Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWhat Are Higher Highs and Higher Lows?

In the world of trading, recognising trends is one of the most crucial skills a trader can have. One of the most reliable patterns used to identify an uptrend is the concept of higher highs and higher lows.

These two components work together to indicate a bullish market, providing traders with essential information about price direction.

In this article, we’ll explore what higher highs and higher lows are, why they matter, and how traders can use these patterns to improve their trading strategies.

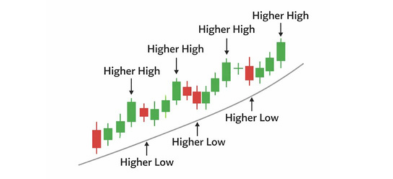

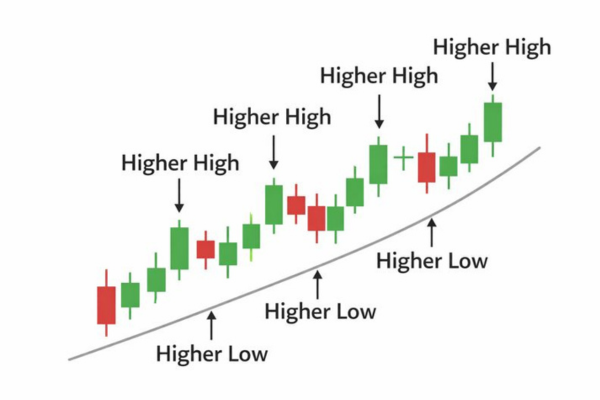

What Are Higher Highs and Higher Lows?

- Higher Highs: A higher high is formed when the price of an asset reaches a new peak that is higher than the previous peak. This indicates that the market is in a bullish trend, with demand outweighing supply.

- Higher Lows: A higher low occurs when the price retraces but does not fall as low as the previous low, forming a base above it. This shows that selling pressure is weakening and the market is maintaining its bullish strength.

When these two patterns occur together, it signals a continuation of the uptrend, providing traders with opportunities to enter long positions with confidence.

Why Do Higher Highs and Higher Lows Matter?

Understanding the importance of higher highs and higher lows can significantly improve your trading strategy. Here are a few reasons why these patterns are so important:

- Trend Confirmation: Higher highs and higher lows serve as a clear signal of a bullish trend. Traders use this pattern to confirm that the market is in an uptrend, helping them align their trades with the prevailing direction.

- Effective Market Entries: The formation of a higher low presents an ideal entry point. Traders typically buy when the price forms a higher low, entering the market after a pullback but before the trend continues upward.

- Risk Management: By identifying the higher low, traders can set stop-loss orders just below this level, ensuring they’re protected in case the trend reverses unexpectedly.

How to Identify Higher Highs and Higher Lows

Identifying higher highs and higher lows is simple once you know what to look for. Here’s how you can spot this pattern on a price chart:

- Look for Successive Peaks: A higher high occurs when the price makes a new peak above the previous peak. This is a sign that the market is trending upward.

- Find Higher Lows: After each higher high, the price tends to pull back. If the next low is above the previous low, you’ve identified a higher low.

- Trend Continuation: Once you spot a higher high followed by a higher low, you can confirm that the trend is still intact and the market is likely to continue in the bullish direction.

Why Is This Pattern So Important for Traders?

- Clear Trend Confirmation: Higher highs and higher lows give traders a clear indication that the market is bullish, making it easier to decide when to enter or exit trades.

- Ideal Entry Points: Traders often enter the market when the price forms a higher low, providing a favorable entry before the trend moves to the next higher high.

- Better Risk Management: By using the most recent higher low to place a stop-loss, traders can effectively manage their risk while staying aligned with the prevailing trend.

Using Other Indicators to Confirm Higher Highs and Higher Lows

While the pattern of higher highs and higher lows is powerful on its own, combining it with other technical indicators can provide additional confirmation of the trend. Some of the most commonly used indicators include:

- Moving Averages: A price above key moving averages, such as the 50-day or 200-day moving average, can reinforce the bullish trend indicated by higher highs and higher lows.

- RSI (Relative Strength Index): If the RSI is between 40 and 70 during an uptrend, it indicates that the market is strong and not overbought, confirming that the higher highs and higher lows are part of a sustainable trend.

Common Mistakes to Avoid

Even experienced traders can misinterpret the higher highs and higher lows pattern. Here are a few common mistakes to avoid:

- Mistaking Sideways Movement for an Uptrend: Higher highs and higher lows in a narrow range might indicate consolidation rather than a strong trend. Be sure to look for a clear breakout before entering the market.

- Ignoring Timeframes: The pattern can appear on short-term charts, but it’s essential to confirm the trend on longer timeframes to ensure its reliability.

- Overlooking Volume: Volume plays a crucial role in confirming trends. Higher highs and higher lows are more reliable when supported by increasing volume.

How to Trade Using Higher Highs and Higher Lows

- Trend Following Strategy: Enter a long position after the price forms a higher low, aiming to ride the uptrend toward the next higher high.

- Breakout Strategy: If the price breaks above a higher high after a higher low, it can signal a continuation of the uptrend, presenting an opportunity for a breakout trade.

- Trailing Stop Strategy: As the price continues to move upward, use a trailing stop just below each higher low to lock in profits while allowing the trend to run its course.

Comparing Higher Highs and Higher Lows with Higher High Lower Low

While higher highs and higher lows indicate astrong bullish trend, the concept of higher high and lower low signals the potential beginning of a bearish trend or market reversal.

- Higher High and Lower Low: This pattern can indicate a trend change or uncertainty. A higher high suggests that the price has reached new peaks, but the formation of a lower low signals that selling pressure is building up and could start to outweigh buying momentum. This pattern often points to a shift from bullish to bearish momentum and is crucial for traders who aim to capitalise on market reversals.

Difference in Focus:

- Higher highs and higher lows form a solid foundation for continuing uptrends, while higher high and lower low often signals the end of a bullish trend and the beginning of a bearish one.

If you are looking for more insights into how the higher high and lower low pattern can help you identify market reversals, check out our separate article on trading bearish trends and reversal patterns.

Conclusion

The pattern of higher highs and higher lows is a cornerstone of technical analysis, particularly for trend traders. Recognising these patterns can help you confirm the direction of the market, find optimal entry points, and manage risk effectively.

However, it’s also essential to recognise when trends may shift. Patterns like higher high and lower low could signal the start of a bearish reversal, and understanding this shift is key to staying ahead in the market.

FAQ

Higher highs and higher lows mean price is trending upward. Each new peak is higher than the last, and each pullback low stays higher, confirming an uptrend.

Many traders wait for a pullback to form a higher low, then enter when price starts pushing up again. A common stop-loss is placed below the latest higher low.

A higher high lower low pattern can signal rising volatility or a possible trend shift, because price makes a new high but then breaks below a prior low.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.