Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWhat Are Bonds?

Bonds are fixed-income securities issued by governments, municipalities, or corporations to raise capital. When you buy a bond, you’re lending money to the issuer in exchange for regular interest payments (called coupons) and the return of the bond’s face value at maturity. Bonds are used for portfolio diversification, steady income, and capital preservation, and their value can fluctuate based on interest rates, credit ratings, and market conditions.

As a trader or investor, understanding the characteristics, risks, and potential returns of each bond type can help you make better decisions in changing market conditions.

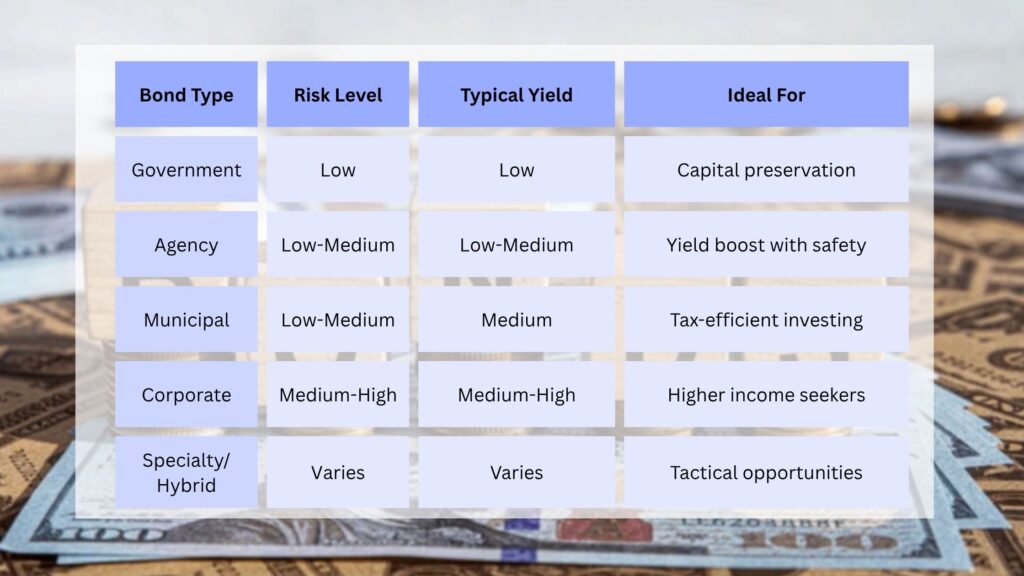

What Are 5 Types of Bonds? A Trader’s Complete Guide

In this guide, we’ll break down the five main types of bonds, why investors buy them, which might suit your goals, and how to trade them effectively.

Government Bonds

Government bonds are issued by national governments to fund public spending. Examples include U.S. Treasury Bills, Notes, and Bonds, as well as Treasury Inflation-Protected Securities (TIPS).

Why traders watch them:

- Serve as the benchmark for interest rates.

- Considered the safest fixed-income investment.

- Ideal during risk-off market conditions for capital preservation.

Agency Bonds

Agency bonds come from government-sponsored enterprises (GSEs) or federal agencies, such as Fannie Mae or Freddie Mac in the U.S. They offer slightly higher yields than Treasuries while maintaining relatively low risk.

Trader insight:

- Useful for picking up extra yield without taking on excessive credit risk.

- Liquidity is generally good, making them easier to trade in active portfolios.

Municipal Bonds

Municipal bonds are issued by states, cities, or local authorities to fund infrastructure and public services.

They come in two forms:

- General Obligation Bonds – Backed by taxing power.

- Revenue Bonds – Repaid from income generated by specific projects.

Trader insight:

- Interest is often exempt from federal taxes (and sometimes state/local taxes).

- A strong choice for tax-efficient investing, especially for high-income investors.

Corporate Bonds

Corporate bonds are issued by companies to raise capital. They range from investment-grade bonds (lower risk, lower yield) to high-yield or junk bonds (higher risk, higher yield).

Trader insight:

- Allows capture of credit spreads for extra return potential.

- Requires monitoring of credit ratings and default risk.

- Good for investors seeking higher income compared to government debt.

Specialty & Hybrid Bonds

This category covers several niche instruments:

- Savings Bonds – Government-backed and suitable for conservative investors.

- Zero-Coupon Bonds – Sold at a deep discount, pay face value at maturity, and are sensitive to interest rate changes.

- Convertible Bonds – Can be converted into company shares, combining fixed income with equity potential.

- Callable Bonds – Can be redeemed early by the issuer, usually in exchange for a higher coupon rate.

Trader insight:

- Zero-coupons can be used for long-duration plays.

- Convertibles work well in volatile or bullish equity markets.

- Callable bonds reward investors for taking on early redemption risk.

Why Invest in Bonds?

Investing in bonds offers a combination of stability, predictable income, and diversification that can balance risk in a portfolio. Bonds provide fixed interest payments, making them attractive for income-focused investors. High-quality bonds, such as government and investment-grade corporate bonds, help preserve capital during market downturns.

Some bonds, like municipal bonds, also offer tax advantages. Traders use bonds to hedge against stock market volatility, manage interest rate exposure, and capture opportunities in credit spreads.

How to Buy Bonds

Bonds can be purchased directly from governments, through brokerage accounts, or via bond funds and ETFs. New bonds are available in the primary market, while existing bonds trade in the secondary market. Investors should compare yields, maturities, and credit ratings before buying to match their risk tolerance and income goals.

- Direct from Government – Platforms like TreasuryDirect (U.S.) offer primary market access.

- Through Brokers – Access to both primary and secondary markets.

- Bond Funds & ETFs – Instant diversification and easier trading.

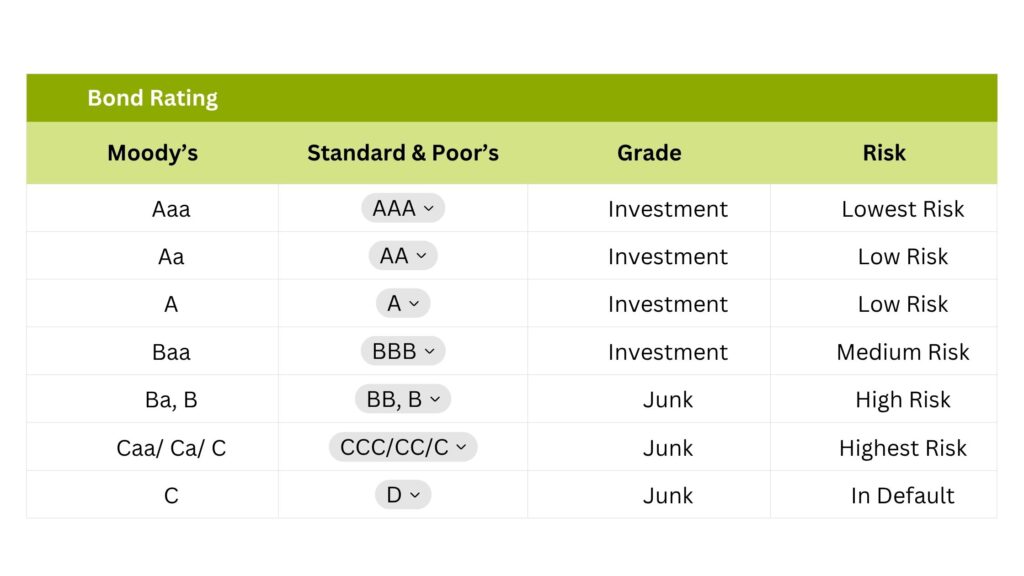

What Is a Bond Rating?

A bond rating is a grade assigned by credit rating agencies, such as Standard & Poor’s, Moody’s, or Fitch, that measures the creditworthiness of a bond issuer. It indicates the likelihood that the issuer will repay interest and principal on time. Ratings range from high-grade (low risk) to junk status (high risk), helping investors compare risk and determine appropriate yield expectations.

The main categories are:

- Investment Grade – High credit quality, lower risk:

- S&P/Fitch: AAA, AA, A, BBB

- Moody’s: Aaa, Aa, A, Baa

- High-Yield (Junk) – Lower credit quality, higher risk:

- S&P/Fitch: BB, B, CCC, CC, C, D

- Moody’s: Ba, B, Caa, Ca, C

Investment-grade bonds are considered safer, while high-yield bonds offer higher returns with greater default risk.

Conclusion

Understanding what are 5 types of bonds gives traders and investors a clearer view of how to balance risk and reward in their portfolios. From safe-haven government bonds to higher-yield corporate and specialty bonds, each plays a role in income generation, diversification, and capital preservation.

At Ultima Markets, you can access expert market insights, real-time analysis, and trading tools to help you identify the right bond opportunities for your strategy. Whether you’re seeking steady income, tax advantages, or tactical trades, Ultima Markets provides the resources to make informed investment decisions.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.