight El Niño/La Niña shifts as a continuing risk for agriculture into 2025, especially in regions where planting and harvest seasons overlap with these climate patterns. Traders and writers should keep an eye on these updates because they directly influence yield, quality, and volatility in coffee, cocoa, sugar, cotton, and OJ.

Soft Commodities List

- Coffee (Arabica & Robusta). Driven by Brazil/Vietnam weather, pests like leaf rust, fertilizer costs, and local currencies (BRL, VND). Seasonal flowering and harvest windows often trigger sharp moves.

- Cocoa. Focused on Côte d’Ivoire and Ghana. Disease (e.g., swollen-shoot or black pod), rainfall, farm-gate policies, and logistics all matter. 2025 pricing still reflects tight supply risks even after corrections.

- Sugar (No. 11). Hinges on Brazil/India output, monsoon strength, and Brazil’s ethanol parity (how much cane goes to fuel vs sugar).

- Cotton (No. 2). Sensitive to U.S./India/China acreage, drought/flood cycles, and global apparel demand.

- Frozen Concentrated Orange Juice. Moves with Florida/Brazil weather, citrus greening (HLB), hurricanes, and frost. Liquidity is thinner, so gaps happen.

What Moves Soft Commodities Prices

Soft commodities prices move due to weather and climate shocks (El Niño/La Niña), pests and plant disease, planting and harvest seasonality, producer-country currencies (BRL, VND, XOF), government policy and trade rules, energy links and substitution (ethanol vs sugar), logistics and freight costs, inventory levels and futures term structure, and global demand trends.

Weather and Climate

Rain, temperature, storms, droughts, frost, and hurricane tracks shift yields and quality. El Niño/La Niña flips rainfall patterns in Brazil, West Africa, and Southeast Asia—often the biggest driver of short-term price spikes.

Pests and Plant Disease

Leaf rust in coffee, black pod and swollen-shoot in cocoa, and citrus greening (HLB) in oranges reduce output and fruit quality, tightening supply.

Planting, Harvest, and Seasonality

Acreage decisions, flowering, pod-setting, and harvest windows create predictable seasonal swings. Thin shoulder months can amplify moves.

Government Policy and Trade

Export taxes/quotas, import tariffs, minimum farm-gate prices, and sanitary rules (e.g., EU deforestation standards) alter supply flows and costs.

Currencies in Producing Countries

Softs are priced in USD. When BRL (Brazil), VND (Vietnam), XOF (West Africa) move, local producers change selling behavior, impacting global prices.

Energy Links and Substitution

Sugar competes with ethanol in Brazil (mills switch cane between sugar and fuel). Cotton competes with synthetic fibers; oil prices can affect textile demand and freight.

Logistics and Freight

Port congestion, container shortages, and shipping rates change delivered costs and timing—critical for coffee and cocoa arbitrage.

Inventories and Term Structure

Certified stock levels and futures curve shape (contango/backwardation) signal tightness. Roll yield affects ETF/ETN returns and hedging costs.

Global Demand and Consumer Trends

Chocolate, coffee, soft drinks, and apparel cycles matter. Pricing power at roasters, confectioners, and mills can pull demand forward or ration it.

Macro and Financial Conditions

USD strength, interest rates, inflation expectations, and fund positioning (CTA/hedge funds) can amplify or mute fundamentally driven moves.

How to Trade Soft Commodities

To trade soft commodities on Ultima Markets, open and verify your account, choose your product (CFDs on coffee, cocoa, sugar, cotton, or orange juice), map key drivers (weather, disease, seasonality), set position size and stops, place a buy or sell order, monitor roll costs and news, and review or close positions with discipline.

Step-By-Step:

Create And Verify Your Account

Complete KYC, add funds in your preferred method, and enable two-factor authentication.

Choose Your Instrument

Select CFDs referencing soft commodities such as coffee, cocoa, sugar, cotton, orange juice. Check contract specs, trading hours, and minimum lot size in the platform.

Plan Your Trade

Define your entry, stop loss, and take profit before you click buy or sell. Align your holding period with the contract you choose.

Manage Risk First

Use conservative position sizing, protective stops, and if available guaranteed stop features. Avoid over-leveraging during high-volatility weather events.

Place The Order

Use market or limit orders. For short-term ideas, consider alerts. For multi-day ideas, review overnight financing and potential roll costs.

Monitor And Adjust

Watch the futures curve and any platform notices about contract rolls. Update stops as the trade moves, or scale out to lock gains.

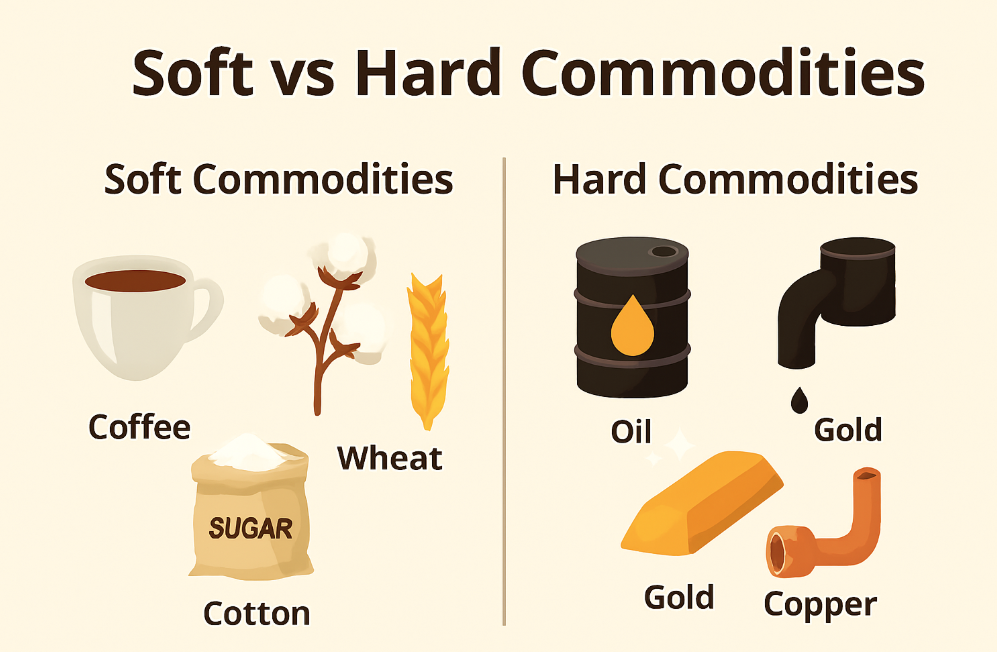

Softs vs Hard Commodities: Know the Difference

Hard commodities (like oil, copper, gold) are extracted. Softs are grown and respond more to weather, pests, and planting decisions than to mining capex or refinery outages. That’s why softs often show stronger seasonality and weather-driven volatility than metals or energy.

| Aspect | Soft Commodities | Hard Commodities |

| Nature | Grown (agricultural) | Extracted (metals/energy) |

| Main Drivers | Weather, pests/disease, harvest seasonality | Industrial demand, geopolitics, mining/production |

| Seasonality | Strong, tied to planting/harvest | Weaker, business cycle–driven |

| Storage/Carry | Perishable, quality decay matters | Easier storage, clearer carry costs |

| FX Sensitivity | High to producer FX (BRL, VND, XOF) | More to USD level and global macro |

| Typical Instruments | ICE softs futures/options, select ETFs/CFDs | NYMEX/LME/COMEX futures/options, ETFs/miners |

| Common Examples | Coffee, cocoa, sugar, cotton, OJ | Oil, natural gas, copper, gold, iron ore |

Conclusion

Soft commodities and hard commodities move for different reasons, but both reward a simple plan. Know what you are trading, choose the right instrument, and manage risk first. In softs, weather, disease, and harvest calendars drive price. In hard commodities, industrial demand and geopolitics matter more. Start with small positions, use clear entries and stops, and check the futures curve and roll costs before you hold.

If you trade on a multi-asset platform, keep a watchlist for coffee, cocoa, sugar, cotton, and orange juice alongside oil, copper, and gold. Review news, climate updates, and inventories each week. Record your trades and refine what works, one setup at a time.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.